A new white paper published by Banking Circle, has identified the stealth effect outdated payments processes are having on the insurance sector.

The white paper reveals that out-dated and manually intensive collection and reconciliation systems are seriously undermining customer experience and profitability targets.

Anders la Cour, Co-founder and Chief Executive Officer of Banking Circle commented:

Anders la Cour

“In the highly competitive insurance market, providers are increasingly investing in automated systems and digitisation strategies for their front-end processes. But back-office functions, such as payments processes, appear to have not kept pace with innovation. Today, out-dated payment architecture has a stranglehold on the insurance industry, holding it back from providing policyholders with the most efficient service.”

Insurance firms reliant on legacy systems, sometimes developed decades ago, and the intensive M&A that has occurred in the sector in recent years means that the opportunity to design systems based on today’s digital advances is limited.

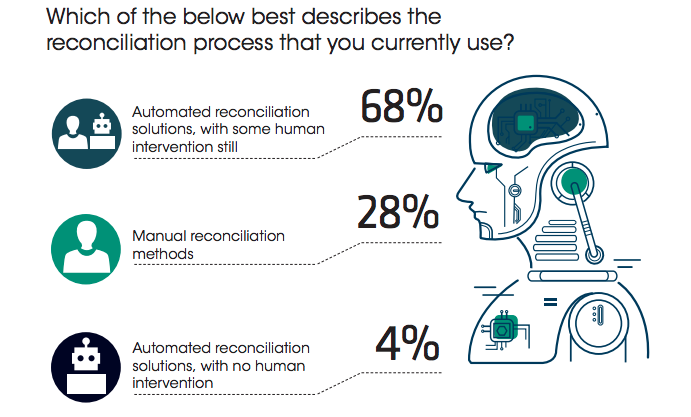

The Banking Circle commissioned research found that nearly a third (28%) of respondents use manual reconciliation methods. And whilst 68% use some automated systems, they also still rely on some level of human intervention. Just 4% said they use fully automated reconciliation solutions.

As a result, payment delays due to issues with reconciliation of payment reference numbers ranked as the biggest issue faced by insurers in the payments arena. According to the research, payment reconciliation processes in the insurance sector are currently highly inefficient, with matching rates lower than 90% for 57% of insurance providers. Anything less than 100% can impact cash flow, draining operational and financial resources as well as results.

As a result, payment delays due to issues with reconciliation of payment reference numbers ranked as the biggest issue faced by insurers in the payments arena. According to the research, payment reconciliation processes in the insurance sector are currently highly inefficient, with matching rates lower than 90% for 57% of insurance providers. Anything less than 100% can impact cash flow, draining operational and financial resources as well as results.

The research also found that there were four key areas that impacted bottom-line profitability for insurers:

- Collection of the insurance premium where direct debit is not used or has failed

- Delays caused by the omission of payment reference details from banks

- Delays caused by inaccurate manual keying of reference data

- Collection of payments from brokers and intermediaries

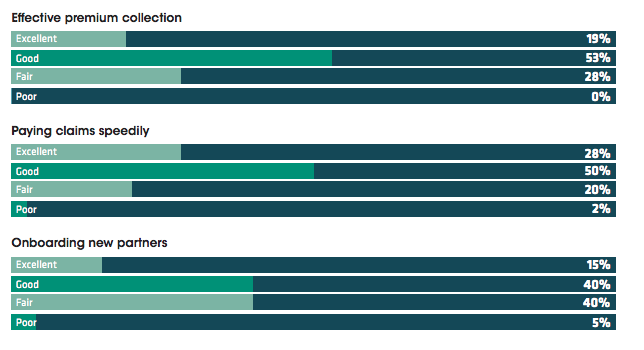

Only 19% of respondents rated their premium collection capability as excellent. And less than a third (28%) ranked their speed of claims payment as excellent. Against the backdrop that 52% of insurers see compliance with operating in the digital space as the biggest threat to their business, the research suggests that insurers need help from external specialists.

How effective would you rate your existing payment infrastructure in terms of:

Anders La Cour continued:

“With so much focus on pricing and the front-end customer experience in the insurance sector it’s not realistic to expect insurance providers to devote resource and investment to building their own payment solutions in-house. There is, therefore, a clear opportunity for the burgeoning InsurTech sector to step in, working in partnership with financial utilities like Banking Circle.”

According to Banking Circle their solution is able to address this very issue.

Featured image credit: Freepik

The post Surprisingly, Only 4% of UK’s Insurance Industry’s Payments is Fully Automated appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments