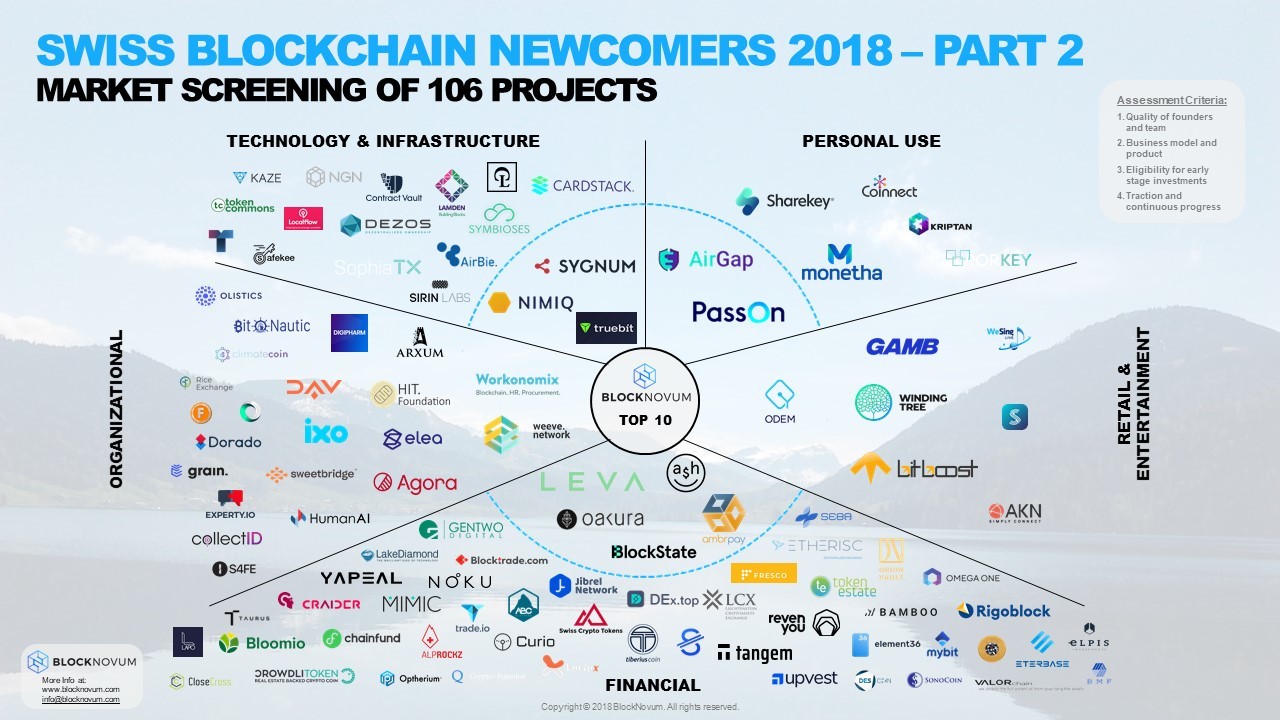

Blockchain investment research & consulting firm BlockNovum just published its highly anticipated second issue of the Swiss Blockchain Startup Newcomer Map. The Zurich based company conducted one of the most in-depth analysis to date of startups in Switzerland that leverage the blockchain technology.

Over 100 new blockchain-related projects were identified and assessed. As selection criteria projects have to be based in Switzerland and need to be classified as “Newcomers” in 2018. Based on the assessment BlockNovum shortlisted the top 10 highest quality projects, which convinced with a great team, a promising business model, continuous progress & traction, and relevance for early-stage investors.

The map comes with the accompanying research report, which includes in-depth assessments of the selected projects and provides more background on BlockNovum’s research methodology and due diligence framework.

Similar to first Newcomer Map and assessment report the aim of this market screening is to provide a thorough overview about Swiss newcomers in the blockchain space for investors and industry exponents alike. The map helps navigate the ever-growing crypto landscape in Switzerland by listing all relevant new startups in one place and classifying them in different categories. The in-depth assessments showcase BlockNovum’s due diligence services, available for VCs, Family Offices, and asset managers with an interest in allocating capital to cryptoassets or blockchain startups.

Highlights

- 106 new blockchain projects / startups were identified and screened.

- With 52 projects, almost half are using blockchain in a Finance context. This confirms the observation from the first map that Switzerland has a strong tendency towards FinTech. 5 out of the top 10 are Finance-related startups: Ambrpay, A$h (former: Midas), Blockstate, Leva, and Oakura.

- 22 startups were classified in the Organizational category, which includes use cases that coordinate, store, track, and organize data and resources. E.g. projects in logistics, energy, or governance. Even though the selection included a handful of great startups, none made it to the top 10. However, some interesting projects worth mentioning in this category are Workonomix, Weeve Network, and Agora.

- Projects in the Technology & Infrastructure category came in third with 18 startups. BlockNovum selected 3 projects for the top 10: Nimiq, Sygnum, and Truebit.

- Startups in the Retail & Entertainment (including gaming, e-commerce, education) and Personal Use (e.g. personal wallet, digital identity, social networks) category came in last with 7 projects each. Even though it did not make the top 10, Odem deserves being mentioned in the Retail category.2 Projects in the Personal Use category made it to the top 10: AirGap and PassOn.

- BlockNovum believes that the short-listed projects make great use of the blockchain technology and have the potential to disrupt their respective industries. To find out more, you can find in-depth assessments and portraits of the top 10 startups in the full report. Have a look.

Methodology

Based on BlockNovum’s dealflow and startup database, we considered projects for the map that met following criteria:

- Blockchain focus: The project needs to make us of the blockchain technology, be a service provider for the blockchain ecosystem, or work on blockchain infrastructure / hardware.

- Switzerland based: The company needs to be founded and operational in Switzerland, or have its headquarters / foundation in Switzerland.

- Newcomers: The project was founded in 2018, secured initial funding (ICO, VC) in 2018, or showed visible initial traction in 2018 (e.g. release of beta).

These selection criteria yielded 106 projects that were not covered in the first issue of the startup map and met the requirements.

Next, the startups were categorized in five categories: Technical, Organizational, Financial, Retail & Entertainment, and Personal. A full description of the categories can be found in the first issue. Often an allocation to one category was not easy. Therefore, some projects might well fit also into another category.

All 106 projects were high-level assessed by BlockNovum based on 4 assessment criteria:

- Quality of founders and team: Professional background, relevant experience, academics, personal assessment.

- Business model and product: Does the project have an innovative solution for which BlockNovum projects high market demand? Is there a promising business model to generate returns?

- Eligibility for early stage investments: The company is looking to raise capital via Seed / VC funding or Token Sale.

- Traction and continuous progress: Project shows trackable progress via Beta release, MVP, regular community updates. Wining of relevant partnerships, clients, or awards.

As a result of the assessment, the top 10 startups were identified.

The in-depth assessment of the shortlisted companies (in the report) is based on BlockNovum’s blockchain startup assessment framework, which consists of 10 categories that are analyzed and rated.

The same type of startup assessments & due diligence reports are offered on-demand or project-based by BlockNovum as part of our services for institutional investors

The same type of startup assessments & due diligence reports are offered on-demand or project-based by BlockNovum as part of our services for institutional investors

Top 10 Swiss Blockchain Project

BlockNovum’s top 10 selection of high-quality startups are:

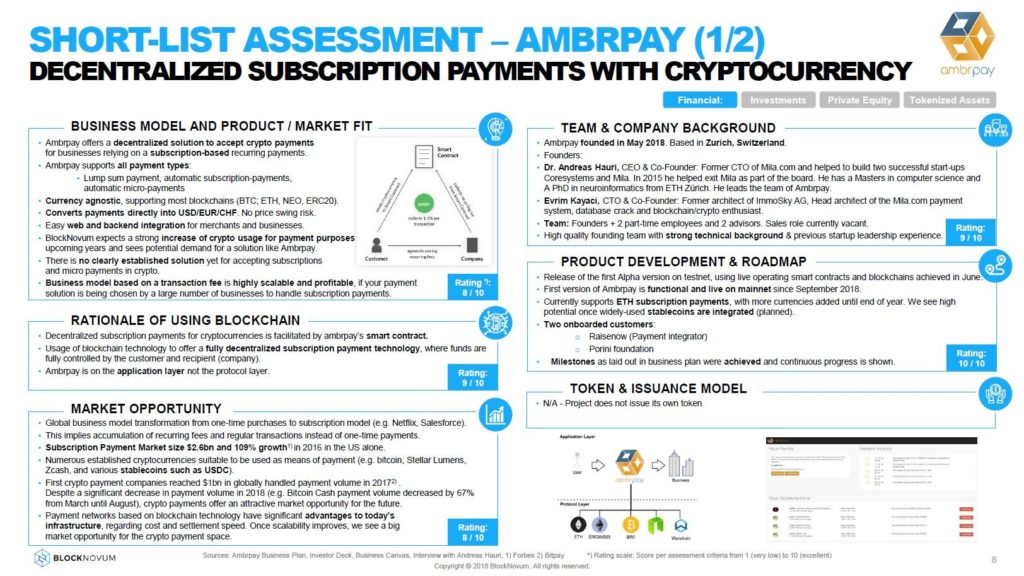

Payment gateway solution that supports subscription payments via smart contracts. It enables subscription payment functionality for cryptocurrencies to be used for established services, such as Netflix or Spotify.

Payment gateway solution that supports subscription payments via smart contracts. It enables subscription payment functionality for cryptocurrencies to be used for established services, such as Netflix or Spotify.

Open source project that develops a new crypto wallet standard via a two-device approach to make secure key handling more accessible. Apps include AirGap Vault and AirGap Wallet for private users and Airgap Knox for institutional self-custody of crypto.

Open source project that develops a new crypto wallet standard via a two-device approach to make secure key handling more accessible. Apps include AirGap Vault and AirGap Wallet for private users and Airgap Knox for institutional self-custody of crypto.

A$H is an investment app targeting millennial retail investors. It enables mobile investments in digital assets and offers gamification, as well as social features. The app runs on the Melon protocol, a decentralized fund management system.

A$H is an investment app targeting millennial retail investors. It enables mobile investments in digital assets and offers gamification, as well as social features. The app runs on the Melon protocol, a decentralized fund management system.

The BlockState infrastructure platform is a stack of software and legal modules that automate resource-intensive investment banking processes such as the issuance of products, valuation and custody of assets, clearing & settlement.

The BlockState infrastructure platform is a stack of software and legal modules that automate resource-intensive investment banking processes such as the issuance of products, valuation and custody of assets, clearing & settlement.

Leva is reinventing private equity (PE) through automation. Their solution makes transactions more efficient and gives PE funds a simpler way to set-up smart investment syndicates and funds. Through Leva investors get unprecedented access to PE and can better diversify their portfolio.

Leva is reinventing private equity (PE) through automation. Their solution makes transactions more efficient and gives PE funds a simpler way to set-up smart investment syndicates and funds. Through Leva investors get unprecedented access to PE and can better diversify their portfolio.

Nimiq aims to be the easiest-to-use decentralized payment protocol & ecosystem. It is browser-based and installation-free. Hence, Nimiq wants to bring the benefits of blockchain technology to the mainstream by developing a blockchain / payment protocol designed for the average user.

Nimiq aims to be the easiest-to-use decentralized payment protocol & ecosystem. It is browser-based and installation-free. Hence, Nimiq wants to bring the benefits of blockchain technology to the mainstream by developing a blockchain / payment protocol designed for the average user.

Oakura supports early stage ventures through its decentralized access to capital and business expertise. With a marketplace built on the blockchain, Oakura uniquely aligns the incentives of startup ecosystem stakeholders by paying service providers with OAK, representing startup equity.

Oakura supports early stage ventures through its decentralized access to capital and business expertise. With a marketplace built on the blockchain, Oakura uniquely aligns the incentives of startup ecosystem stakeholders by paying service providers with OAK, representing startup equity.

![]()

PassOn builds a systemic infrastructure to bring inheritance into the digital age by leveraging blockchain and smart contract technologies. The infrastructure and standard allow to secure digital assets and directly transfer them to beneficiaries of inheritance.

Sygnum develops an integrated solution to securely issue, store, trade and manage digital assets, which meets the highest institutional standards. Sygnum is also building an integrated equity issuance system to help companies raise capital from investors by tokenizing shares.

Sygnum develops an integrated solution to securely issue, store, trade and manage digital assets, which meets the highest institutional standards. Sygnum is also building an integrated equity issuance system to help companies raise capital from investors by tokenizing shares.

Open source protocol to increase scalability of Ethereum. The TrueBit protocol allows trustless, secure, scalable consensus on large computations orders of magnitude beyond what’s possible in Ethereum today.

Open source protocol to increase scalability of Ethereum. The TrueBit protocol allows trustless, secure, scalable consensus on large computations orders of magnitude beyond what’s possible in Ethereum today.

This article first appeared on Linkedin

The post Swiss Blockchain Startup Newcomers Map and Top 10 Project Selection appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments