Famous for its banking sector and ranked the most innovative country in the world by the Global Innovation Index , Switzerland has been leading transformative developments emerging from the digitalization of its banking and financial sector. Even the Swiss Board of Advisors name now digitization as the most important topic.

An estimated 10% of all European fintech businesses are now based in Switzerland, mainly in the city of Zurich.

According to the IFZ Fintech Study 2018, 2017 was the year that the Swiss fintech industry matured, with the sector becoming widely acknowledged as an important innovation driver and startups penetrating the financial system on different levels.

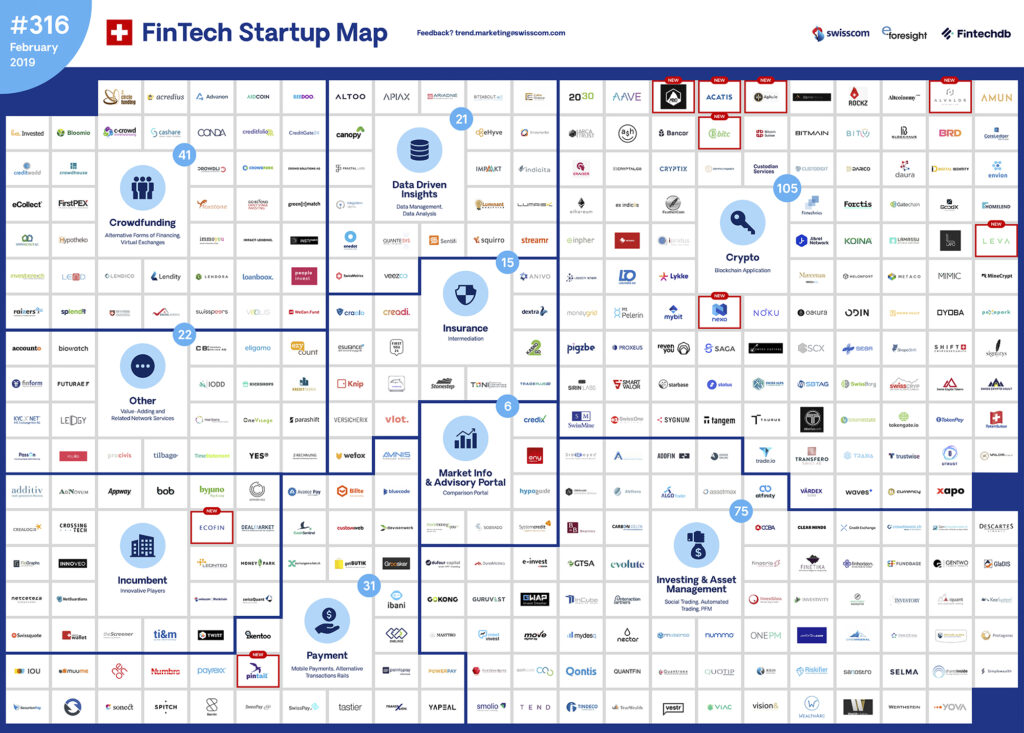

There were 220 fintech companies in Switzerland by the end of 2017, with 32 new companies being incorporated throughout the year. Two segments in particular have been witnessing significant growth: crypto and blockchain, and investment management.

A booming crypto industry

With over a hundred companies, the crypto and blockchain industry is Switzerland’s most developed fintech segment with ventures tackling multiple topics from cryptocurrencies and crypto-assets, to asset management and decentralized applications.

The willingness of political decision-makers to maintain and enhance Switzerland’s attractiveness for new technologies and companies, and the government’s desire to promote a sustainable crypto and blockchain economy, have largely contributed to the expansion of the Swiss blockchain sector.

The Federal Council issued a report in December 2018, providing a legal framework for blockchain, stating that Switzerland’s existing rules are well suited to dealing with such new technologies but there is still a need for some amendments.

According to the IFZ Fintech Study 2018, more than half of the new fintech ventures incorporated in Switzerland in 2017 operated in the blockchain and crypto space. The majority of these companies were founded in Zug, also known as Crypto Valley for the high concentration of blockchain startups located in the municipality.

Some of the hottest crypto and blockchain startups in Switzerland right now include Bitcoin Suisse, a company providing private and institutional clients with a wide-range of crypto-related services such as brokerage, crypto-assets storage, bespoke ICO services, and other crypto-financial services, Crypto Finance (Top Funded), which offers blockchain-related services through three subsidiaries: Crypto Fund, Crypto Broker and Crypto Storage, Melonport, a startup building the Melon Protocol, a decentralized asset management protocol which allows anyone to set up, manage and/or invest in an investment fund of digital assets, and Proxeus, a company providing a tool that enables the creation of blockchain applications that can be integrated into existing systems.

Investing and asset management

Second to blockchain and crypto is the investing and asset management field, unsurprisingly. With over 75 companies, it is the second most crowded fintech segment in Switzerland.

These companies, also called wealthtechs, offer an alternative to traditional wealth management firms, providing customers with technology-enabled tools including full-service brokerage alternatives, automated and semi-automated robo-advisors, self-service investment platforms, asset class specific marketplaces, and tools to keep up with the changing dynamics in wealth management.

Three new wealthtech companies were incorporated in Switzerland in 2017: GlaDIS, a company providing a technology software to build robo-advisory structures, VIAC, which offers a digital pensions solution, and Vision&, which offer qualified investors the opportunity to allocate funds to crypto assets.

Besides these new markets entries, there are multiple fintech companies in the field of investment management and wealth in Switzerland including Selma, a robo-advisor serving as a “personal assistant,” Simplewealth, an automated investment management service, and True Wealth, an online management platform.

Other Swiss fintech startups to keep an eye on

After wealthtech, crowdfunding is another top fintech segment in Switzerland. Companies and platforms in the field include Cashare, CreditGate24, Lend and Crowd4Cash, which provide loans for both private persons and companies, Splendit, which focuses solely on student loans, Creditworld, Swisspeers, and Lendico (in cooperation with PostFinance), which focus exclusively on small and medium-sized enterprise (SME) loans, Loanboox, a peer-to-peer (P2P) debt financing platform for public sector borrowers, and Instimatch, a P2P lending platform for institutional lenders and borrowers.

Other noteworthy startups in Switzerland include Amnis Treasury Services, which provides services in the fields of international payments, treasury and risk management, Apiax, a regtech startup, Monito, a comparison website for international money transfer services, NetGuardians (top funded), a cybersecurity startup, Neon, a provider of digital accounts, PriceHubble, a proptech company, Parashift, an artificial intelligence (AI) based accounting document management platform, and Yapeal, an upcoming neo-back.

Check out our selection of Switzerland’s hottest 19 Fintech Startups here.

The post Switzerland’s Booming Fintech Startup Industry in 2019 appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments