ICOs have gained further momentum this year, raising US$13.7 billion through 537 campaigns in the first five months of 2018 alone, according to a new report by PwC and Crypto Valley.

The US remains a leading ICO destination, raising more than US$1 billion this year so far. In Asia, it is Singapore that has emerged as the main ICO hub with US$1.1 billion, followed by Hong Kong with US$US$223 million.

In Europe, Switzerland stands out as the ICO capital, followed by the UK, the latter rapidly gaining terrain in terms of volume and numbers. Swiss ICOs have raised US$456 million.

But in recent months, tax havens such as the Cayman Islands and the British Virgin Islands have emerged as leading ICO hubs as they hosted “unicorn ICOs” EOS and Telegram.

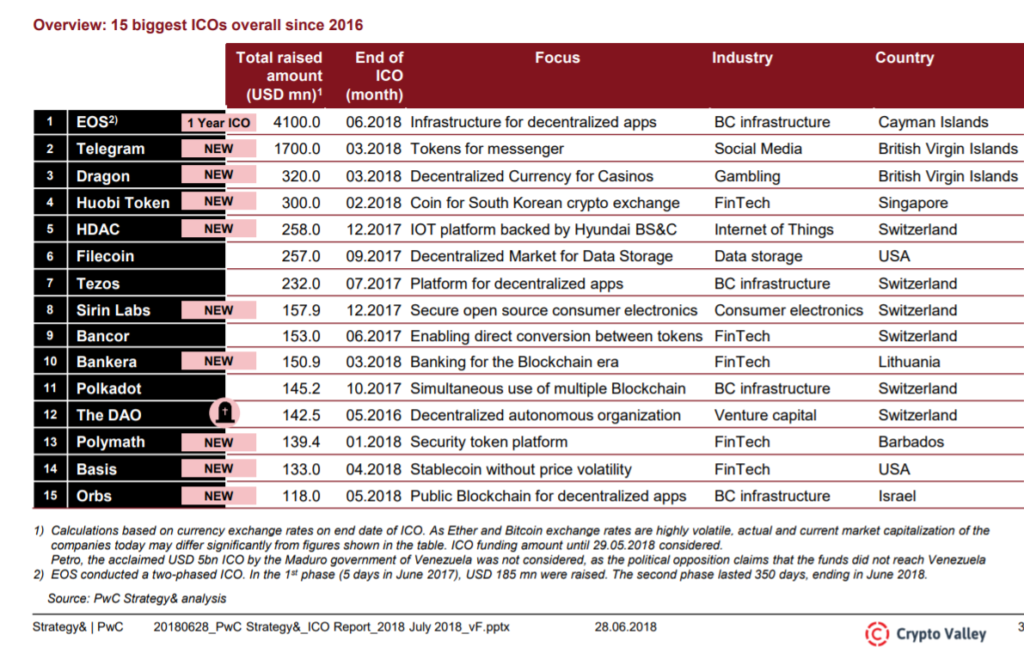

The following are the 15 biggest ICOs to have ever occurred so far:

EOS – US$4.1 billion

EOSIO is software that introduces a blockchain architecture designed to enable vertical and horizontal scaling of decentralized applications. The software provides accounts, authentication, databases, asynchronous communication and the scheduling of applications across multiple CPU cores and/or clusters. EOSIO is being developed by Cayman Islands software developer Block.one.

Telegram – US$1.7 billion

Messaging app Telegram is building the Telegram Open Network (TON), a fast, secure and scalable blockchain and network project. The TON blockchain will be capable of handling millions of transactions per second if necessary, and promises to be both user-friendly and service provider-friendly.

Dragon – US$320 million

Dragon Coin is a project by Macau based casino operator Dragon Corp. Dragon Coin, or DRG, is an Ethereum utility token used to participate in the Dragon blockchain ecosystem. DRG tokens are exchanged for DGC (Dragon Global Chips), a cryptocurrency gaming chip, at supporting casinos, which allows both players and casinos to take advantage of the added transparency and security of blockchain technology.

Huobi Token – US$300 million

Huobi, one of the leading cryptocurrency exchange by volume, has created its own native token, Huobi Token. Huobi Token is a point system based on blockchain distribution and management, running natively on the Ethereum blockchain. Huobi Tokens enable users to vote for their favorite projects to be listed on Huobi’s HADAX platform, and also allow them to receive free tokens from these projects. Users can also purchase special packages using Huobi Tokens that reduce their trading fees.

HDAC – U$258 million

HDAC, also known as Hyundai DAC, is an Internet-of-Things (IoT) platform supported by car manufacturer Hyundai. HDAC is a blockchain based platform that allows IoT devices to communicate with one another, while handling payments, data storage and identity authentication.

Filecoin – US$257 million

Filecoin is an open-source, public, cryptocurrency and digital payment system intended to be a blockchain-based digital storage and data retrieval method. It is made by Protocol Labs and builds on top of InterPlanetary File System (IPFS). Mining Filecoins entails letting other people store data on one’s hard drive.

Tezos – US$232 million

Tezos is a decentralized blockchain that promises to create a new digital commonwealth. Like Ethereum, Tezos is designed to make use of smart contracts. However, it claims to take the smart contract concept “one step further by letting participants directly control the rules of the network.”

Sirin Labs – US$57.9 million

Sirin Labs is a smartphone manufacturer that is currently developing the first cyber-protected, blockchain-enabled mobile phone and PC line. The Finney devices will run on Sirin Labs’s open-source operating system, Sirin OS, designed to support inherent blockchain applications, such as a crypto wallet, secure exchange access, encrypted communications, and a peer-to-peer resource sharing ecosystem for payment and apps, supported by the SRN token. The devices will form an independent blockchain network.

Bancor – US$153 million

Bancor is a blockchain protocol that allows users to convert between different tokens directly as opposed to exchanging them on cryptocurrency markets. The Bancor Protocol aims to be a new standard for Ethereum tokens. It lets smart contracts connect with a liquidity network for continuous liquidity on the chain throughout the network. Because of the protocol and this liquidity, there is no requirement to match sellers and buyers.

Bankera – US$150.9 million

Bankera is building “a digital bank for the blockchain era.” It will offer proper bank solutions such as IBAN accounts, payment cards and payment processing, not only for cryptocurrencies but also for cash, payment cards etc. The Bankera ecosystem will include a digital wallet, exchange platform, a debit card, and payment solutions for merchants.

Polkadot – US$145.2 million

Polkadot is a protocol that allows independent blockchains to exchange information. Polkadot is designed to enable applications and smart contracts on one blockchain to seamlessly transact with data and assets on other chains.

The DAO – US$142.5 million

The DAO was a digital decentralized autonomous organization and a form of investor-directed venture capital fund. The DAO had an objective to provide a new decentralized business model for organizing both commercial and non-profit enterprises. After raising US$142.5 million in a token sale, the DAO suffered a massive hack before completely collapsing.

Polymath – US$139.4 million

Polymath is a cryptocurrency project that wants to offer a method for traditional investment assets to be tokenized and tradable in a manner somewhat similar to other blockchain assets. It plans to do this through what it calls an “security token offering” (STO).

Basis – US$133 million

Basis, a project by American cryptocurrency startup Intangible Labs, is working on a “stable coin.” The company’s big idea is to develop a new token that people will actually use, instead of use to speculate. Basis is designed so that it can stabilize against anything it can source an exchange rate for, whether that the euro, yen, or even a global consumer price index (CPI).

Orbs – US$118million

Tel Aviv-based Orbs is developing a decentralized, open and transparent network providing a public blockchain infrastructure-as-a-service built for large scale consumer applications. The three primary infrastructure offerings of the Orbs platform include consensus-based decentralized compute services, consensus-based decentralized storage services and Consensus as a Service (CaaS).

The full PwC Strategy& and Crypto Valley Association report can be viewed here

The post The 15 Biggest ICOs So Far appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments