Despite common perception, financial services are often designed with wealthier white men in mind, making them therefore not always appropriate to a woman’s needs and preferences. In this context, a new niche of women-focused fintech products has emerged to serve this demographic with innovative products and services especially designed with their requirements and goals in mind.

In a new report produced in partnership with Keen Innovation, the European Women Payments Network (EWPN) gives an overview of the ecosystem of fintech for women, outlining why women need their own financial services.

In its Female Finance: Digital, Mobile, Networked report, the EWPN argues that although it is well documented that around the world, women undertake most daily household economic activities, most traditional financial products and services are actually developed for middle-class to wealthy white males. And because men’s and women’s goals and priorities differ substantially, most financial products fail to deliver true, meaningful value to women.

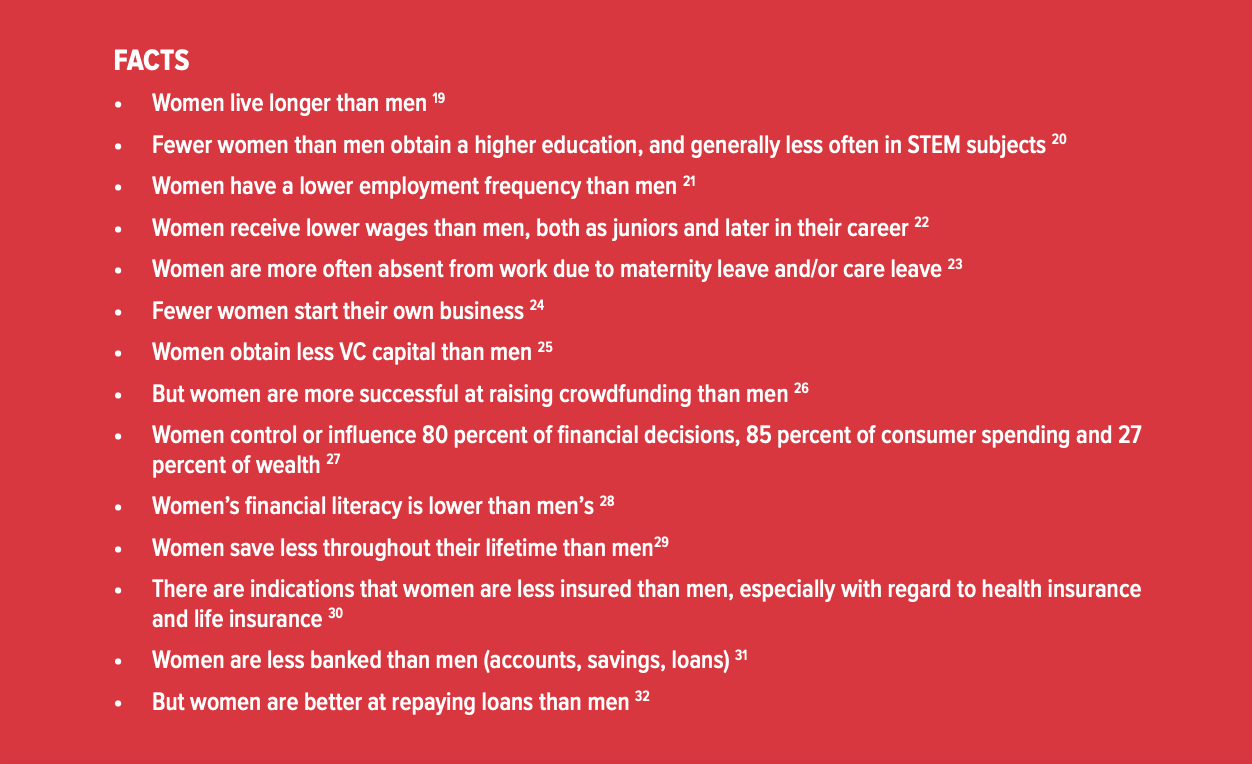

Some facts about women’s lives and their use of financial services, Female Finance: Digital, Mobile, Networked, June 2020, Source: EWPN and Keen Innovation

The report outlines three key considerations to keep in mind when developing and delivering financial services targeting women:

- The need for financial tools that help women develop and fulfil their social role like solutions that assist women who are primary domestic money managers with budget tracking, etc.;

- Financial tools that help them overcome historical barriers. For example, men tend to do better in the area of investing because women are generally not trained in these kinds of financial skills, and may have different decision-making processes. Additionally, women looking for professional help will often be met by stereotypical expectations; and

- Tools that meet women’s design and aesthetics preferences with features specifically for women rather than simply giving a product a feminized look.

Women-focused digital financial services

The EWPN report provides an overview of a new generation of digital financial services aimed at women, or used primarily by them, delving into five specific categories: payments and credit, financial management, insurance, investment, and funding sources for female entrepreneurs.

In the payments and credit vertical, the report cites the examples of Upwards, a fintech startup from India which offers a personal loan exclusively for working women professionals, Afterpay, a “buy-now-pay-later” platform used by a broad demographic but which largely targets women in their marketing, and Musoni Microfinance, a digital microfinance institution from Kenya that offers group lending, individual loans, agricultural loans, education loans and emergency loans. Around 63% of Musoni Microfinance’s clients are women and over 68% of the agri-business loans are to women smallholder farmers.

In financial management, several women-focused fintech solutions exist. Nav.it, for example, is a financial app helping women in the US pay down debt, automate savings, track spending and learn how to more optimistically navigate their financial future.

In Switzerland, traditional financial institution Bank Cler launched in 2001 Eva, an offering designed especially for women. Eva provides private female customers with consulting services and access to networking and events.

And in the UK, Smart Purse is a financial education platform that helps women become more savvy with money and give them the confidence to talk, understand and feel good about money.

In insurance, Jubilee Life Insurance provides an offering called Zaamin that’s specially designed to help women save and accumulate funds with the aim of providing financial security in old age and which also provides benefits in case of accidental death.

In the Philippines, Manulife’s Eve is a women’s health insurance policy that covers pregnancy complications and congenital anomalies of newborns, as well as cash benefits for seven days of hospital stay after childbirth. It also offers critical illness protection, cash support if the policy holder is diagnosed with female-specific cancer, coverage for surgery such as breast tumor removal, hysterectomy and reconstructive surgery, and includes life insurance.

In investment, FinMarie and Ellevest are two robo-advisory platforms especially designed for women. In the US, Women Investing Now (WIN) aims to empower women with the knowledge, skills and right-on-time decision guidance needed to reach good financial decisions and achieve financial goals.

Finally, the report outlines several funding sources specifically targeted at female entrepreneurs. These include for example Voulez Capital, a venture capital (VC) firm for female founders, and Neome, an investment club for women angel investors. Several women-focused crowdfunding platforms also exist including IFundWomen, Fund Dreamer and Women You Should Fund.

Female Fintech Ecosystem Europe

Female Fintech Ecosystem, Source: Female Finance: Digital, Mobile, Networked, June 2020

International management consulting firm Oliver Wyman estimates that financial services firms are missing at least a US$700 billion revenue opportunity each year by not fully meeting the needs of women customers.

These opportunities come from a combination of new clients, new products and services, and increased market share, the firm says in its Women in Financial Services 2020 report.

The post The Booming Women-Focused Fintech Ecosystem in Europe and What It Means appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments