The future of retail banking in Switzerland will be data-driven, ecosystem-based and run primarily through mobile consumer interfaces, a new study conducted by Business Engineering Institute St. Gallen found.

The study, commissioned by Contovista, Viseca, smama and e.foresight, is based on interviews of 14 experts from Swiss retail banks. It seeks to understand how incumbents perceive the relevance of so-called “data-driven banking,” and where adoption and implementation currently stand at.

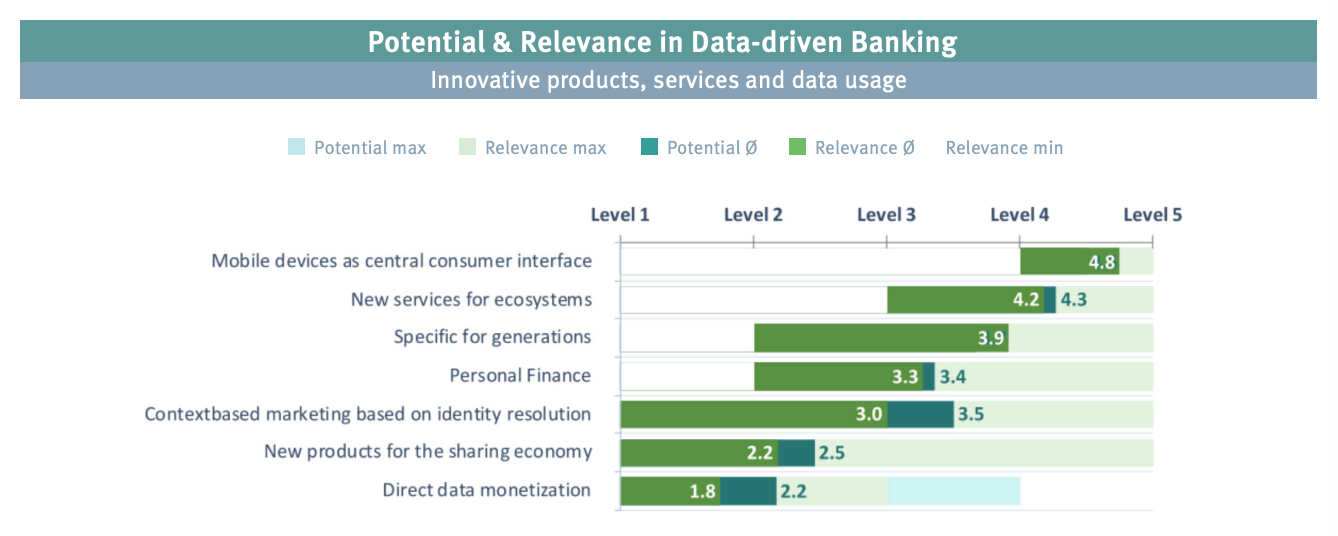

When asked about the most relevant innovations in their data-driven banking strategies, Swiss retail banks cited mobile devices, ecosystems and generational targeted offerings as the top three trends.

Potential and relevance in data-driven banking, Innovative products, services and data usage, Source: Data-driven Banking, by Business Engineering Institute St. Gallen (BEI) on behalf of Contovista, Viseca, smama und e.foresight, Sept 2020

Mobile banking is rapidly rising to prominence, especially at a time when COVID-19 is accelerating the shift to digital. In Insider Intelligence’s second annual UK Mobile Banking Competitive Edge Study, released in July 2020, data shows that 68% of all UK respondents surveyed use mobile banking.

Of that that use mobile banking, 86% said mobile was their primary banking channel and 62% said they would even change banks if the mobile banking experience fell short.

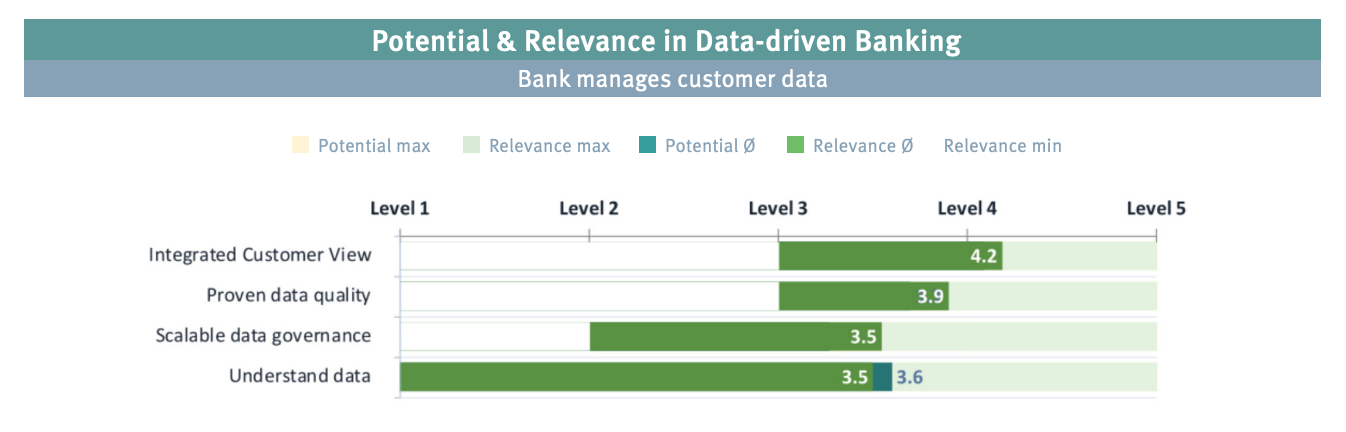

For Swiss retail banks, an integrated customer view with complete transaction history is considered the entry ticket to data-driven banking, the Business Engineering Institute St. Gallen research found. A united customer view with accurate data makes digital activation in context-based marketing possible. In this context, data management is seen as a cornerstone of data-driven banking, the study found.

Potential and relevance in data-driven banking, Bank manages customer data, Source: Data-driven Banking, by Business Engineering Institute St. Gallen (BEI) on behalf of Contovista, Viseca, smama und e.foresight, Sept 2020

Data-driven banking revolves around collecting, processing and using customer data to provide greater personalization. For Swiss retail banks, a personalized customer approach through profiling and behavioral analysis is top priority, the study found.

Potential and relevance in data-driven banking, Bank analyses their customers, Source: Data-driven Banking, by Business Engineering Institute St. Gallen (BEI) on behalf of Contovista, Viseca, smama und e.foresight, Sept 2020

The results from the Business Engineering Institute St. Gallen study echo findings from PwC’s Banking 2020 Survey. The firm, which polled 560 C-suite level respondents from banks across the world, found that developing a customer-centric business model has been this year’s top priority for incumbents.

Over the next five years, banks will be focusing on enhancing customer data collection (54%), evaluating their performance from a customer’s viewpoint (53%), and allowing for increased customer choice in configuring product features including pricing (50%), the PwC survey found.

Areas of significant effort over next 5 years, Source: PwC Banking 2020 Survey

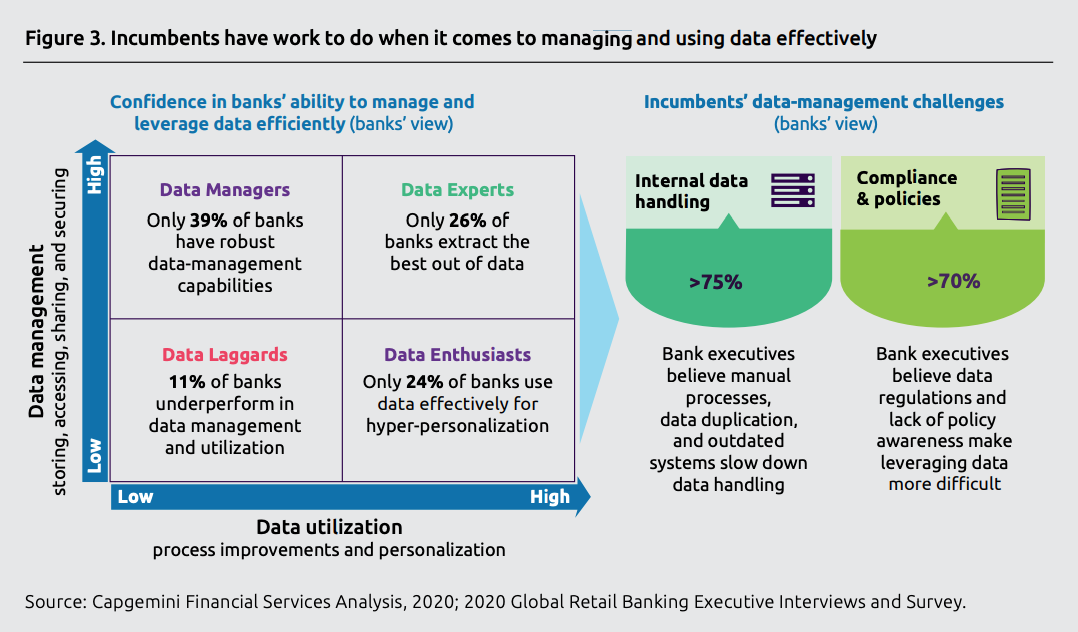

Though incumbents have understood that the future of banking will be data-driven, most banks still do not capitalize on their data-rich advantages. According to Capgemini and Efma’s World Retail Banking Report 2020, just 24% of banks actually use data effectively for hyper-personalization, and only 26% of them currently extract the best out of data.

Incumbents have work to do when it comes to managing and using data effectively, Source: Capgemini Financial Services Analysis, 2020; 2020 Global Retail Banking Executive Interviews and Survey

The post The Future of Retail Banking is Ecosystem-Based, Mobile-First and Data-Driven: Study appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments