The Green Fintech Network, a group of startups and experts in digital and sustainable financial services, has released an action plan to improve the framework conditions of green fintech companies active in Switzerland.

The action plan, released on April 8, 2021, outlines 16 proposals intended to turn the country into a leader in green fintech. These proposals focus on five areas: cultivating new startups; boosting the ecosystem and innovation; easing access to capital; fostering access to data; and promoting access to clients.

A green fintech action plan for Switzerland

To foster startup growth, the group proposes the introduction of an annual innovation challenge intended to attract global talent and entrepreneurs and encourage them to set up shop in Switzerland.

Dedicated green fintech accelerator tracks should also be established to support early-stage startups through education, mentorship, and financing. Finally, Switzerland should leverage the new Federal Law on distributed ledger technology (DLT) and encourage the use of blockchain in green finance, the group says.

To boost the green fintech ecosystem and innovation, it encourages the hosting of regular gatherings that would allow key stakeholders from Switzerland and abroad to exchange knowledge, latest research and enable match-making for joint projects. A key focus should also be put on exchanging knowledge and building ties with foreign agencies and global green fintech hubs and communities.

To encourage innovation and develop talent, the group proposes the establishment of distinct research funding opportunities for agencies such as Innosuisse, and encourages the creation of dedicated master classes on green digital finance, stressing the need for Switzerland to produce high class specialists and promote knowledge of sustainable finance among finance professionals.

To ease access to capital, the group suggests the creation of a fund of funds dedicated to green fintechs. The fund would invest in venture capital (VC) funds that have a focus on Swiss startups and could be financed by the government for example through the issuance of green tech bonds. It also recommends greater regulatory flexibility for pension funds to invest in green fintechs, and proposes measures to encourage VCs to base their funds in Switzerland.

On data accessibility, the group recommends the creation of an international sustainability data platform which would combine today’s dispersed environmental data points into an unified view. It also advises the Swiss government to work towards ensuring that Swiss actors have access to key sustainability data sets, and stresses the need for companies to improve sustainability disclosures to increase awareness of and capacity to address risks such as climate change.

Finally, to promote Swiss green fintech, the group suggests the establishment of a Swiss green fintech map that would give local startups global visibility. It also encourages stakeholders to come together to form a dedicated industry trade group that would help drive the transition towards a sustainable financial center, and promote the Swiss green digital finance ecosystem on a global scale.

Switzerland’s green fintech push

The Green Fintech Network is an informal group of experts representing companies and organizations such as the Zurich University of Applied Sciences, F10 Fintech Incubator and Accelerator, PwC and Swisscom, but also green fintech startups like MSCI Carbon Delta, Rep Risk and Yova.

The group was initiated by the State Secretariat for International Finance SIF and is part of Switzerland’s broader ambition to become a global leader in green digital finance.

Green finance refers to any structured financial activity that’s been created to ensure a better environmental outcome. Globally, the industry has blossomed with the green bond market projected to be worth US$2.36 trillion by 2023.

Sustainable finance, an evolution of green finance that takes into consideration environmental, social and governance (ESG) issues and risks, has considerably picked up in Switzerland over the past four years.

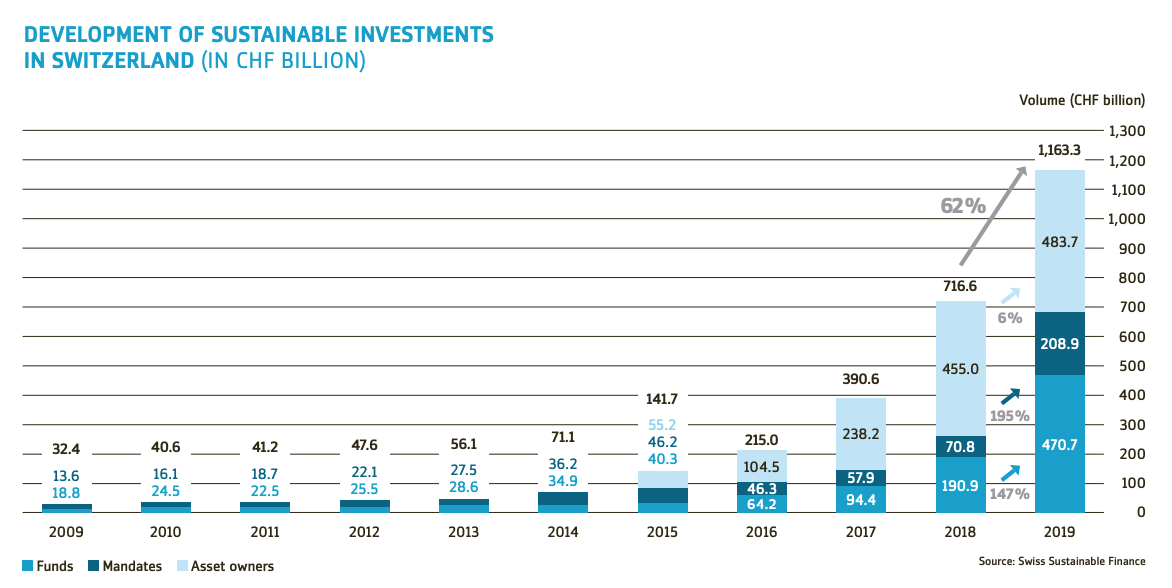

According to the Swiss Sustainable Investment Market Study 2020 prepared jointly by Swiss Sustainable Finance and the Center for Sustainable Finance and Private Wealth (CSP) at the University of Zurich, the market for sustainable investments in Switzerland experienced double-digit growth with volume increasing by 62% to over CHF 1,163 billion in 2019.

Development of sustainable investments in Switzerland (in CHF billion), Source: Swiss Sustainable Finance, via Swiss Sustainable Investment Market Study 2020

Featured image credit: Photo by Tanathip Rattanatum from Pexels

The post The Green Fintech Action Plan to Turn Switzerland Into a Sustainable Digital Finance Hub appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments