While the world is moving rapidly to cash in on the rapid changes and opportunities that technology brings, Switzerland may have slept through it all.

McKinsey recently released a report, urging the Swiss to “wake up” from its slumber that saw multitrillion dollar business opportunities pass them by. Although the report focuses on the losses sustained by the country in the tech scene, it suggests some serious implications for fintech development within the country.

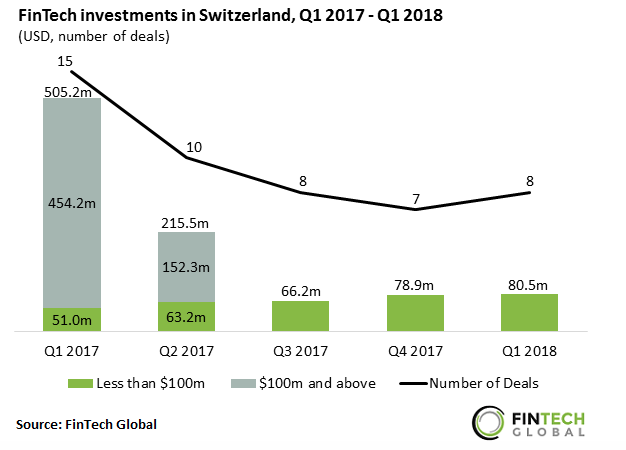

In fact, according to numbers from EY, Switzerland’s progress in adopting fintech is in fact below the global average. Figures show that investments in fintech in the country has slowed down last year, both in value and in number of deals, due to the lack of later-stage deals, as reported by FinTech Global.

PwC similarly noted Switzerland’s sleepy attitude towards the risk of fintech towards its core business, with only 40 percent of Swiss respondents feeling that their core business is at risk. In contrast, globally about 80 percent of companies believe their core business could be made redundant in the next five years.

Multinationals are the backbones of the country

Multinationals are the backbones of the country

McKinsey’s report noted that Switzerland’s economy is highly reliant on both local and foreign multinationals, accounting for over a third of the country’s GDP. In the past decade, these corporations have contributed CHF 3.5 billion per year to the GDP, and generated CHF 500 million per year in tax revenue upon relocation.

Multinationals are responsible for creating jobs in high-productivity sectors, providing 1.3 million jobs. Multinationals relocating to Switzerland have also for the past decade pay for close to half of the Swiss federal corporate tax revenues.

This is especially relevant, considering that most of the fintech unicorns across the globe are concentrated within Asia, China and India especially. If Switzerland wants a piece of that pie, it needs to appeal to foreign based fintechs, in hopes that they would choose Switzerland as its headquarters for Europe.

Losing the international headquarters charm

However, as noted in the McKinsey report, Switzerland has been losing that charm. Where it once was the top choice for headquarter locations, it has gradually slipped down the ranks, losing relevance to prominent cities in other markets, such as Singapore and Dubai.

According to the report, of multinationals relocating to European headquarter hubs, Switzerland’s market share decreased from 27 percent in 2009-2013 to 19 percent in 2014- 2018, even though relocation activity has increased overall.

Of all tech companies relocation, only 3 percent chose Switzerland. Similarly, only 5 percent of Chinese companies have chosen Switzerland for their relocation plan, with many opting to set up shop elsewhere, most favouring Germany and the UK.

So far, Luxembourg attracted all major Chinese banks (e.g., Agricultural Bank of China, China Merchant Bank) and payment providers (e.g., Alipay). This is despite Switzerland’s neutrality and reputation in China. Considering that China is leading the way for global fintech development, it may be a step too late for Switzerland to draw on Chinese expertise.

Losing the headquarters, as mentioned earlier on in the article, isn’t just about business. It also directly impacts on job creation and tax payments, and Switzerland may have just lost a huge chunk of potential due to that.

Lacking talents

Right now one of the largest drawback for many companies to choose Switzerland is the lack of available talent, especially in technology. A research by Eurostat also highlighted that compared to other European markets, the absolute number of STEM (science, technology, engineering, mathematics) graduates in Switzerland is low.

McKinsey suggest that while Switzerland has some of the most prestigious schools globally, it does not seem to provide sufficient talent to attract resource-intense multinational headquarters.

This is partially due to policies stating that international students who graduate from STEM programs in Switzerland only have six months to find employment before they have to leave Switzerland. On top of that, executives have expressed that it is difficult to compensate for the insufficient Swiss talent supply with people from outside Europe, mainly because of the restrictive immigration policy with non-EU countries.

Compounded with this issue, some executives believe that women have difficulty working in Switzerland due in part to high childcare costs, which further shrinks the available pool of talent. This is bad news for fintech, considering that the kind of skills and knowledge required in fintech is even more specialised than what is offered on general STEM programs.

Wobbly regulations

Even areas where the Swiss were traditionally perceived as strong in, namely regulatory reliability and tax environment, are facing a lot of uncertainty. Businesses are getting increasingly antsy with the country’s loose ends in international agreements and domestic reforms.

For example, Switzerland’s relationship with the EU and transatlantic free trade agreements, the reform of the Swiss Code of Obligations, and the Corporate Responsibility Initiative. Additionally, the Swiss government have proposed a tax reform, and the upcoming referendum will set the course for Switzerland’s tax regime. It is currently a period of high uncertainty, which is also affecting the confidence of multinational corporations.

Next steps

It’s not the end of the road for Switzerland however. McKinsey has listed some suggestions that could help boost the country’s appeal to foreign multinationals, which can in turn help development of technology, including fintech, within the country.

One of the biggest roadblock right now is talent shortage. McKinsey suggests the government review immigration regime for qualified, critical talent and expanding capacity at Swiss universities for sought after subject matters.

Also, there is a lot of anxiety revolving the uncertainty of Switzerland’s position in the international regulatory, economic, and tax context. To ease the worries, the government needs to clarify their position and establish the country as a powerhouse in open markets, while providing a favorable, reliable and predictable regulatory environment.

Finally, Switzerland needs to take a proactive approach to compete with its neighbours, and countries in other markets, including Netherlands, Ireland, or Singapore. Targeting high-potential, value-creating sectors such as artificial intelligence or robotics can have a positive impact on fintech development as well.

Many of the technologies that would drive the next industrial revolution are key components on a fintech platform. By marketing the country as a location that would be driving this change will in turn help draw in the companies that can help develop the fintech landscape in Switzerland.

Featured image credit: Unsplash

The post The Multitrillion Dollar Opportunities Switzerland Missed while it was Asleep appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments