Different system, different language, different rules: three factors that are quick to deter expats from pursuing home ownership in Switzerland. Sprinkle in a dose of legalese and the cost of having everything translated – with no guarantee that the end product will be any clearer – and the task seems virtually impossible. It comes as little wonder, then, that rental agreements continue to reign among expats, despite many wanting to put down lasting roots and gain a foothold on the Swiss property ladder.

Lifting the fog

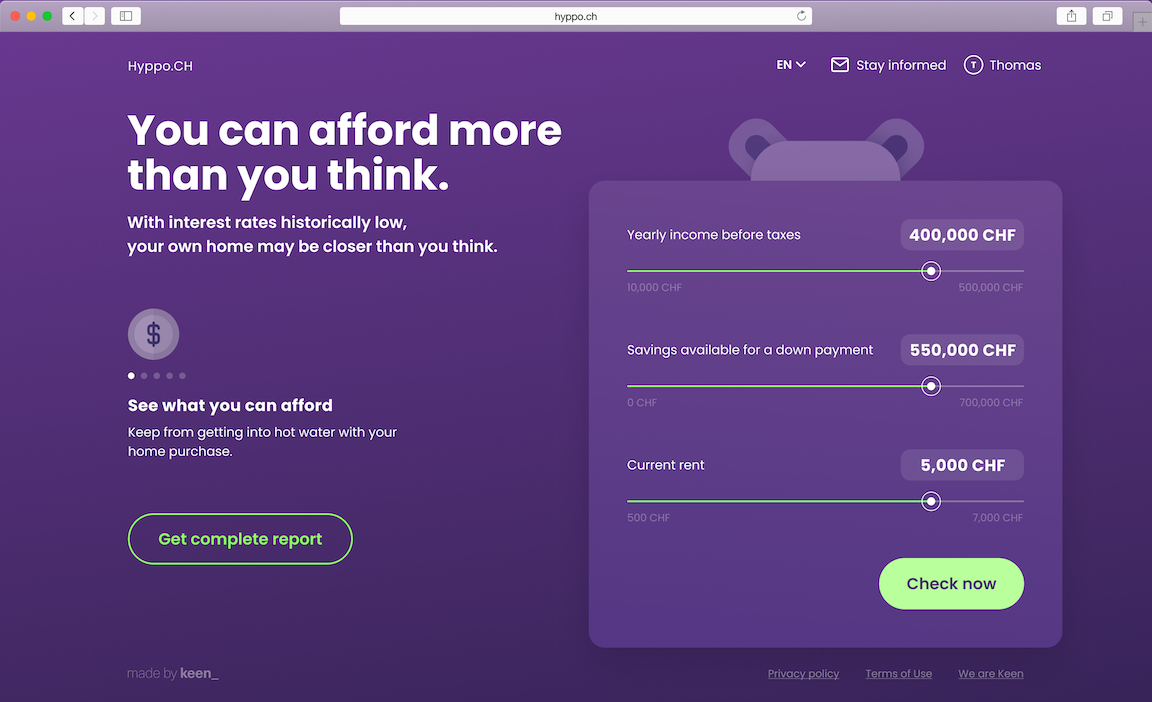

Fortunately, there’s now a way for expats to navigate the mortgage minefield with ease: Hyppo.CH, an innovative online mortgage calculator designed by Keen Innovation – a fintech innovation lab based in Basel – has the answers to all the questions a potential buyer may have about purchasing a property in Switzerland. The website breaks down the entire mortgage process into plain, simple language – no fewer than five languages in fact. It covers everything from how much a down payment should be in Switzerland (it’s 20%) to which residence permits are required. Nothing is left out, the explanations are simple and every step is clearly signposted with intuitive visual guides. Free to use and accessible at home and on the go, the website is available in English, German, French, Italian and Spanish. By the way, did you know you could use your pension savings as a guarantee in order to afford a bigger house? Now you do – you’re well on your way to becoming a true Swiss resident!

A few steps toward a dream future

Hyppo is originally designed as a web app that works on every platform. The landing screen is a streamlined version of the calculator on the Hyppo.CH website, and is intended to give users a quick overview of the type of home they can afford in Switzerland. This makes it ideal for use on the go – after, say, spotting a dream home for sale while out on a day trip.

No need to sweat the legal stuff

After inputting a few details, Hyppo.CH tells users if they fulfil legal requirements in order to sign their name on the dotted line. Not all residents with a foreign passport are eligible to purchase a home in Switzerland, so it’s a good idea to know this from the outset. EU citizens, for example, have the same rights as a Swiss passport holder. But citizens of other countries have to apply for an additional permit if they want to buy a holiday home or a second residence. Also worth knowing: owning property in Switzerland isn’t a fast track to a residence permit; in fact, it has no effect at all. Conversely, buying a property here while resident abroad results in certain restrictions (which vary depending on the canton).

The financial nitty-gritty

Buying a property involves much more than simply paying the mortgage (and interest) each month. Many people don’t realise this when they agree to the payment terms, meaning their dream home can quickly turn into a debt nightmare. Hyppo.CH sets out exactly what costs are involved – interest, building maintenance and amortisation – in a clear, colour-coded pie chart.

Hidden costs revealed

A down payment is essential for home ownership – this is the amount you have to pay upfront. However, this is not the only one-time payment a prospective homeowner will have to stump up: there’s also the fee for the notary (who oversees signature of the relevant documents by the purchaser and the seller) and a sizeable canton-specific property transfer tax, which covers the cost of the property’s entry into the land registry. A mortgage advisor will usually leave the latter fees out of the conversation – but Hyppo.CH doesn’t.

To buy or not to buy: that is the question

Buying a property is a good idea only if the numbers add up. If they don’t, it’s easy to become saddled with unmanageable amounts of debt. That’s why Hyppo has a feature that compares the monthly costs of renting a property with those involved in owning one. It states how many years it will take before owning returns a ‘profit’ over renting and sets out some handy additional factors to consider before making the property plunge.

Buying a property is a good idea only if the numbers add up. If they don’t, it’s easy to become saddled with unmanageable amounts of debt. That’s why Hyppo has a feature that compares the monthly costs of renting a property with those involved in owning one. It states how many years it will take before owning returns a ‘profit’ over renting and sets out some handy additional factors to consider before making the property plunge.

A handy PDF primer

Hyppo compiles all the information entered and all the calculations made into a convenient, easy-to-read PDF that can be downloaded and shared with trusted advisors, or simply saved for later consultation. That means there’s no need to enter the same data and perform the calculations again – it’s already there.

The best things in life are free

A property valuation is an important step along the road to owning a home. Why? Because a bank uses it to determine the property’s value and ultimately to grant or decline a mortgage. A property valuation can be a fantastic bargaining chip when a prospective homeowner sets their sights on a bigger place, as they can cite the market value during price negotiations and hopefully swing it in their favour. Hyppo.CH enables users to request a property valuation free of charge – all it takes is an email address and a qualified adviser will get in touch within just one business day.

Proof of funding is another free service provided by Hyppo.CH. This document is essential, as it confirms the prospective homeowner is financially solvent. Given that demand for proof of funding is rather high in Switzerland, it can often take several business days to obtain one – by which time the property might already be off the market. Thankfully, users can simply enter their email address and they will be contacted by a qualified adviser within one business day, who will resolve their proof of funding request ASAP.

Ilya Shumilin

“Our primary goal when developing Hyppo was to create an intuitive online mortgage calculator that helps expats on their journey to home ownership in Switzerland. How? By setting out in no uncertain terms exactly what it involves. Financing, legal, practical, administrative: Hyppo answers every question, offers practical advice and recommendations, and hopefully builds a little excitement en route to becoming a home owner in the land of cheese and chocolate.”

Ilya Shumilin, Open Innovation Manager, Keen Innovation AG

No hidden agendas, only straight talk

In any financial agreement, it’s easy to fall victim to unexpected costs, especially when they are deliberately buried in the small print. Hyppo.CH lists all the hidden fees a buyer can expect along the path to home ownership, and also breaks down the legal requirements involved in buying a property in Switzerland. The mortgage calculator can even analyse a person’s salary, savings and current rental agreement, and offer a recommendation on whether the time is right to buy or if renting is the better option. Hyppo.CH also comes with a range of additional services provided at no extra cost, including an in-depth property assessment and written confirmation of financing. What’s more, registered users can download a PDF report – protected by two-step verification – with an overview of their current financial situation and buying options.

In other words, it’s never been easier for potential buyers from Europe and further afield to get the ball rolling with a Swiss mortgage.

Featured image: edited from Pexels

The post The Voice of Reason: Hyppo.ch Offers Straight Talking on Swiss Home Ownership appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments