From retail and telecommunications to construction and transport, numerous sectors are currently experiencing disruption and digital transformation. This trend has been further accelerated by the global pandemic that forced people to adopt digital services in all spheres of life.

In the financial services sector, a major trend arising out of this drive for digital transformation has been the rise of neobanks, that operate solely online without any physical presence, unlike traditional banks.

As the Economist put it, the future of banking could be best understood through the eyes of digital natives. The main reason people choose a bank is convenience – for older people that means a nearby branch, while for the younger tech-savvy generation it means an excellent app.

Amid this robust growth of neobanking, a number of significant influencers have emerged in the space. Here’s a look at the top 10 influencers shaking up the neobanking space.

Global neobanking Influencers

Thousands of media articles and social media posts were scoured through and analysed by Commetric to find the top neobanking influencers. The company used Influencer Network Analysis, which uses natural language processing (NLP), text mining, dynamic visualisation and human enrichment, to provide a data-backed ranking of neobanking influencers.

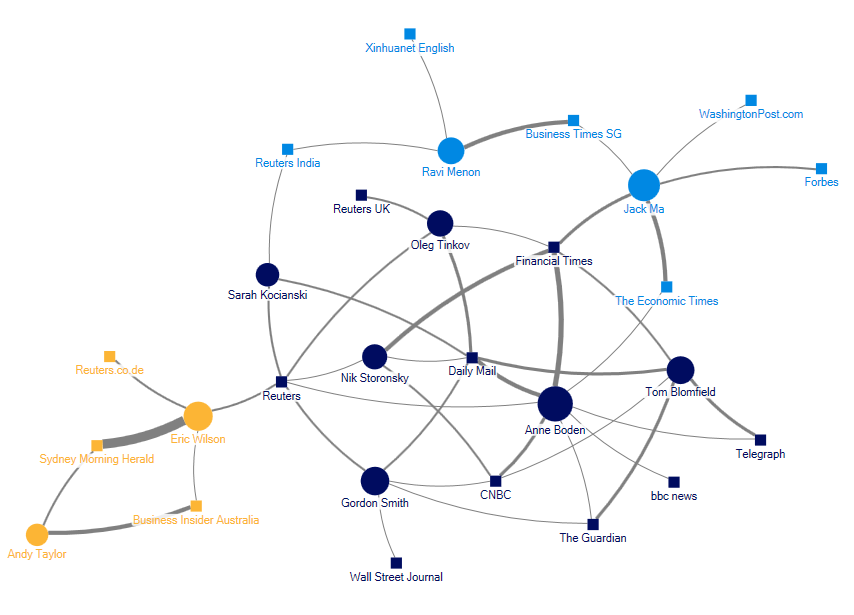

The media discussion around the relevant neobanking companies is presented as a two-mode network map below, displaying the influencers (circles) and the publications (squares) that referenced them in the neobanking coverage. The size of the circles indicates the influencer’s prominence in the media discussion, while the width of the connections between the individuals and the publications is indicative of the coverage volume.

Moreover, social media conversations including 18,399 tweets posted between May 2020 and May 2021 were also analysed by Commetric. As with everything relating to technology, cryptocurrencies, blockchain, AI or innovation as a whole, the social media discussion around neobanking is very dynamic, with many influencers regularly sharing thought leadership.

1. Anne Boden, CEO of Starling Bank

The bulk of the influencers came from neobanks, with Anne Boden, CEO of Starling, being the most influential individual in the debate. Publications like the Financial Times, CNBC and the BBC mentioned her not only in reports on Goldman’s investment in Starling but also in analyses on female leadership in the financial services industry.

Boden told the BBC,

“women have to achieve more, work harder and be much more perfect to get the job compared to a man,” and that the experience of being treated differently because she is female only inspires her to work harder.

The rise of neobanks and fintech startups as a whole has been perceived as ushering in more opportunities for women to become leaders. Banking has been an industry with a palpable presence in the gender diversity media debate – for example, Goldman Sachs received a flurry of media attention after announcing that it will carry out IPOs only for companies that have at least one woman or non-white board member.

2. Eric Wilson, Co-founder of Xinja

The second most influential individual, Eric Wilson, Co-founder of Xinja, was mentioned by outlets like Daily Mail and The Guardian because of his bank’s failure – Xinja became the first Australian bank to return all customer deposits and to surrender its banking licence after it failed to develop a sustainable business model. Wilson told Business Insider Australia earlier in the year that the bank had been “punched in the face” but that it was picking itself back up.

3. Tom Blomfield, Founder of Monzo

Monzo Founder Tom Blomfield gained prominence in the media for his decision to quit the digital bank because of mental health struggles during the pandemic after stepping down as CEO last year. He had also said that he did not enjoy working for Monzo in the two years since it transformed from a startup into a major brand with almost 5 million customers. Prior to Monzo, Blomfield worked at rival Starling.

Talking about his experience with Monzo at a recent podcast, he said,

“If I knew … the amount of pain and heartache involved I would never have started. But I didn’t know that, so I had a huge amount of self-confidence, a huge amount of naivety and just assumed that I could figure it out.”

4. Nik Storonsky, CEO of Revolut

Considered a “genius” by many, Nik Storonsky, CEO of Revolut, recently gained the spotlight for his assertion that if he was starting a payments business today, he would think digital banking wouldn’t be attractive because the capital requirements are so much tighter. He was referring to the Financial Conduct Authority’s plan to enforce new rules that experts say will drive up costs.

Storonsky has also been in the news previously for his mercurial personality, as well the startup’s questionable client acquisition and hiring practices.

5. Spiros Margaris, Founder of Margaris Ventures

Spiros Margaris, venture capitalist and futurist, and the founder and owner of Margaris Ventures had the highest influence score. He is a well-established thought leader and a frequent speaker at international fintech and insurtech conferences.

Recently, he suggested that although some claim the fintech industry has already seen the most exciting achievements it has to offer, there’s a lot more still to see, because to date, fintechs — from neobanks to trading apps — have picked only the low-hanging fruit. He also tweets about Bitcoin, saying that it is much more than a speculative asset.

6. Interfima and its director Marc R Gagné

Margaris was followed by the professional financial association Interfima and its director Marc R Gagné, who shares cybersecurity-related news. Gagné is a privacy and data governance advocate who sits on the Board of Directors of the Privacy and Access Council of Canada since 2010.

With nearly two decades of experience, Gagné has been focused on providing policy advice for government and corporate clientele alike. He is also a contributing author for Irish Tech News and regularly tweets about cybersecurity breaches and related issues.

7. Urs Bolt, product manager of ti&m

The most influential individual from a tech firm was Urs Bolt, product manager of digital banking at Swiss software firm ti&m, who recently tweeted that while tech innovations are driving digital banking, most banks’ core systems can’t keep pace nor leverage innovations.

Bolt has over 30 years of experience in wealth management, investment banking and related technology businesses. My core expertise lies in developing and rolling out new digital business platforms. He currently focuses on helping financial service providers and tech companies realign business strategies, advising on strategic projects, developing solutions and markets, and building business partnerships. He is also an active public speaker, moderator, micro-blogger, lecturer and author.

8. Theodora Lau, Founder of Unconventional Ventures

From the investment community, Theodora Lau, founder of Unconventional Ventures, a US financial wellness consultancy was found to be a neobanking influencer with a particularly prominent presence. Unconventional Ventures provides consulting services to drive innovation with the aim of improving systematic financial wellness.

Through Unconventional Ventures, Lau focuses on developing and growing an ecosystem of financial institutions, corporations, startups, entrepreneurs, venture capitalists, and accelerators to better address the unmet needs of consumers. She is also a renowned speaker in the industry, regularly talking on topics including artificial intelligence (AI) and fintech.

Moreover, she co-hosts One Vision, a podcast on innovation and fintech, and runs a weekly newsletter, ‘FinTech Prose,’ which discusses emerging technologies such as voice recognition and AI), fintech and innovation. Additionally, she is a guest contributor at Harvard Business Review, Nikkei Asia, MIT Tech Review, American Banker, Breaking Banks, Irish Tech News, among others.

9. Bradley Leimer, Founder of Unconventional Ventures

Bradley Leimer founded Unconventional Ventures with Lau and regularly writes and speaks about banking and technology trends, advises corporates, startups, accelerators and gives speeches at key industry conferences in the financial sector. He promotes engagement banking strategies, that can be described as a marketing, sales, and service model that uses technology to achieve both customer intimacy and scale. A significant element of these efforts is understanding customer behaviour and predicting its impact on evolving business models in banking, Leimer believes.

10. Jim Marous, host of Banking Transformed

One of the most prominent journalists in neobanking is Jim Marous, host of the Banking Transformed podcast. Marous is an internationally recognized financial industry strategist, co-publisher of The Financial Brand, and owner and publisher of the Digital Banking Report. Marous provides advice on all aspects of digital transformation within the financial services industry.

As a prominent public speaker and author within the financial services industry, Marous contributes to Forbes and has been featured by CNBC, CNN, The Wall Street Journal, New York Times, The Financial Times, The Economist, among other publications. Marous has also advised the White House on banking policy in the past.

11. Christian König, Founder of Fintech News Network

With more than 15 years of experience in financial services including fintech and investment banking, Christian König, Founder of Fintech News Network, has rightly emerged as a neobank influencer. König started his career as a derivatives banker and moved on to the publishing industry to bridge the gap in fintech reporting.

While traditional media houses overlooked the importance of fintech, König aimed at raising awareness around the sector, especially in emerging markets. His company focuses on providing emerging and insightful fintech-related news. Fintech News Network currently has a presence in Switzerland, Singapore, Malaysia, Hong Kong, the Philippines, Vietnam, Middle East, the Baltic and Africa.

Owing to his expertise in content marketing and digitisation, König is also a well-known lecturer and consultant, both within and outside the financial sector.

12. Brett King, CEO of Moven

The only neobank CEO influencer on the list is Brett King, CEO of Moven, one of the first challenger banks which closed its US consumer financial services operations in 2020 due to lack of funding. Moven continues to operate as a mobile banking and financial technology application developer.

King is regarded as an influencer in financial services globally, contributing to publications like the BBC and the Huffington Post and producing on-air interviews with women leaders in the financial tech sector. He recently tweeted about how the shift to a digital-first world triggered by the pandemic has exposed the disparity in digital inclusion.

The post Top 12 Global Neobanking Influencers in 2021 appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments