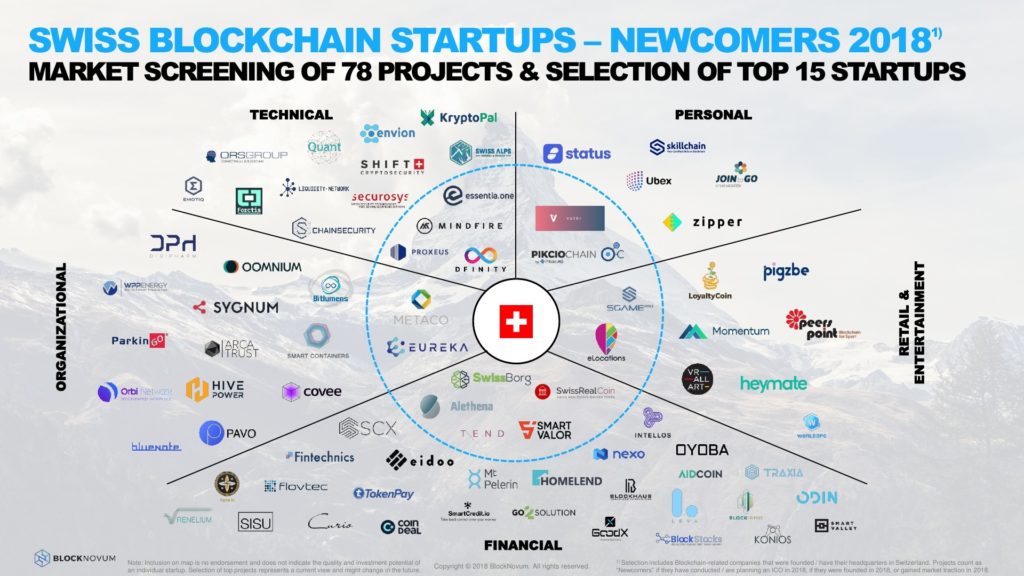

BlockNovum just published its second public Blockchain research report, which provides a comprehensive market overview about Blockchain startups in Switzerland. The report specifically focuses on “Newcomers” in the Blockchain space.

This selection includes startups that did conduct an ICO in 2018 (or are planning to ICO later this year), that were newly founded in 2018, or that managed to get first measurable traction (through product release or media attention) in 2018.

The aim of the report is to provide a thorough overview about Swiss newcomers in the blockchain space for investors and industry exponents alike. The map helps navigate the ever-growing crypto landscape in Switzerland by listing all relevant new startups in one place and classifying them in different categories.

Research Focus:

BlockNovum categorized the screened projects in five categories: Technical, Organizational, Financial, Retail & Entertainment, and Personal.

- Technical: Projects that provide a technical solution or service related to the blockchain technology. This includes new protocols, blockchain layers, file storage, computation, cyber security, artificial intelligence (AI), technical platforms, and infrastructure solutions related to the blockchain.

- Financial: Projects and services with a focus on financial applications and use cases. This category includes new cryptocurrencies, exchanges, payment systems, banking services, prediction markets, funds & investment services, investment related data & information platforms, tokenized assets, and others.

- Organizational: Projects with an organizational focus that mainly tackle challenges related to coordinating, tracking, and organizing people, resources, or data. Hence, this category consists of use cases around governance, supply chain, internet of things (IoT), content distribution, energy etc.

- Personal: This category includes startups that provide applications for personal use in daily life. Therefore, this section lists offerings around personal authentication, social networks, messaging, personal data & monetization, advertising, or personal healthcare.

- Retail & Entertainment: The last category includes services with a retail focus or with entertainment purposes. Blockchain startups in this category offer services around marketplaces, gaming, virtual reality, music, sports, art, education, ticketing, and others.

Furthermore, the research focus was explicitly set on projects that were founded and are operational in Switzerland. Companies that have their headquarters in Switzerland and/or conduct an ICO according to Swiss regulations were also included.

Overall BlockNovum identified 78 blockchain-related projects that matched the selection criteria. Note that “older” and more established cryptoassets / startups that did an ICO in 2017, or earlier, were not included in the map. Therefore, you won’t find the likes of Ethereum, Ambrosus, Modum, Lykke, Cardano, Shapeshift etc. in this overview.

Findings & Selection of 15 High Potential Startups:

In the report BlockNovum lists all 78 startups including a categorization and short description for each. Out of all screened startups, BlockNovum selected 15 projects which were assessed to have the highest investment potential. The selection was based on the expected product-market fit, viability of use cases, founding team and experience, stage of development, quality of website/whitepaper/MVP, and the token type & usage.

It has to be noted that several startups in the map came out of stealth mode very recently or are at a very early stage of development. Therefore, these projects could not be properly assessed yet and stay on our watchlist. Consequently this list is not to be seen as final and will be updated for interested clients in the future.

To illustrate BlockNovum’s market research and investment screening offering, an example assessment of long-listed and short-listed startups is given as well in the report. The long-list analysis covers the selected “Technical” and “Financial” startups, whereas the “short-list” assessment example is performed for “Proxeus”. This type of research is primarily geared towards investors who require a high-level market overview and assessment of several startups that match their investment criteria. Subsequently, short-listed projects can then be properly analyzed and evaluated with BlockNovum’s in-depth investment research & due diligence offering.

To see the selection of the top 15 blockchain startups, have a look at the full report here: BlockNovum_Market Screening_Switzerland-2018

Top 15 Swiss Blockchain Newcomer Startups in 2018

Essentia is a modular decentralized framework empowering users with full control over their own IDs, data and assets. Our mission is to offer the full control of decentralization in the hands of the users, by enabling both on-chain, off-chain and multichain interoperability, between users, machines and third parties.

Essentia is a modular decentralized framework empowering users with full control over their own IDs, data and assets. Our mission is to offer the full control of decentralization in the hands of the users, by enabling both on-chain, off-chain and multichain interoperability, between users, machines and third parties.

Proxeus is a powerful tool that unlocks the next stage of digitization by easily integrating blockchain workflows in parallel with existing systems. Proxeus is a blockchain entrepreneur with over a decade experience in building successful digital businesses. Proxeus have developed their own technology allowing us to industrialize the creation of blockchain applications, powered by XES, their own cryptocurrency.

Proxeus is a powerful tool that unlocks the next stage of digitization by easily integrating blockchain workflows in parallel with existing systems. Proxeus is a blockchain entrepreneur with over a decade experience in building successful digital businesses. Proxeus have developed their own technology allowing us to industrialize the creation of blockchain applications, powered by XES, their own cryptocurrency.

DFINITY is a blockchain based world computer network that is powerful enough to host business applications at scale. The network features a variety of innovations in the blockchain space. The DFINITY network is self-governing through the use of an adaptive network called the Blockchain Nervous System (BNS).

DFINITY is a blockchain based world computer network that is powerful enough to host business applications at scale. The network features a variety of innovations in the blockchain space. The DFINITY network is self-governing through the use of an adaptive network called the Blockchain Nervous System (BNS).

VETRI’s value proposition constitutes a radical shift from the way we manage our personal data and how companies exploit it for monetary gains.

VETRI’s value proposition constitutes a radical shift from the way we manage our personal data and how companies exploit it for monetary gains.

PikcioChain is a fully distributed information superhighway that brings individuals and organisations together to buy, sell and exchange data with confidence. Pikcio has been designed to store, secure, verify and certify data while ensuring the data source retains full control of their information at all times. Pikcio lets the user choose how to share their data, who to share it with, while also providing them with the opportunity to be paid for its use.

PikcioChain is a fully distributed information superhighway that brings individuals and organisations together to buy, sell and exchange data with confidence. Pikcio has been designed to store, secure, verify and certify data while ensuring the data source retains full control of their information at all times. Pikcio lets the user choose how to share their data, who to share it with, while also providing them with the opportunity to be paid for its use.

Sgame Pro

Sgame Pro is the first mobile games aggregator where players can “mine” crypto-tokens while simply playing the world’s most popular games.

is the first mobile games aggregator where players can “mine” crypto-tokens while simply playing the world’s most popular games.

The SwissRealCoin mechanism has been designed to create a crypto token with the full upside potential of crypto currencies, while protecting the downside through an inner value and sustainable growth.

The SwissRealCoin mechanism has been designed to create a crypto token with the full upside potential of crypto currencies, while protecting the downside through an inner value and sustainable growth.

TEND is a blockchain company that creates a new, life-enriching investment world driven by passion and meaning. A marketplace of investment-related experiences for forward-thinking, like-minded people who wish to invest their money more purposefully and live a fuller and enriched life. We provide to our customers amazing investments and related experiences, elevating and inspiring them to achieve the unexpected and explore new personal horizons.

TEND is a blockchain company that creates a new, life-enriching investment world driven by passion and meaning. A marketplace of investment-related experiences for forward-thinking, like-minded people who wish to invest their money more purposefully and live a fuller and enriched life. We provide to our customers amazing investments and related experiences, elevating and inspiring them to achieve the unexpected and explore new personal horizons.

Alethena is the first Swiss Blockchain-Asset Rating Agency. Reliable due diligence and a resulting rating are established by providing a professional, transparent, and in-depth methodology. Proudly transferring the values of its Swiss heritage, Alethena sets itself the highest standards of neutrality and independence. A scalable and decentralised methodology is the definite goals to be achieved with A.I. and Machine Learning in the near future.

Alethena is the first Swiss Blockchain-Asset Rating Agency. Reliable due diligence and a resulting rating are established by providing a professional, transparent, and in-depth methodology. Proudly transferring the values of its Swiss heritage, Alethena sets itself the highest standards of neutrality and independence. A scalable and decentralised methodology is the definite goals to be achieved with A.I. and Machine Learning in the near future.

The SwissBorg Project aims to revolutionize asset management solutions with a community-centric approach powered by Ethereum. Members will be able to optimize their cryptocurrency holdings with the help of our Cyborg advisors and deep learning algorithms.

The SwissBorg Project aims to revolutionize asset management solutions with a community-centric approach powered by Ethereum. Members will be able to optimize their cryptocurrency holdings with the help of our Cyborg advisors and deep learning algorithms.

Established in 2014 in Switzerland, Metaco has rapidly become an expert in helping banks and financial institutions, including national banks, capitalise on the latest blockchain technologies and systems. Its high-grade cryptographic solutions can be fully integrated into a bank’s core processes.

Established in 2014 in Switzerland, Metaco has rapidly become an expert in helping banks and financial institutions, including national banks, capitalise on the latest blockchain technologies and systems. Its high-grade cryptographic solutions can be fully integrated into a bank’s core processes.

About the Study/Author:

“BlockNovum is a Swiss Blockchain and Cryptoasset investment research & consulting firm. We provide professional assessments, fundamental valuations, and market research reports for the emerging asset class of cryptoassets & blockchain startups. Our target client segment includes mainly institutional investors (VCs, family offices, [Crypto]-funds & other asset managers) with an interest in allocating capital to cryptoassets or blockchain startups.”

This article first appeared on linkedin.com

The post Top 15 Swiss Blockchain Newcomer Startups in 2018 appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments