The Portuguese fintech industry is growing at an accelerated pace, with now over 100 companies operating locally, including regional leaders Revolut and Monese, according to Portugal Fintech’s 2019 industry report.

The report, which presents an overview of the industry’s progress and main trends of 2019, also includes a selection of the year’s “top 30 Portuguese fintechs.”

Out of the 30 companies, 70% are headquartered in Portugal, while the remaining are either double-based or based outside national territory. Insurtech, and lending and credit are the most popular segments, representing a combined 34% of the 30 companies.

Almost 80% of these companies operate under a business-to-business (B2B) business model, the research found, and 16 of them were founded over the past 3 years, showcasing that the sector has just begun taken off within the last few years.

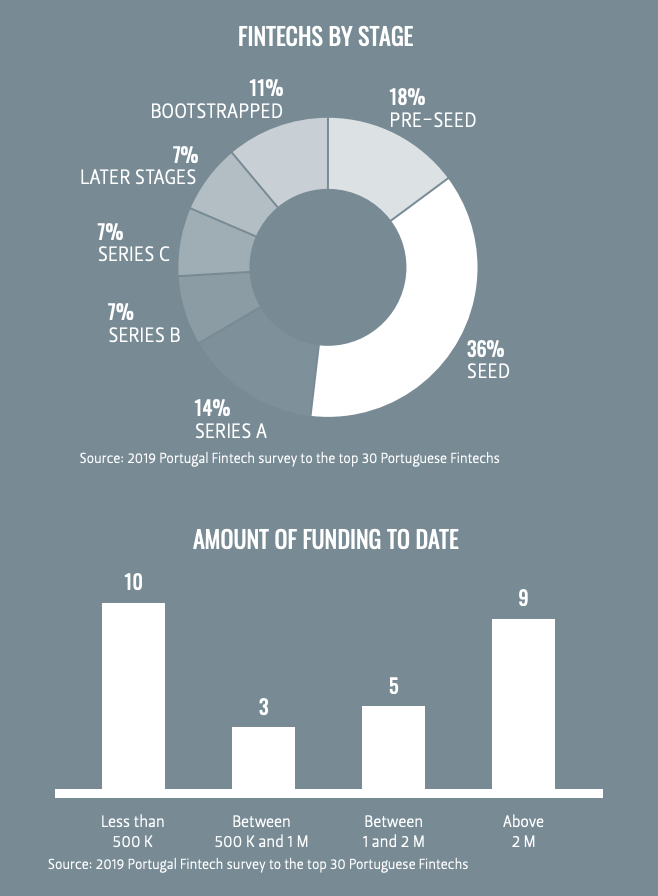

These 30 companies have raised a combined of more than EUR 210 million from both national and international venture capital (VC) firms. 67% of them are early stage (pre-seed to Series A) ventures, with 37% of them having raised less than EUR 500,000, and 33% more than EUR 2 million in funding.

Portugal fintech funding, Portugal Fintech Report 2019, Portugal Fintech

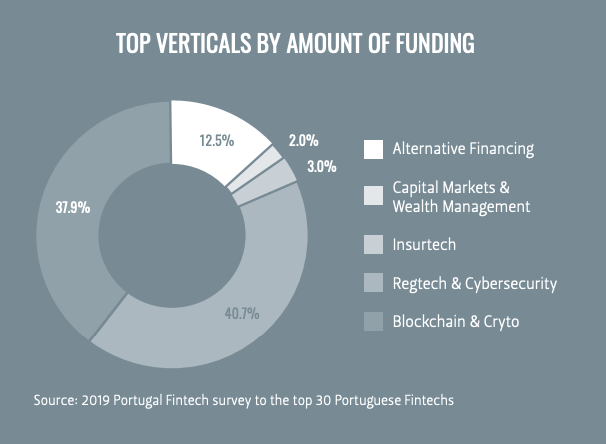

According to the report, fintech companies within the regtech and cybersecurity segment have raised the highest amounts of funding (40.7%), followed by blockchain and crypto (37.9%).

Top verticals by amount by funding, Portugal Fintech Report 2019, Portugal Fintech

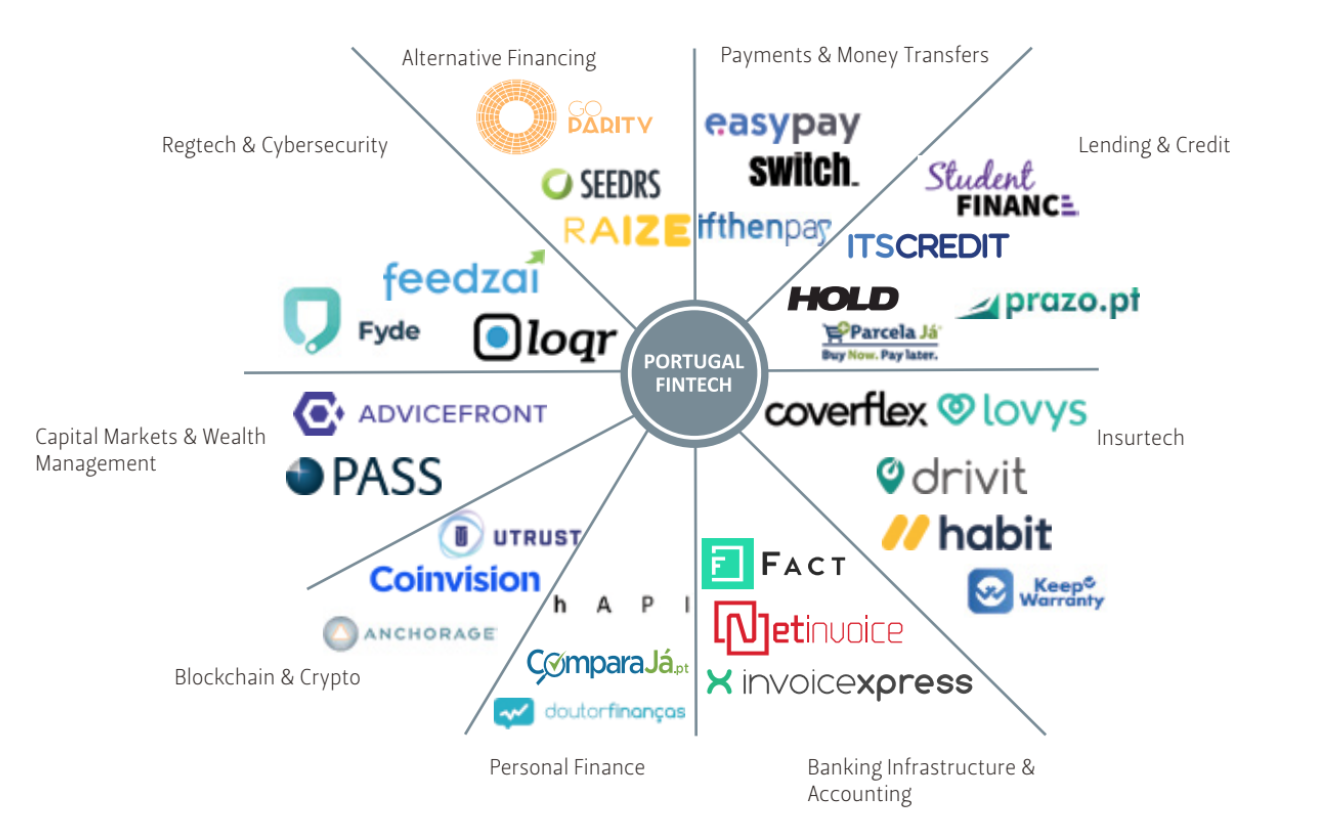

Top 30 Fintechs in Portugal in 2019

Top 30 Portuguese Fintechs, Portugal Fintech Report 2019, Portugal Fintech

According to the report, the top 30 Portuguese fintech companies of 2019 consist of:

- Three payments and money transfers startups: Switch, Ifthenpay, and EasyPay, all headquartered in Portugal;

- Three regtech and cybersecurity companies: Feedzai (HQ: USA), Loqr (Portugal) and Fyde (USA);

- Five insurtechs: Coverflex (Portugal), Drivit (Portugal), Habit Analytics (USA), Lovys (France) and Keep Warranty (Portugal);

- Two capital markets and wealth management companies: Advicefront (UK) and Pass (Portugal);

- Three personal finance companies: ComparaJá.pt (Portugal), Doutor Financas (Portugal) and Hapi (Portugal);

- Three alternative financing companies: GoParity (Portugal), Raize (Portugal) and Seedrs (UK).

- Five companies in lending and credit: Hold (Portugal), Itscredit (Portugal), Parcela (Portugal), Prazo.pt (Portugal) and StudentFinance (Spain);

- Three banking infrastructure and accounting companies: Fact.pt (Portugal), InvoiceXpress (Portugal) and Netinvoice (Portugal); and

- Three blockchain and crypto startups: Anchorage (USA), Coinvision (Portugal), and Utrust (Switzerland).

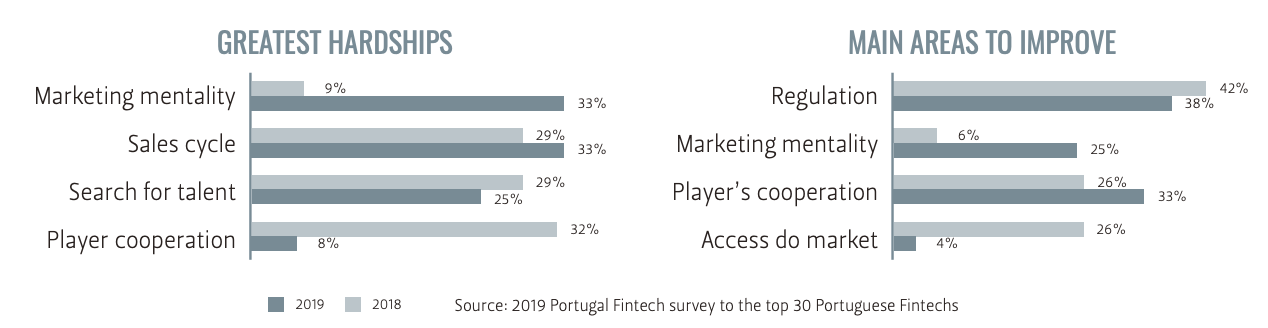

As part of the research, the trade group surveyed the 30 companies to better understand the state of the industry and the biggest challenges they faced in 2019.

Respondents cited player cooperation and talent as the greatest hardships faced in 2019, and, as for 2018, they cited regulation as the main ecosystem challenge in 2019.

Greatest hardships and challenges, Portugal Fintech Report 2019, Source: 2019 Portugal Fintech survey to the top 30 Portuguese Fintechs

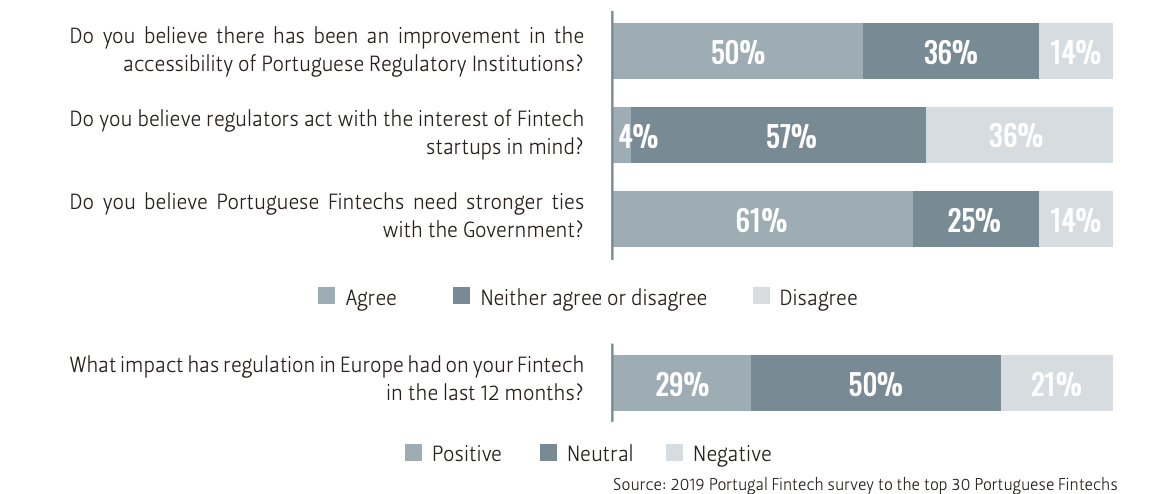

Nevertheless, efforts have been made in these regards with 50% stating that they saw improvements in 2019 in the accessibility of Portuguese regulatory institutions, and 46% agreeing that it had become easier to work with incumbents in 2019.

Working with incumbents, Portugal Fintech Report 2019, Source: 2019 Portugal Fintech survey to the top 30 Portuguese Fintechs

Policy and regulation, Portugal Fintech Report 2019, Source: 2019 Portugal Fintech survey to the top 30 Portuguese Fintechs

Key fintech trends in Portugal

According to Ricardo Macieira, country manager of Portugal at Revolut, the country is rapidly emerging as a “key fintech hub in Europe” with major tech events such Web Summit taking place annually, in addition to a being home to a “very tech savvy” population that’s keen on adopting new products and services.

Revolut, which opened its Portugal office in late-2019, says it now has more than 270,000 users in the country. Today, Portugal represents its 7th biggest market in Europe for its retail business, and the 5th biggest for its business offering.

Team Genesis, a specialized team part of law firm Morais Leitão, Galvão Teles, Soares da Silva, which focuses on directing legal advice to emerging companies and founders, notes that an increasing number of international fintech scaleups like Revolut have been setting up shop in Portugal, citing the country’s clear legislative framework and the favorable passporting rules in the European Union (EU).

Meanwhile, consultancy firm Accenture says it has been working collaboratively with industry participants including innovative startups and entrepreneurs, as well as banks, insurance companies, and organizations like Associação Portugal Fintech and Nova School of Business and Economic, to build a leading fintech and insurtech ecosystem in Portugal with a particular focus on artificial intelligence (AI).

“Portugal is more than ever well suited to be a key player in this new revolution and drive the future of AI in financial services, today,” the firm claims.

The post Top 30 Fintechs from Portugal appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments