The UK, a renowned fintech hub with a thriving ecosystem and an international talent pool spanning the whole country, continues to maintain its leading position on the global fintech scene.

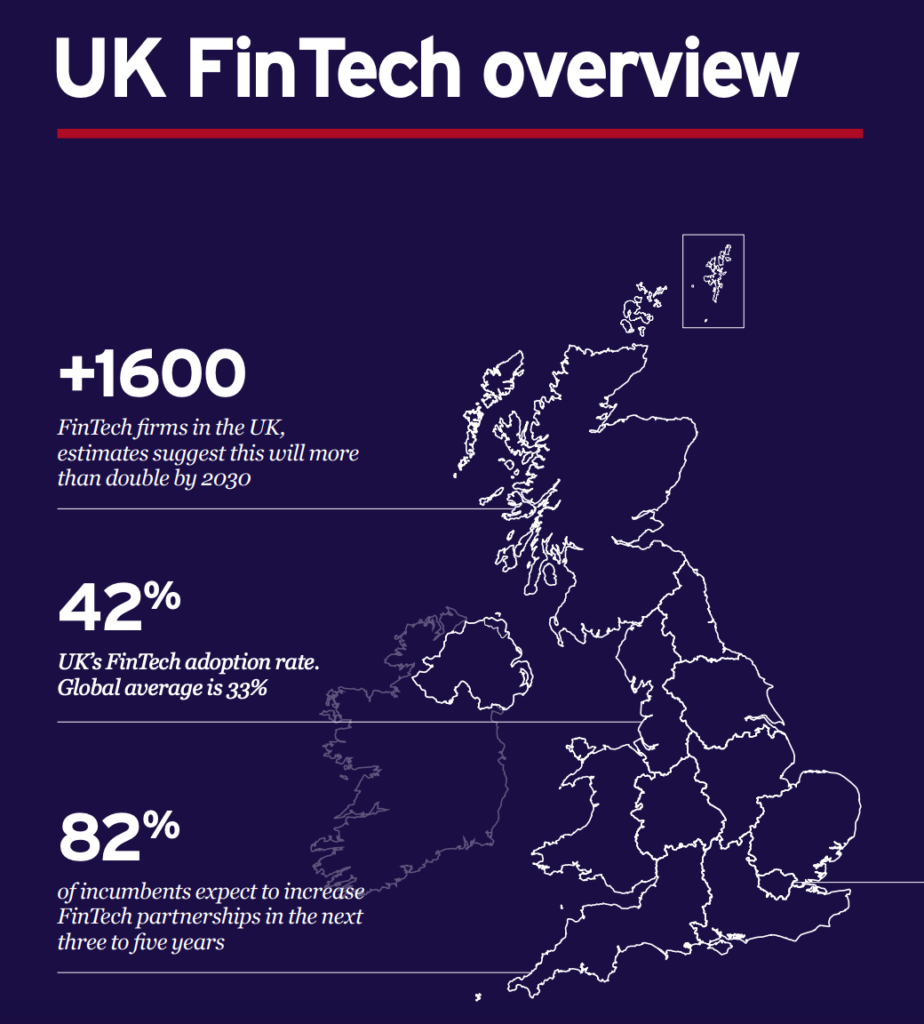

Today, the UK is home to more than 1,600 fintech firms which raised US$3.3 billion in 2018, representing more than 68% of the US$4.8 billion recorded across Europe, according to this year’s UK Fintech State of the Nation report.

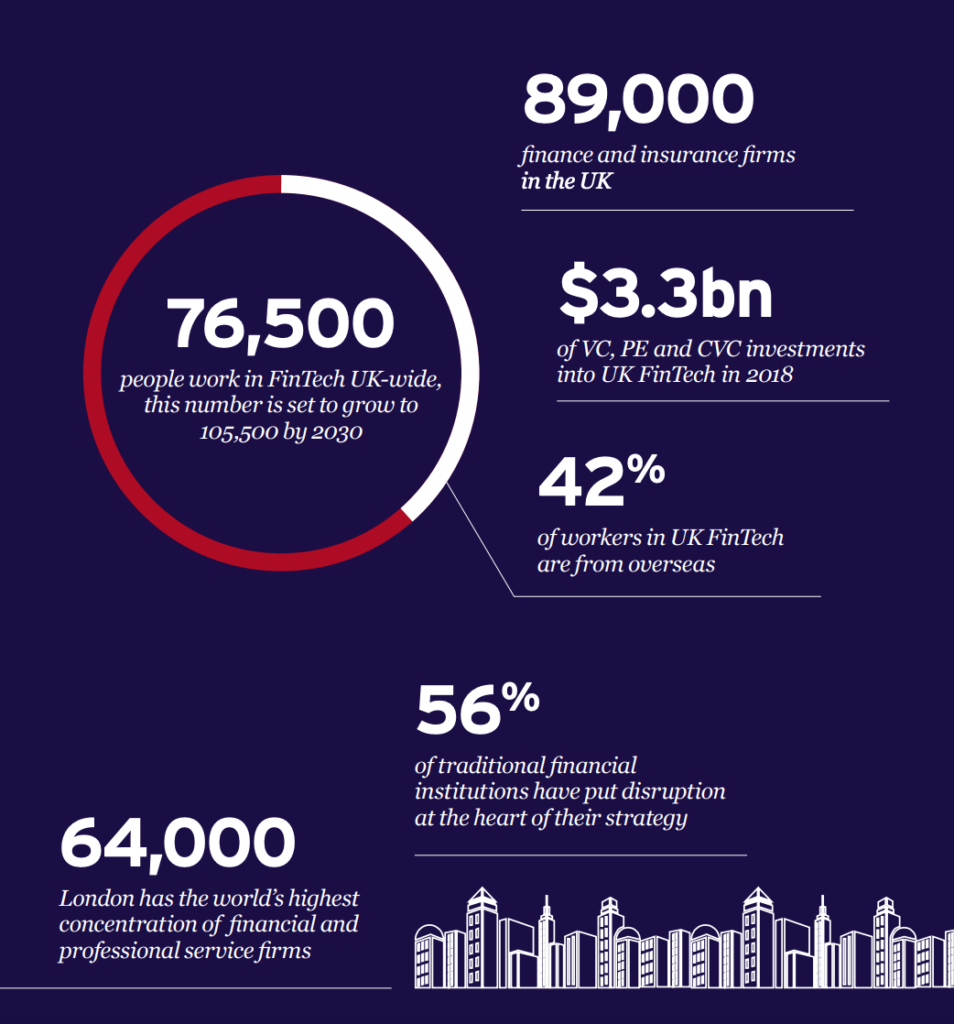

Released earlier this month by Her Majesty’s Treasury (HM Treasury), the Department for International Trade and Innovate Finance, the report provides an overview of the UK’s fintech industry. According Peter Estlin, the Lord Mayor of the city of London, the UK fintech sector now employs over 76,500 people and generates a revenue of GBP 6.6 billion.

“As we reflect on the last then years, the face of financial and professional services in the UK has transformed,” Estlin said.

“Innovation is now firmly at the heart of the sector and the UK has emerged to become the global hub for fintech.”

In 2018, insurtech and fintech were the biggest employers among high-growth digital tech firms, employing 24% and 18% of the high-growth workforce respectively. The country now leads the rest of the world in fintech with investment in high-growth fintechs achieving GBP 4.5 billion between 2015 and 2018.

One of last year’s most notable investments is Revolut’s US$250 million Series C funding. The round was one of the world’s top 10 largest venture capital funding rounds in 2018. Last year also saw the first initial public offering (IPO) for a UK fintech with Funding Circle obtaining a GBP 1.5 billion valuation and raising GBP 300 million in September 2018.

According to the report, challenger banks took most of 2018’s fintech funding in the UK, raising US$461 million. Other fintech sub-sectors that showed sharp increase in activity include personal finance and wealth management (US$333.6 million), alternative lending and finance (US$306.6 million), blockchain and digital currencies (US$174.7 million), insurtech (US$103.1 million), and payments (US$102.5 million).

“Increasing levels of investment into the UK’s fintech industry show that the industry is going from strength to strength,” said Alastair Lukies CBE, a member of the Prime Minister’s Business Council, and a founding partner at Motive Partners.

“The UK remains Europe’s best destination for fintech investment and the increasing levels of later stage growth capital being deployed suggest the industry is maturing at an unprecedented rate globally.”

The UK’s position as “the undisputed fintech capital of the world” has been built on three key factors: the strength of the UK in financial services, the nature of UK consumers and the UK regulatory environment, the report summarizes.

Fintech companies in the UK benefit from its skills in financial services and its draw as a place for international investment and capital raising, it says, and UK consumers are some of the most digitally savvy in the world. The country’s robust regulatory regimes including peer-to-peer (P2P) lending regulations and the Financial Conduct Authority (FCA)’s regulatory sandbox, are providing a favorable environment for innovation in financial services.

“The UK is a global fintech leader, building on the commanding role London holds as a financial services hub. Investors put more money into UK fintech than any other European country in 2018,” said Charlotte Crosswell, CEO at Innovate Finance.

“The UK’s deep pools of entrepreneurial and tech talent, progressive regulators and policy makers, capital and professional expertise, and its vibrant startups are driving the digital economy.”

While the report puts the UK fintech industry in a good light, praising its strong growth, experts and industry observers are warning of the possible negative impact of Brexit on the industry. A report released earlier this year claims that leaving the European Union (EU) is making it harder for fintech firms in Britain to recruit top talents, threatening to slam the brakes on the sector’s growth.

Up to a fifth of the skills needed in recent years has come from EU countries and UK recruiters are now seeing a net migration of tech graduates back to the bloc. Companies are struggling to fill roles in coding, cloud computing, machine learning, software development, cyber, artificial intelligence (AI) and blockchain, the report says.

Featured image: London, England, PxHere.

The post UK Maintains Its Position As A Leading Fintech Hub appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments