Overview of Wealthtech in Switzerland

Wealthtech, a sub-category of fintech which involves creating digital solutions to transform the investment and asset management industry, is thriving.

In 2016, wealthtech companies raised a record of US$796 million through 98 deals, according to CB Insights, and the sector is set to further grow in the years to come with digital wealth management sector expected to be worth some US$16 trillion by 2025, according to the Financial Times.

Wealthtech companies leverage cutting edge technologies including artificial intelligence (AI) and big data, to offer financial advice. Arguably, the most popular wealthtech product that’s been extensively talked about in recent years is robo-advisors (B2B and B2C), or digital platforms that provide automated, algorithm-driven financial planning services with little to no human supervision.

But wealthtech covers a much broader spectrum, ranging from micro-investment and robo-retirement platforms, to digital brokers and various investment tools for research, product comparison, and more.

Wealthtech In Switzerland

With a share of approximately 25% of global assets managed on a cross-border basis, amounting to US$10,000 billion, Switzerland is the global market leader in the wealth management business. The financial center manages around twice as many assets as its UK or Singapore counterparts, and three times as many as in Hong Kong, according to figures provided by the Association of Swiss Asset and Wealth Management Banks.

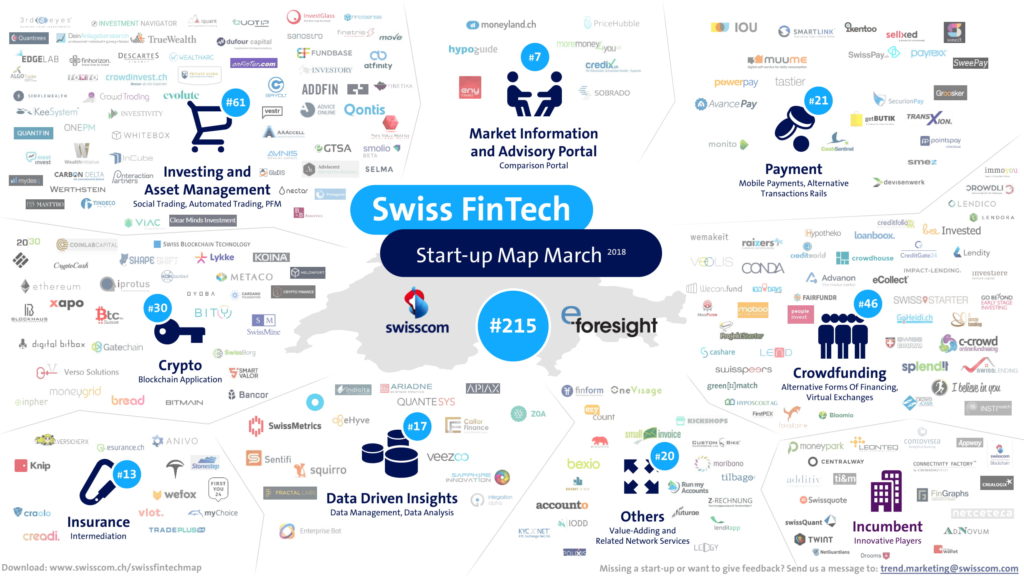

Given Switzerland’s world leading position in wealth management, it comes with little surprise to see that wealthtech is the most crowded segment of the Swiss fintech industry with 61 ventures. Wealthtech is followed by crowdfunding with 46 companies, cryptocurrency with 30 companies, and payments with 21 companies, according to Swisscom’s latest Swiss Fintech Startup Map.

Swiss Fintech Startup Map – March 2018, by Swisscom

Unsurprisingly, Swiss banks have been at the forefront of digitalization of wealth management. UBS launched its Smartwealth robo-advisor two years ago, Glarner Kantonalbank has been operating its Investomat platform since 2015, and Credit Suisse is reportedly working on its very own platform and recently acquired a 10% stake in Singapore-based Canopy, an account aggregation and analytics platform for financial institutions, wealth management profession and high net worth individuals. Canopy is said to be eyeing an expansion into the Swiss market.

Besides the banks, several startups have been set up in the past years to offer wealth management services, serving either commercial or retail clients, or in several cases both. One of the oldest platforms is True Wealth, which founded the first robo-advisor startup in Switzerland back in 2013. Meetinvest is another notable one that was established in 2014. The Meetinvest platform combines a social media platform with an investor toolkit. The company also provides a B2B2C investment platform for the wealth management industry.

Geneva-based InvestGlass was founded in 2014 and offers a white-labeled, client and prospect management platform for bankers and wealth managers.

Swiss Wealthtech meets Regtech

Evolute Zurich offices, via Evolute

One of the newest players is Evolute Group, a firm that offers an integrated platform for independent wealth managers and banks. The platform covers the entire wealth management and aims to be a one-stop-shop for asset managers. It is composed of numerous features like advisor tools, interaction, compliance, customer relationship management, portfolio solutions, documents management and interfacing.

Evolute Group is the result of a merger between with regtech startup SwissComply and fintech startup Evolute last year. The firm aims to crack the wealthtech market with specialized knowledge through its regulatory and compliance arm.

Earlier this years, the co-founder of derivatives boutique Leonteq Michael Hartweg took over as chairman of Evolute Group. Hartweg co-founded Evolute two years ago after leaving Leonteq in 2015.

The post Wealthtech In Switzerland: A short Overview appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments