Stablecoins, or digital tokens with values tied to fiat currencies or other assets, have surged in popularity over the past year on the back of booming cryptocurrency transaction activity, the emergence of decentralized finance (DeFi), and a large rise in digital payments more generally.

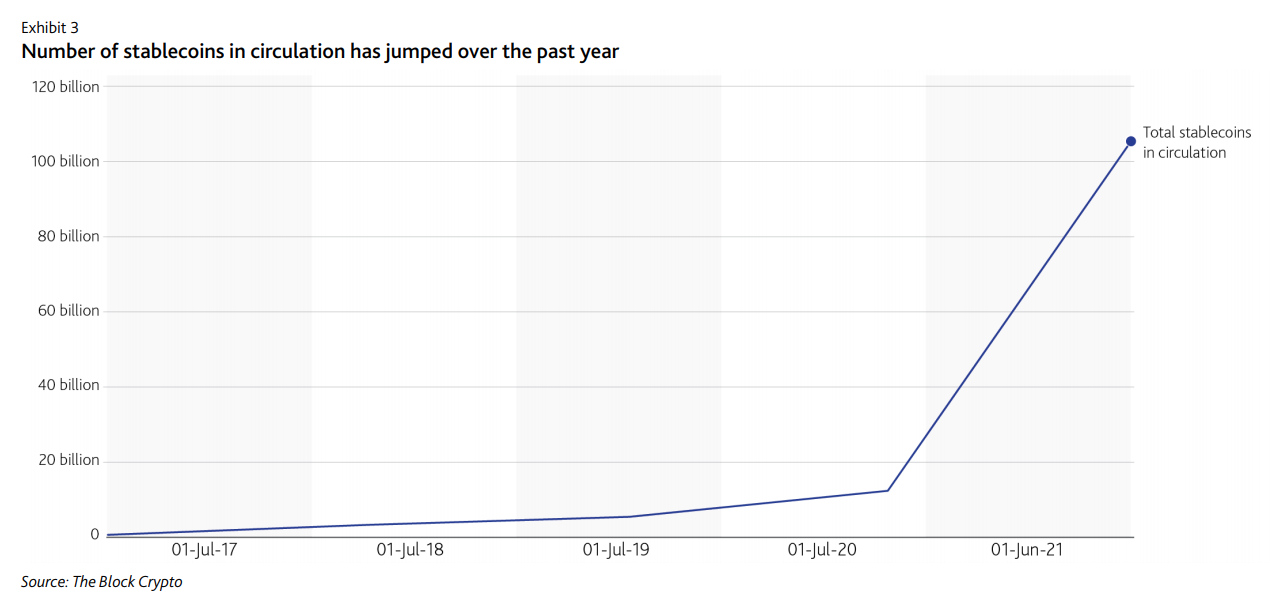

Total stablecoins in circulation recently surpassed 100 billion, up from about 10 billion a year ago, according to a June paper by Moody’s. Globally, CB Insights estimates that there have been at least 200 stablecoins either released or in development.

Number of stablecoins in circulation has jumped over the past year, Source: FAQ on the risks and opportunities of stablecoins, Moody’s Investors Service, June 2021

While historically, stablecoins were created for use in the crypto and blockchain realm, interest is expanding to the traditional financial sector where a growing number of financial institutions are attempting to find ways to integrate stablecoins into their businesses.

JPMorgan launched in 2020 the JPM Coin, a system that allows clients to instantly transfer US dollars held on deposit with the bank, facilitating thus real-time value movement and helping solve common hurdles of traditional cross-border payments.

In March 2021, Visa began supporting the use of USD Coin (USDC), a stablecoin backed by the US dollar, to settle transactions. The firm started piloting the capability with partner Crypto.com, but plans to offer the USDC settlement capability to additional partners later this year.

Meanwhile, digital currency group Diem Association, formerly known as Facebook’s Libra project, is planning to launch a pilot of a stablecoin pegged to the US dollar later this year.

With stablecoins rapidly entering the mainstream, we look today at what these innovations are, what they bring to the table, and what risks they pose.

What are stablecoins?

A stablecoin is a cryptocurrency whose value is pegged to another asset class, such as a fiat currency or gold, to limit price fluctuation. Stablecoins aim to solve traditional cryptocurrencies’ volatility issue, all the while retaining the convenience cryptocurrencies typical offer, including instant consensus-based settlement and privacy.

Stablecoins are also different from central bank digital currencies (CBDCs), which are digital representations of legal tender and direct liabilities of the central bank itself, since they are issued by the private sector as a digital alternative to fiat currency.

Currently, four main types of stablecoins exist. These have different characteristics and roles within the digital asset ecosystem. The fiat-collateralized stablecoin is pegged to a fiat currency such as the UD dollar or the euro and maintains a 1:1 ration with a unit of that currency, while the crypto-collateralized stablecoin is pegged to a cryptocurrency like bitcoin or ether. The asset-backed stablecoin uses exchange-traded commodities such as precious metals and oil as collateral. Finally, the algorithmic stablecoin deploys an experimental mechanism to control the money supply and maintain the price.

Advantages of stablecoins

The key advantage of stablecoins is their practical application for everyday transactions because their values don’t fluctuate as much as traditional cryptocurrencies like bitcoin and ether. Since stablecoins offer all the major benefits of cryptocurrencies, minus the volatility, they have the potential to be a pertinent alternative to cash.

Stablecoins also have the benefits of DLT, including low costs, global reach and speed. They can potentially facilitate cross-border trades, lower transactions fees and speed them up. They can also help improve financial inclusion by providing a universally accessible peer-to-peer payment system.

Not only that, but in a world that’s increasingly more connected, stablecoins offer the potential for better integration into our digital lives since they’re being designed by firms that thrive on user-centric design.

Challenges and risks associated with stablecoins

Despite the significant advantages stablecoins bring, they also present challenges and risks. First, banks could lost their place as intermediaries if they lose deposits to stablecoin providers. Second, monopolies could rise and tech giants could use their networks to shut out competitors and monetize information, notes the International Monetary Fund (IFM).

Weaker currencies could also face threats, especially those in countries with high inflation and weak institutions. Local currencies could be shunned in favor of stablecoins in foreign currency, creating thus a new form of “dollarization” and undermining monetary policy, financial development and economic growth.

Other risks include misuse of personal information, especially in models where providers are offering their services free of charge in exchange for personal data, exposure to money laundering and other criminal activities, systemic risks in the case the operational failure of a payment system, and environmental implications related to the amount of energy required to mine tokens.

These risks, coupled with the stablecoin’s global reach and their rapid growth in usage, have led regulators, policymakers and central banks to begin looking closely into the sector.

Earlier this week, top financial regulators in the US met to discuss stablecoins. Treasury Secretary Janet Yellen emphasized “the need to act quickly to ensure there is an appropriate US regulatory framework in place.”

In September 2020, the European Union (EU) set out plans to create comprehensive rules for crypto assets, including stress tests as well as capital and liquidity requirements, stating that Facebook would have to adhere to them before launching its proposed stablecoin in the bloc.

The Swiss Financial Market Supervisory Authority (FINMA) published in 2019 a supplement to its initial coin offering (ICO) guidelines, outlining how it treats stablecoins under Swiss supervisory law.

Featured image credit: Photo by Roger Brown from Pexels

The post What are Stablecoins and What Risks and Opportunities Do They Bring? appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments