Like other sectors, fintech funding has been hit hard by the COVID-19 pandemic and the resulting economic turmoil, with investment down during the first months of 2020. However, the long-term impact of COVID-19 will differ across segments, with sectors including payments, insurtech and hybrid robo-advisors expected to benefit from the crisis in the long run, according to a new report by CB Insights.

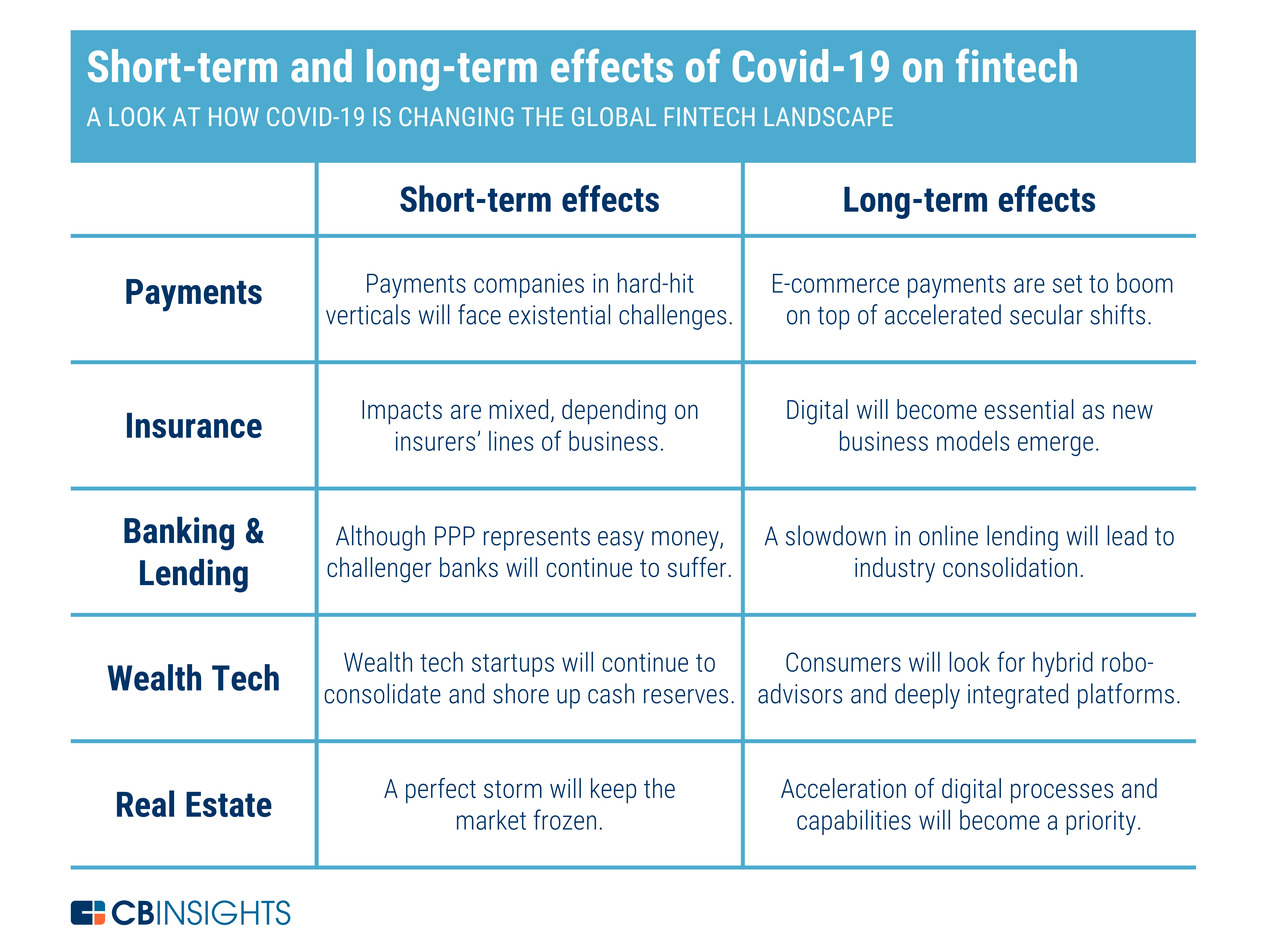

In a brief released earlier this month, the market and business intelligence company looks at the short- and long-term effects of COVID-19 on five fintech segments: payments, insurance, banking and lending, wealth and capital markets, and real estate.

Short-term and long-term effects of COVID-19 on Fintech, June 2020, Source: CB Insights

In the payments sector, the reports notes that while companies serving hard-hit verticals including travel, restaurants, and events and entertainment, will continue to struggle in the short term, payments companies serving e-commerce have seen payments volume explode and will continue to see traction.

This is because COVID-19 is contributing to an explosion in e-commerce at the expense of physical retail, a trend that will result in payments companies enabling online retailers taking more and more market share away from payments companies serving physical retailers, the report says.

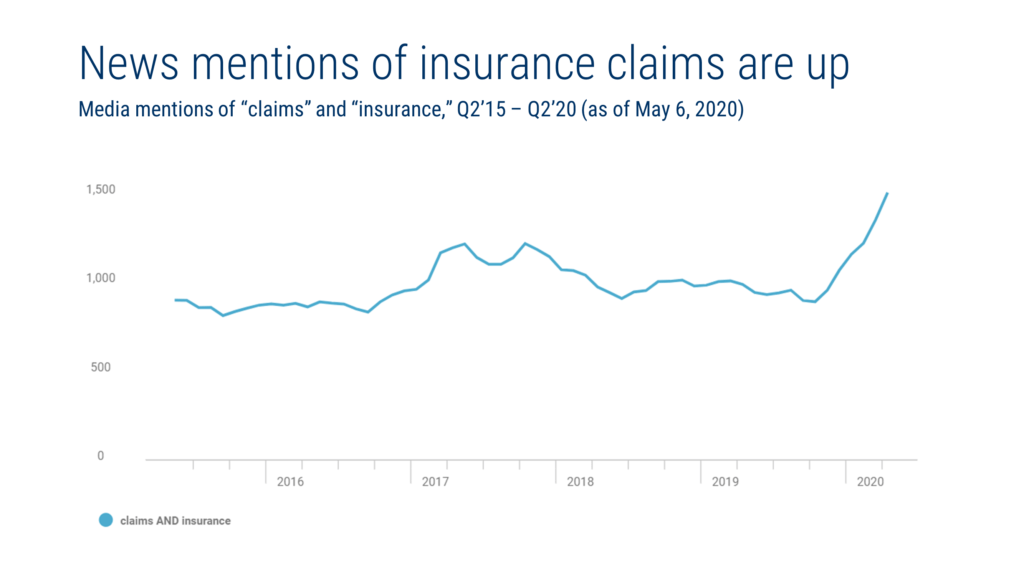

In insurance, the current crisis has shown how static and outdated traditional insurance products are. In the aftermath of COVID-19, consumers will turn to more flexible and transparent products such as on-demand insurance, parametric insurance, and usage-based insurance, CB Insights predicts.

In the long run, the winners will be those that leverage digital capabilities and technology to digitize key value chain operations including underwriting and claims management, thus improving operational efficiency and cutting costs.

In the long run, the winners will be those that leverage digital capabilities and technology to digitize key value chain operations including underwriting and claims management, thus improving operational efficiency and cutting costs.

As a result, incumbents could end up having to rely more on business-to-business (B2B) insurtech startups to improve their digital capabilities, the report says.

In wealthtech and capital markets, startups in the space have raised significant cash amid COVID-19. There has also been several acquisition deals with likely more consolidation to come in the short term, the report says.

One fact that has become clear with COVID-19 is that investors still want relationships with human advisors. In fact, popular robo-advisors Betterment and Wealthfront experienced higher-than-average engagement with human advisors in Q1’20, the report says. Hence, in the long term, CB Insights believes hybrid robo-advisory services will become mainstream, a trend that could be beneficial for established players such as Fidelity and Charles Schwab, which offer more established hybrid advisory services alongside zero-commission models.

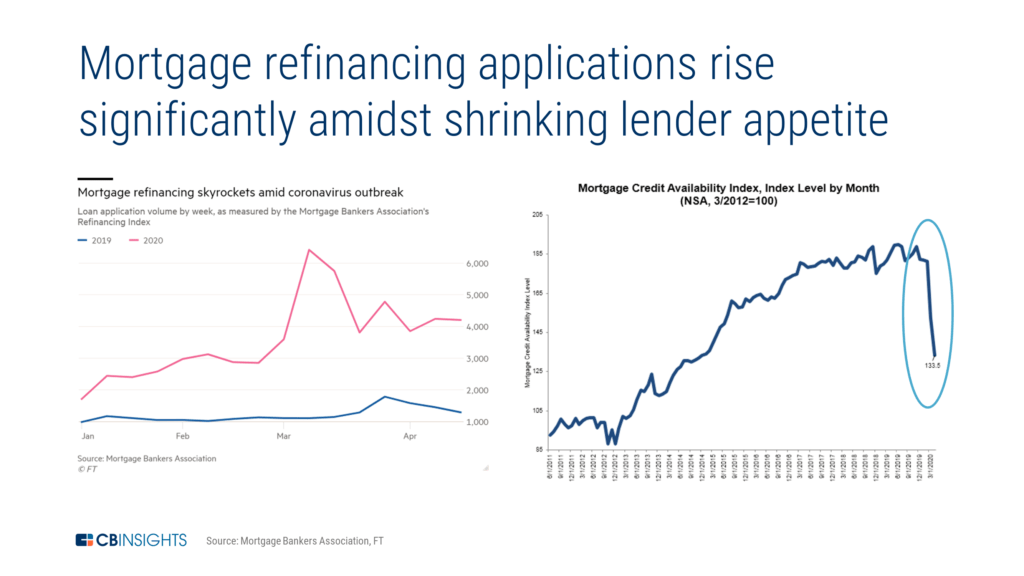

In real estate, the pandemic has crushed demand but also supply as owners hold out for more favorable conditions. This has put a toll on online real estate portals with players like Zillow and Realtor.com recording a significant reduction in web traffic.

On the financing side, traditional lenders have tightened up credit requirements and borrowers are now facing difficulties securing financing. This has put the spotlight on digital mortgage lenders, which will likely benefit from the pandemic in the short term, the report says.

On the financing side, traditional lenders have tightened up credit requirements and borrowers are now facing difficulties securing financing. This has put the spotlight on digital mortgage lenders, which will likely benefit from the pandemic in the short term, the report says.

In the long term, digital processes and technology will become stable stakes for the industry, with capabilities like virtual home tours and virtual neighborhood walks becoming the new normal.

Finally, in banking and lending, digital challenger banks will continue to struggle amid COVID-19 and limited spending. The more resilient will be those with lots of capital such as N26, Revolut and Chime, but also those with a loyal base of primary banking customers that link direct deposits such as Chime, as well as those with durable, multi-product offerings like Stash, MoneyLion, and Betterment, the report says.

In digital lending, players such as LendingClub, Kabbage and OnDesk have been hit the hardest as defaults rise and fewer loans are given out.

The long-term outlook is still uncertain for most of them as many will likely see insolvency while others get acquired by bigger players, the report says. Credit startups that white-label their lending technology to banks, like ODX, Amount and Powered by Upstart, are more likely to be sustainable.

So far, COVID-19 has acted as a catalyst for digitalization and though the current crisis will continue to accelerate digital banking and lending, it will also filter out businesses that lack a durable revenue model, CB Insights says.

The post Which Fintech Sectors Will Gain From COVID-19? appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments