The fintech of 2016 is a universe away from the fintech of 2019. That’s just the song for any field encompassing tech these days. Yet, one thing that does not change year-on-year it seems, is Switzerland’s position as a global fintech hub—second place.

In a report titled the IFZ FinTech Study 2019 by the Institute of Financial Services Zug IFZ, despite rapid fintech development in various regions, the top 6 positions for fintech hub has not changed since last year. Therefore, yet again, Singapore ekes out a victory over Switzerland as a top global fintech hub.

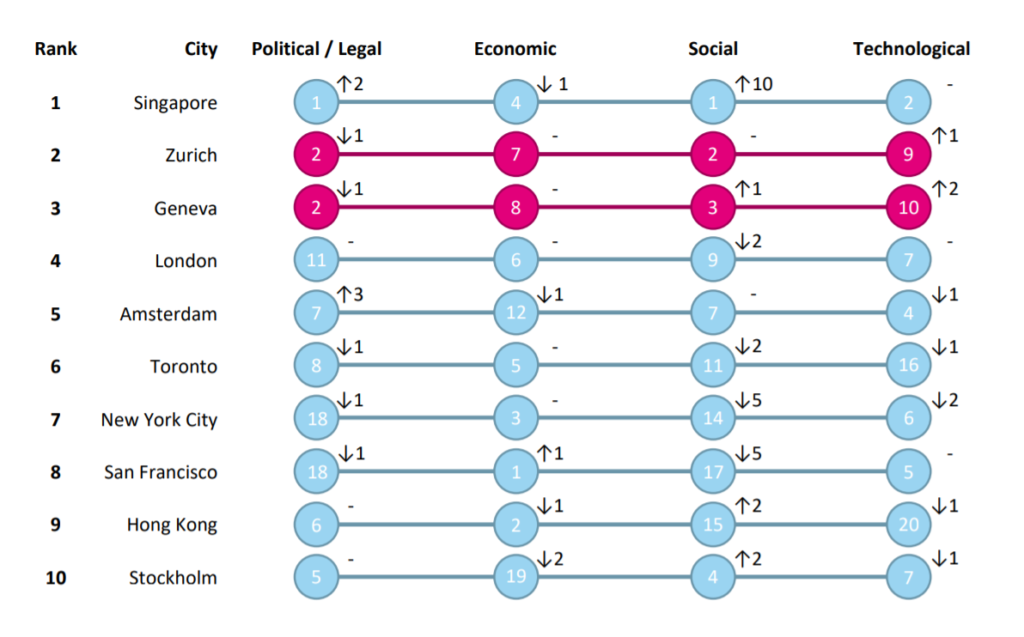

Zurich and Geneva take the second and third place respectively on the rankings.

It should be noted that while Switzerland’s Zurich and Geneva may not be on top, the cities still present very promising circumstances for rapid fintech development. There is always room for development of course, but it is still accurate to say Switzerland’s cities are aspirational fintech hubs.

A clearer breakdown of how Switzerland performs on each individual marker are as below:

Political and Legal Environment

Zurich and Geneva are only slightly outperformed by Singapore in the political and legal environment area, and are tied at second place. All three present high political stability, high regulatory quality and relatively high government effectiveness—which translates to their fintech-related spheres.

Most recently Switzerland’s FINMA is paving the way for more relaxed licenses for fintechs specifically, requiring less extensive audits and simpler reporting procedures. While the regulator seems to encourage blockchain-related innovations, it remains vigilant of fake cryptocurrencies. Their deployment of course, is not perfect but enough to encourage higher trust.

Economy

This is the area where Zurich and Geneva lacks somewhat according to this report, as both cities are at seventh and eighth in rank, respectively; positions they continue to hold from last year’s report.

Their lower position here compared to other markers owes to their relatively small market size and high wage levels, precluding them from rising in the ranks.

The small market sizes explain themselves; while economic adversity lends well to fintech growth, as evidenced by various Southeast Asia regions with low banked populations leading to more unique fintech innovations catering to a real need in their respective markets. The meteoric growth of peer-to-peer lending in Indonesia proves this point.

Singapore may be in a similar boat here with Switzerland, but what is has is proximity to other Southeast Asian regions and relatively lower wages compared to Switzerland.

Social

The two Swiss cities performed admirably in this vector as well. Compared to last year’s ranking, Zurich retained its position while Geneva climbed from fourth to third place.

Switzerland’s cities showcase “exceptional talent environment”, owing to its universities, skills labour force and high quality of life.

Zurich and Geneva are only outperformed by Singapore which climbed ten positions in a year-to-year comparison. This strong increase is partially based on the ranking methodology, since Singapore was excluded in some social indicators in which it performed comparably bad in the last year.

Technology

Compared to its other markers, Switzerland’s cities performed the worst in technology, which is unsurprisingly led by Tokyo, followed by Singapore and Seoul.

Zurich and Geneva apparently slightly climbed in the ranks compared to last year’s evaluation, but it is weakened due to low levels of government online services, and e-participation.

However, Zurich and Geneva are still strong in its high degree of university and industry collaboration, and intense ICT use by the Swiss population.

Yet, the report still characterises the Swiss fintech environment as in an “excellent condition”, giving it room to improve in the economic and technological dimension. Despite Switzerland’s relatively low performance in the technology dimension, its rise in ranking from last year, according to the report, marks that Switzerland is at least on the right track to expanding its role as a global fintech hub.

The post Why Switzerland is Still Second to Singapore as a Global Fintech Hub appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments