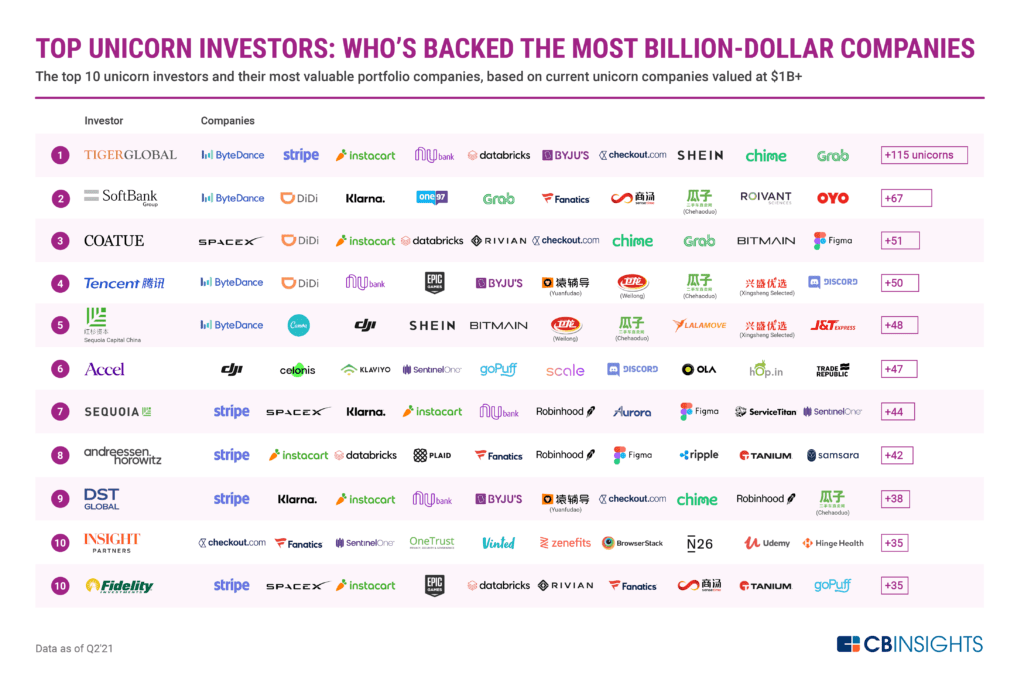

With more than 120 unicorn companies in its portfolio, US-based Tiger Global Management is the world’s top unicorn investor, way ahead of SoftBank Group with 77 unicorns and ranked second, and Coatue Management with 61 and ranked third, data from CB Insights show.

Over 350 institutional investors boast at least five unicorns in their portfolios but Tiger Global Management tops the ranking. Tiger Global Management, one of the most profitable tech investors, holds stakes in more billion-dollar companies than any other firms. Tiger Global Management is known for its fast-paced investing style, and this year, it has already invested in more than 170 venture deals in startups.

Tiger Global Management’s unicorn portfolio companies include ByteDance, the owner of TikTok, Stripe, the world’s most valuable fintech company, Nubank, Brazil’s top digital bank, Checkout.com, an online payment services provider, Chime, a mobile banking startup, and Grab, one of Southeast Asia’s so-called super apps.

After Tiger Global Management, SoftBank Group was found to be the second largest unicorn investor. Japan’s SoftBank Group primarily invests in companies operating in the tech, energy, and financial sectors. It also runs the Vision Fund, the world’s largest tech-focused venture capital (VC) fund, with over US$100 billion in capital, backed by sovereign wealth funds from countries in the Middle East.

In the fintech space, SoftBank has invested in unicorn startups like Klarna, the world’s leading buy now, pay later (BNPL) provider, One97 Communications, the owner and operator of India’s largest online commerce platform and mobile wallet Paytm, and Creditas, a Brazilian lending business.

At the third position is Coatue Management, a US-based global tech-focused investment manager. Coatue Management invests in both the public and private markets with a focus on tech, media, and telecommunications, as well as the consumer and healthcare sectors.

Coatue Management has invested in fintech unicorns such as Bitmain Technologies, a semiconductor companies providing hardware and solutions for blockchain and artificial intelligence (AI), Fireblocks, a digital asset custody, transfer and settlement platform, and Ramp Financial, a provider of corporate cards designed to save businesses money.

Top unicorn investors, data as of Q2 2021, Source: CB Insights

Most efficient unicorn investors

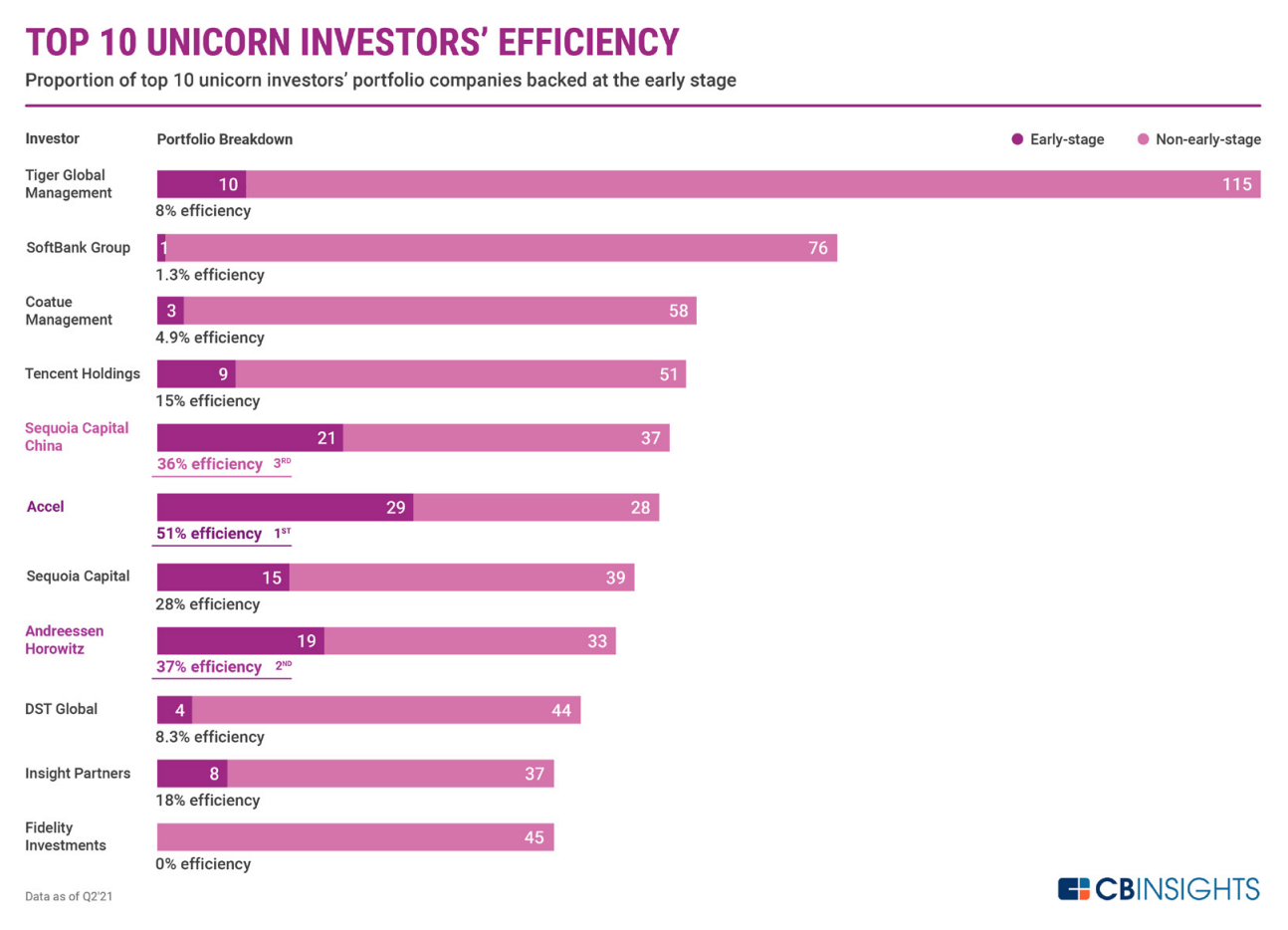

In addition to its ranking of the world’s top unicorn investors, the CB Insights report also looks at each of the top ten unicorn investors’ so-called efficiency rate.

This rate corresponds to the proportion of total unicorn investments to the number of those investments made at the early stage. It’s indicative of a firm’s unicorn investment prowess and of expertise in assessing future winners and champions early on in their journey.

Accel, Andreessen Horowitz and Sequoia Capital China emerged as the most efficient unicorn investors, having invested in 51%, 37% and 36% of their unicorn portfolio companies at the early stages (seed or Series A funding), respectively.

Examples of fintech unicorns in which these investors have invested in early on include peer-to-peer payment technology company Circle (Accel), startup-focused banking services provider Mercury (Andreessen Horowitz), and cross-border payments and foreign exchange platform Airwallex (Sequoia Capital China).

Top 10 unicorn investors’ efficiency, data as of Q2 2021, Source: CB Insights

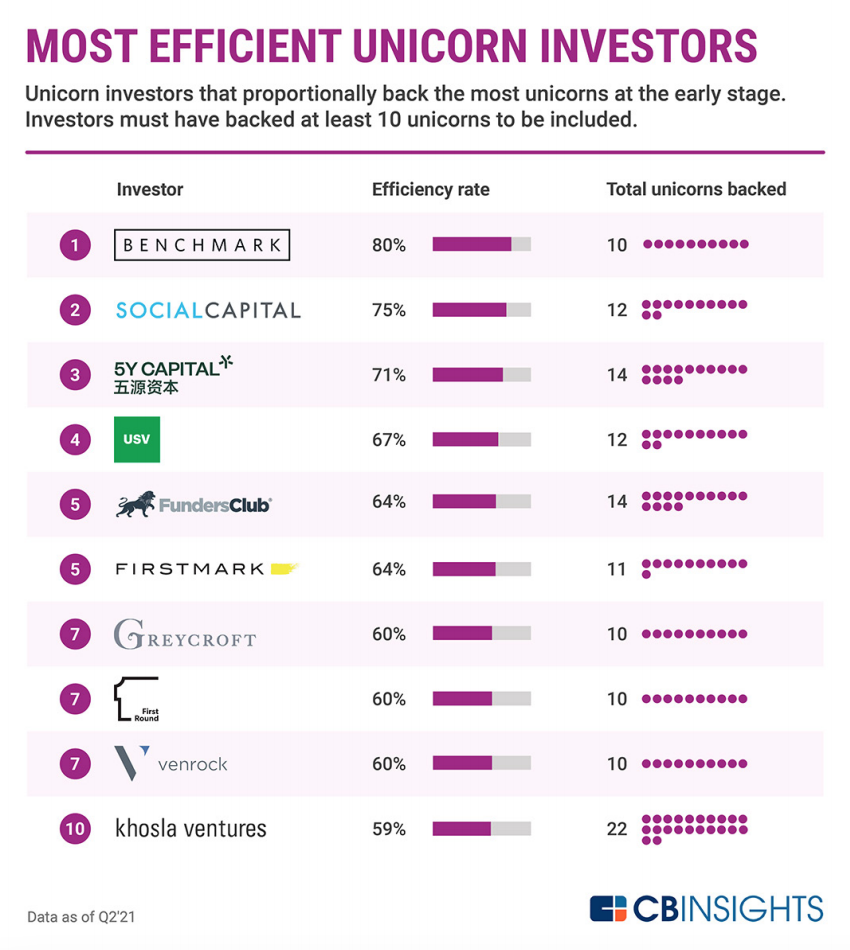

Looking more broadly at all investors that have backed at least 10 unicorns, Benchmark tops the list in efficiency for early-stage unicorn investments at 80%, followed by Social Capital (75%) and 5Y Capital (71%).

Most efficient unicorn investors, data as of Q2 2021, Source: CB Insights

As of August 2021, there were more than 800 unicorns around the world worth a combined US$2,588 billion, according to CB Insights data. 131 of these billion-dollar companies operate in the fintech space, and have a cumulative valuation of US$516 billion.

Among the top 20 most valuable private companies, eight are fintechs: Stripe (US$95 billion valuation), Klarna (US$45.6 billion valuation), Revolut (US$33 billion valuation), Nubank (US$30 billion), Chime (US$25 billion valuation), FTX (US$18 billion valuation), One97 Communications (US$16 billion valuation), and Checkout.com (US$15 billion).

The post With 120+ Unicorns, Tiger Global Management Has Backed the Most Billion-Dollar Companies appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments