The financial services industry is on the verge of transitioning from open banking to a new phase of innovation which Capgemini and Efma refer to as Open X.

With an emphasis on deeper collaboration and specialization, Open X will require banks and fintechs to re-evaluate their strategy for innovation and serving customers, according to the World Fintech Report (WFTR) 2019 published earlier this month.

According to Anirban Bose, CEO of Capgemini’s financial services and member of the group’s executive board, while open banking has long been regarded as transformational for financial services, it is just one part of a much bigger picture.

“The industry is on the verge of a more comprehensive evolution, where there is opportunity to leapfrog into an integrated marketplace that we are calling Open X,” Bose said. “In Open X, there will be seamless sharing of data, and ecosystem partners will be able to collaborate in a far more comprehensive way. Our research suggests that banks and fintechs need to prepare themselves for a more radical change than many previously anticipated.”

For Vincent Bastid, secretary general of Efma, collaboration will be the foundation of the future of financial services.

“In the era of Open X, ecosystem players will have to work together more effectively than they have previously,” Bastid said. “Only by embracing collaboration and new, specialist roles can both banks and fintechs thrive and best serve their customers.”

Open X

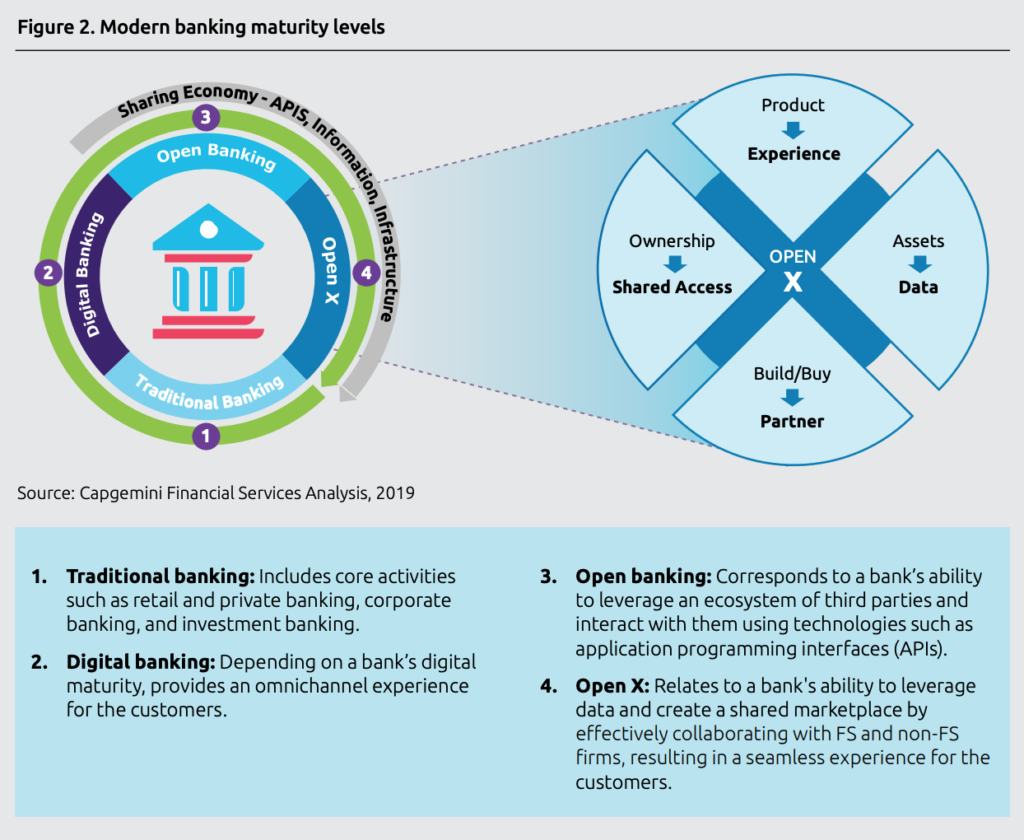

Open X refers to a new operational age where the financial services industry is moved onto a shared ecosystem or marketplace. In this new paradigm, players leverage data extensively and collaborate with other players to provide customers with a seamless experience.

According to the report, Open X reflects a four-pillar market shift that values experience over products, sharing over resource ownership, data versus traditional assets, and evolution through partnerships instead of buying or building new solutions.

In this new landscape, application program interfaces (APIs) will play a critical role, the report says.

APIs are already significant open banking enablers as they allow third parties to access bank systems and data in a controlled environment. Nearly 89% of banks leverage APIs to collaborate with fintech firms as part of their business strategy, according to a Capgemini and Efma survey of banking executives.

But as API acceptance expands, ecosystem players will have to embrace the use of standardized APIs. Standardization will be needed to help reduce fraud, improve interoperability, increase speed to market, and enhance scalability, the report says.

Findings from the survey suggest that industry players are looking at two potential monetization models for APIs: revenue-sharing, which 60% of banks and 70% of fintechs think is feasible, and API access fees, a model supported by 46% of banks and 55% of fintechs.

Adopting new roles

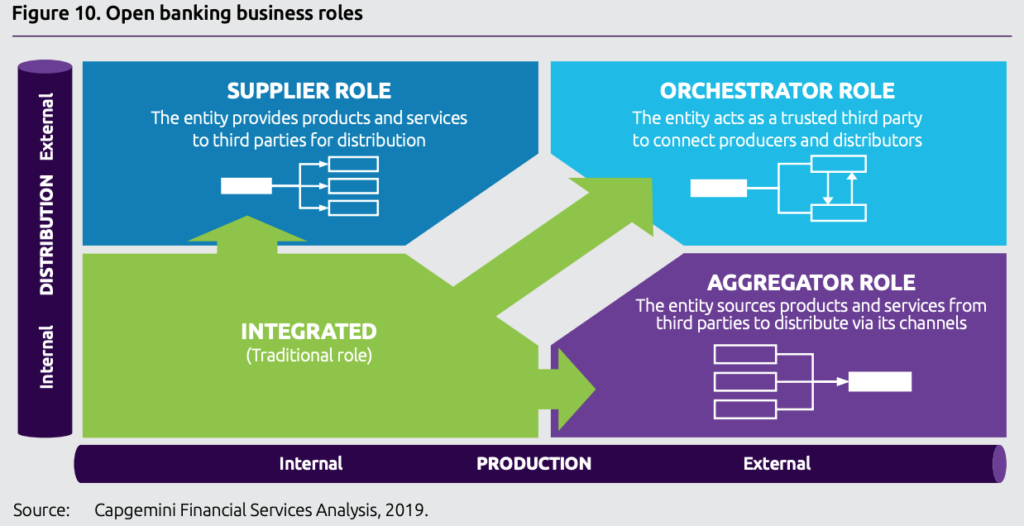

In this evolving financial services ecosystem, three new specialist roles will emerge, the report says. These are the suppliers, or entities focusing on developing products and services; aggregators, or companies that delegate product and service creation to third parties or external players but use its internal channels for distribution; and orchestrators, or central entities that coalesce ecosystem players by connecting and coordinating their interactions.

Tencent’s WeBank, China’s first Internet-only bank, for instance, already acts as a supplier by offering payment services to smaller banks that can’t afford to build real-time payment services.

By working with consumers, banks and fintech to help end users find the most suitable financial products, London-based fintech Bud acts as an orchestrator.

And Banco Santander, which has reinvigorated its online Openbank by integrating with Moneybox, allowing customers to round up their purchases to the nearest dollar and invest spare pennies, acts as an aggregator. The bank has also integrated robo-advisory fintech Scalable Capital into Openbank, enabling customers to create goal-based investment portfolios.

Within the Open X ecosystem, banks will need to identity and build their role as a supplier or aggregator. Aside from internal capabilities, they will also need to develop their future strategies based on current market scenarios, whether regulators choose to regulate, supervise, or just offer basic open banking guidelines.

The post World Fintech Report 2019: Financial Industry To Enter New Phase of Innovation – “Open X” appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments