2018 witnessed an explosion of high-profile venture capital (VC) deals in the European fintech space, surpassing the US by nearly EUR 100 million, according to PitchBook.

Just a few weeks ago, UK banking startup OakNorth raised US$440 million from SoftBank’s Vision Fund and Clermont, in the continent’s biggest-ever fintech VC deal, beating the previous record of US$300 million set by German digital bank N26 only a month before in its Series D.

Only less than two months into 2019, VC fintech fundraising is already approaching the EUR 1 billion mark as startups have already secured nearly EUR 921 million across 33 deals.

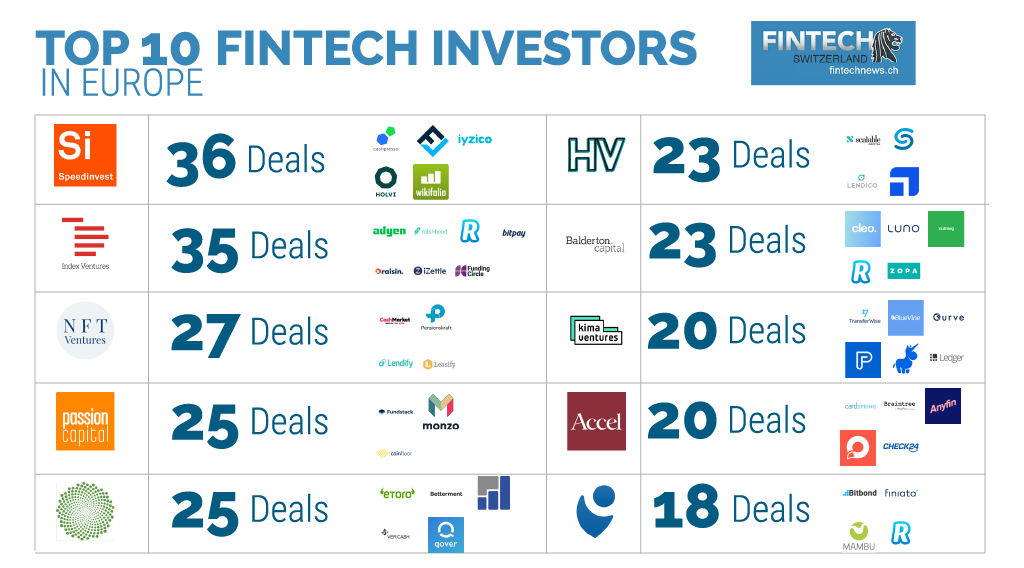

According to PitchBook data, the following are the ten most active VC investors (excluding accelerator and incubator rounds) in the European fintech sector since the beginning of 2014:

Speedinvest

No. of Deals: 36

Notable Investments: Cashpresso, FinCompare, Holvi, Iyzico, Lemonway, WeFox and Wikifolio.

Speedinvest is an Austrian VC fund for early-stage tech startups. It partners with a global network, that includes operations in Silicon Valley, to become a key investment and development hub for Europe’s start-up community.

Index Ventures

No of Deals: 35

Notable Investments: Auxmoney, BitPay, Funding Circle, iZettle, Adyen, Raisin, Revolut and Robinhood.

Index Ventures is an international venture capital firm with dual headquarters in San Francisco and London, investing in technology-enabled companies with a focus on e-commerce, fintech, mobility, gaming, infrastructure/artificial intelligence, and security.

NFT Ventures

No of deals: 27

Notable Investments: CashMarket, Lendify, Fundment, Leasify and Pensionskraft.

Established in Stockholm in 2014, NFT Ventures is a VC firm focusing on fintech, covering verticals including payments, lending and personal finance, but also sectors where fintech is part of the product solution such as e-commerce, insurtech, proptech and regtech.

Passion Capital

No of deals: 25

Notable Investments: Coinfloor, Fundstack and Monzo.

Passion Capital is a VC and incubator fund specializing in seed/startups, growth capital and early-stage companies. It focuses on investments in digital media, mobile, Internet, and technology sectors.

Anthemis Group

No of deals: 25

Notable Investments: eToro, Betterment, Qover, Vericash and Bento.

Anthemis Group is a London-based venture investment and advisory firm focused on financial services companies across the world.

HV Holtzbrinck Ventures

No of deals: 23

Notable Investments: Scalable Capital, Spotcap, Lendico and Upvest.

HV Holtzbrinck Ventures is a Munich- and Berlin-based VC firm that supports founders in developing their internet companies.

Balderton Capital

No of deals: 23

Notable Investments: Cleo, Luno, Nutmeg, Revolut and Zopa.

Balderton Capital is a European early-stage VC investor focused exclusively on European founded technology companies at Series A.

Kima Ventures

No of Deals: 20

Notable Investments: Ledger, TransferWise, Payfit, Assurup, BlueVine and Curve.

Kima Ventures is a VC firm specializing in seed stage, startups, and early stage companies. It invests in first round, focusing on sectors including Internet, video games, mobile, software, fintech, and telecommunications applications.

Accel

No of deals: 20

Notable Investments: Anyfin, Braintree, Cardspring, Check24, and Coverfox.

Accel, formerly known as Accel Partners, is an American venture capital firm. Accel works with startups in seed, early and growth-stage investments, focusing primarly on tech sectors that include consumer, infrastructure, media, mobile, SaaS, security and customer care services.

Point Nine Capital

No of deals: 18

Notable Investments: Bitbond, Finiata, Mambu and Revolut.

Point Nine Capital is an early-stage VC firm primarily focused on SaaS, online marketplaces, AI and crypto. It is based in Berlin but invests all over the world.

The post 10 Most Active VCs in the European Fintech Sector appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments