Evolving needs and investors behaviors, combined with the advancement of technology, have created opportunities for traditional players and new disruptors to reshaping the wealth management industry.

In recent years, companies have arrived on the scene offering wealth management solutions leveraging technologies such as artificial intelligence (AI), big data and cloud computing.

This breed of fintech companies, referred to as wealthtechs, is on the rise around the world. The following are 11 wealthtech tools and solution providers for financial markets insights:

European providers

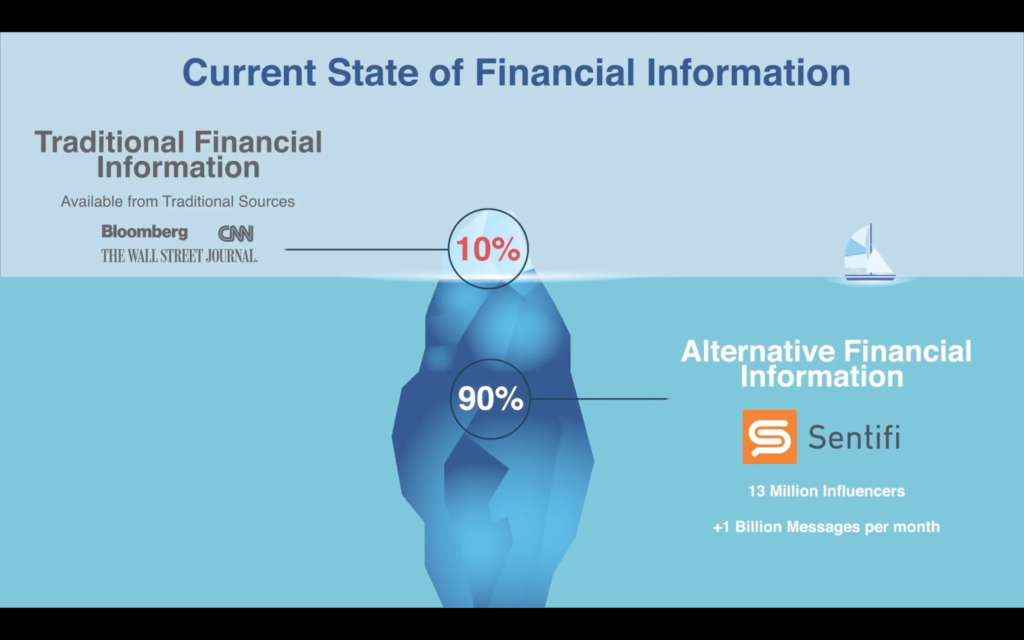

Sentifi (Switzerland)

Switzerland’s Sentifi was founded in 2012 with the goal of improving the information people all over the world use to make investment decisions. Sentifi uses AI and machine learning to analyze alternative data, classify it, rank the sources and link the results to over 50,000 global companies, commodities and currencies. The technology also detects risk events, including political, societal, environmental, economic, and corporate events that impact global financial markets and assets, and customers’ portfolios.

Sentifi illustration

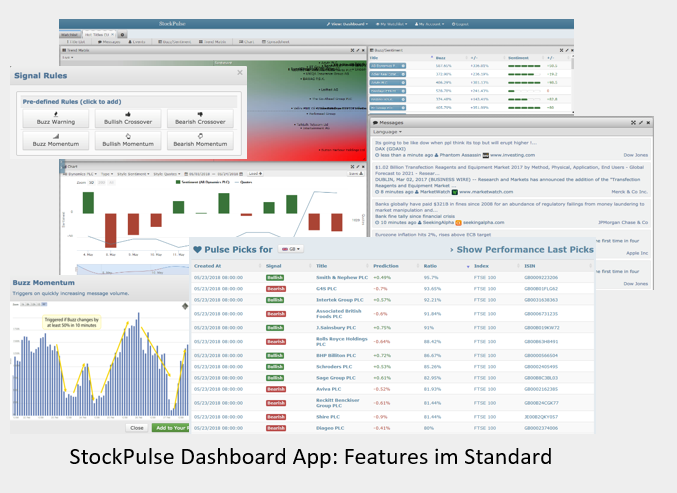

StockPulse (Germany)

StockPulse is a German fintech startup that uses AI-driven technology to analyze sentiment and mood data on more than 35,000 stocks, indices, forex, commodities, industries and cryptocurrencies. The company’s ESG methodology incorporates both positive and negative factors flagged by a variety of carefully selected sources that are calculated in real-time, thus providing investors with more timely, actionable information in their investment decisions.

InteractiveBrokers, one of the world’s largest online brokers, began offering StockPulse’s sentiment data and sentiment report to its customers in December 2018.

StockPulse Dashboard: Key Features

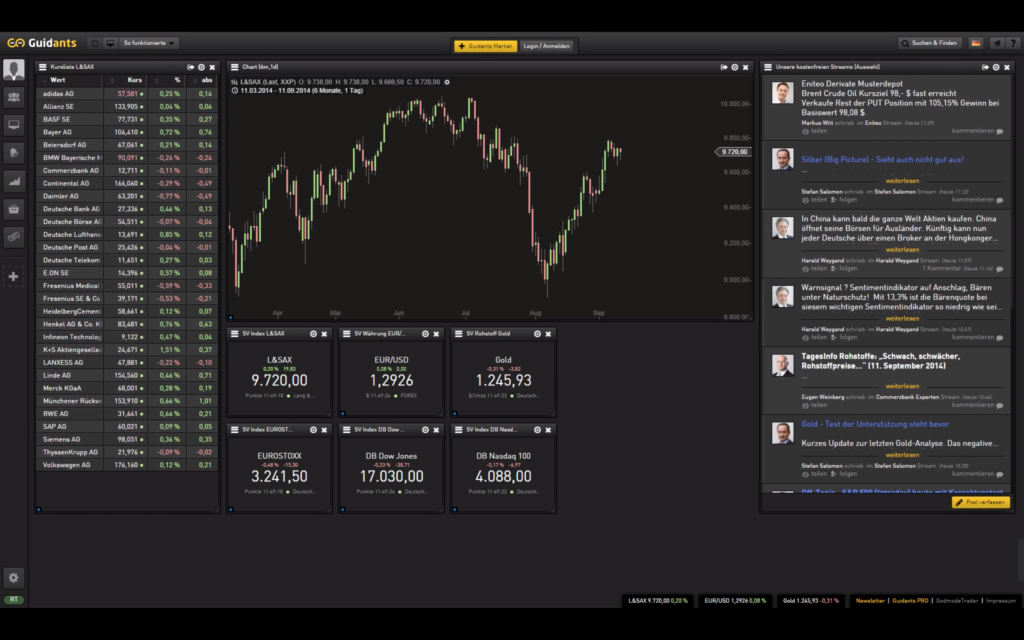

Guidants (Germany)

Guidants, a product of Germany’s BörseGo, is a platform that gives customers an overview of developments in the stock market, providing real-time market data in the form of prices, charts and news as well as innovative tools and evaluations, the possibility to network with other users and experts, as well as the ability to individually design their own desktop. It allows users to monitor, analyze, discuss and trade the markets in a timely manner.

Guidants platform interface

Yukka Lab (Germany)

Berlin-based Yukka Lab detects market sentiments and transforms them into innovative tools for the finance and communications industry. Yukka Lab‘s software reads and understands financial news within seconds and provides asset managers and financial advisors with an information advantage at a considerably smaller expenditure of time. The company’s text analysis technology allows users to reliably anticipate market moods, opinions and trends and adjust strategies accordingly.

Clients and partners of Yukka Labs include UBS, Falcon Private Bank, Additiv, Avaloq, M.M.Warburg & CO, and Banque Cramer.

Yukka platform

RavenPack (Spain)

Spanish firm RavenPack is a big data analytics provider for financial services, offering professionals quick and accurate analysis of large amounts of unstructured content. The company’s products aim to allow clients to enhance returns, reduce risk and increase efficiency by incorporating the effects of public information in their models or workflows.

Clients of RavenPack include leading hedge funds, banks, and asset managers from across the world.

RavenPack platform

Asian providers

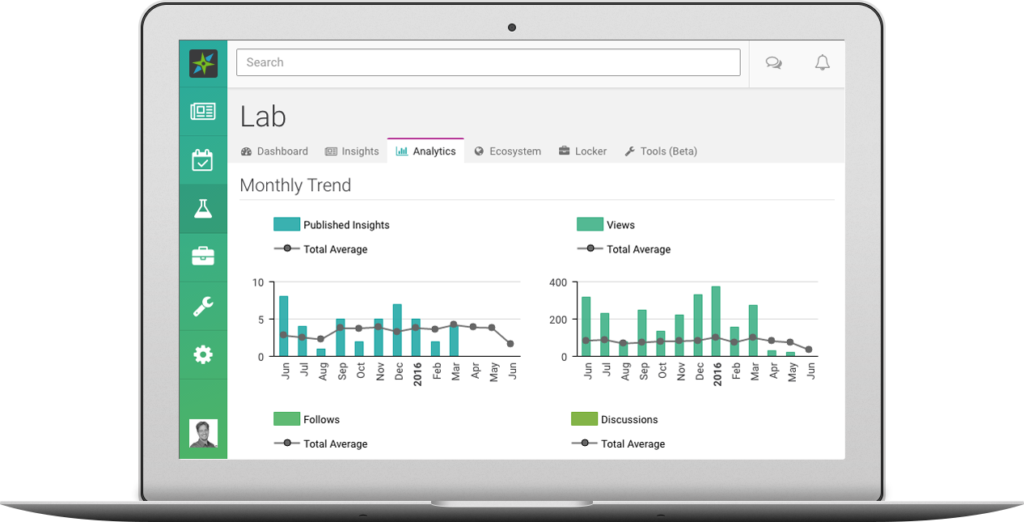

Smartkarma (Singapore)

Founded in 2014 and headquartered in Singapore, Smartkarma is a collaborative marketplace for Asian investment research and analysis. Smartkarma’s proprietary online platform facilitates the distribution of investment related content created by independent research providers to professional, accredited and/or institutional investors via paid subscriptions. The company aims to “unite the fragmented research industry, empowering world’s leading investors, analysts and corporates to collectively achieve their full potential.”

Smartkarma platform

Heckyl (India)

Heckyl is an analytical platform for Investors, traders and researchers. The company provides real-time financial information, news analytics and heatmaps of markets, companies and businesses.

The platform covers millions of news sources and aims to keep customers updated constantly on government moves, hedge funds or private equity investments, venture capital deals, economic announcements and more. It also provides market analysis, sentiment analysis, global market trends and predictive data analytics.

Heckyl was founded in 2010 and is headquartered in Mumbai.

Heckyl platform

American providers

Dataminr

Founded in 2009 and headquartered in New York, Dataminr is a real-time information discovery company that transforms real-time data from various public sources into actionable signals, identifying the information in real-time for clients in finance, public sector, news, security and crisis management. The company’s technology analyzes all public tweets and posts, and delivers the earliest warning for breaking news, real-world events, off-the-radar content and emerging trends.

Dataminr for finance

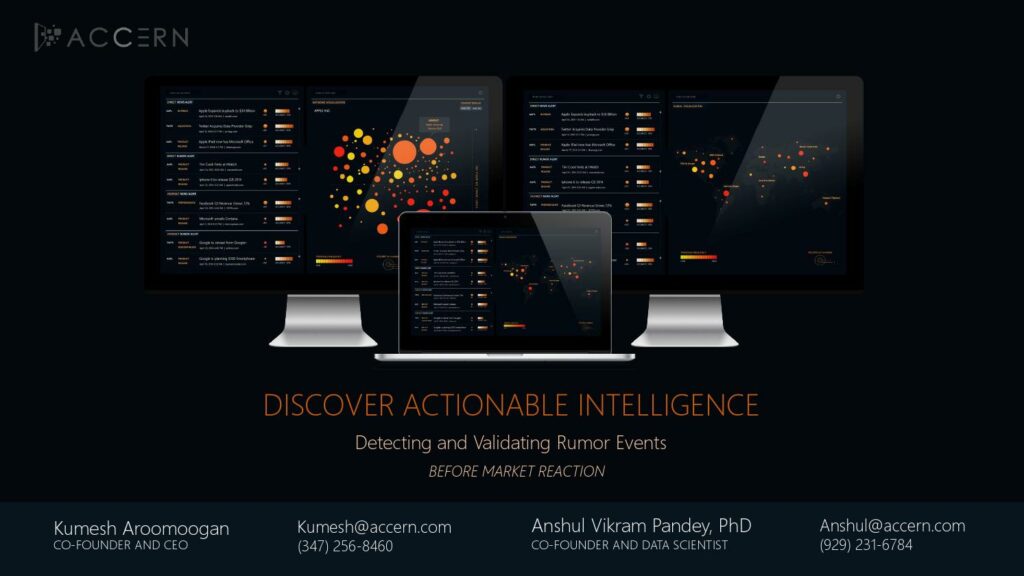

Accern

Accern is a data design company headquartered in New York City. Founded in 2014, the company provides an AI-powered text analytics platform which produces structured insights based on real-time data analysis of online material and premium data feeds. The platform monitors an estimated one billion websites, including news articles, blogs, and social media content, and is used primarily by financial institutions including Credit Suisse, Moody’s and Norges Bank, to support trading, investment, and research.

Accern Pitch Deck by Kumesh Aroomoogan, Co-Founder and CEO, via issuu.com

AlphaSense

AlphaSense is a tech company offering AI-powered business insights via a specialized search engine for financial services professionals. AlphaSense’s search engine utilizes natural language processing to search through all major filings, earnings calls, conference transcripts and other related documents. Users can set alerts on saved searches and receive instant notification when research, news, press announcements or new data points are available on companies, industries or any keywords of interest.

AlphaSense platform

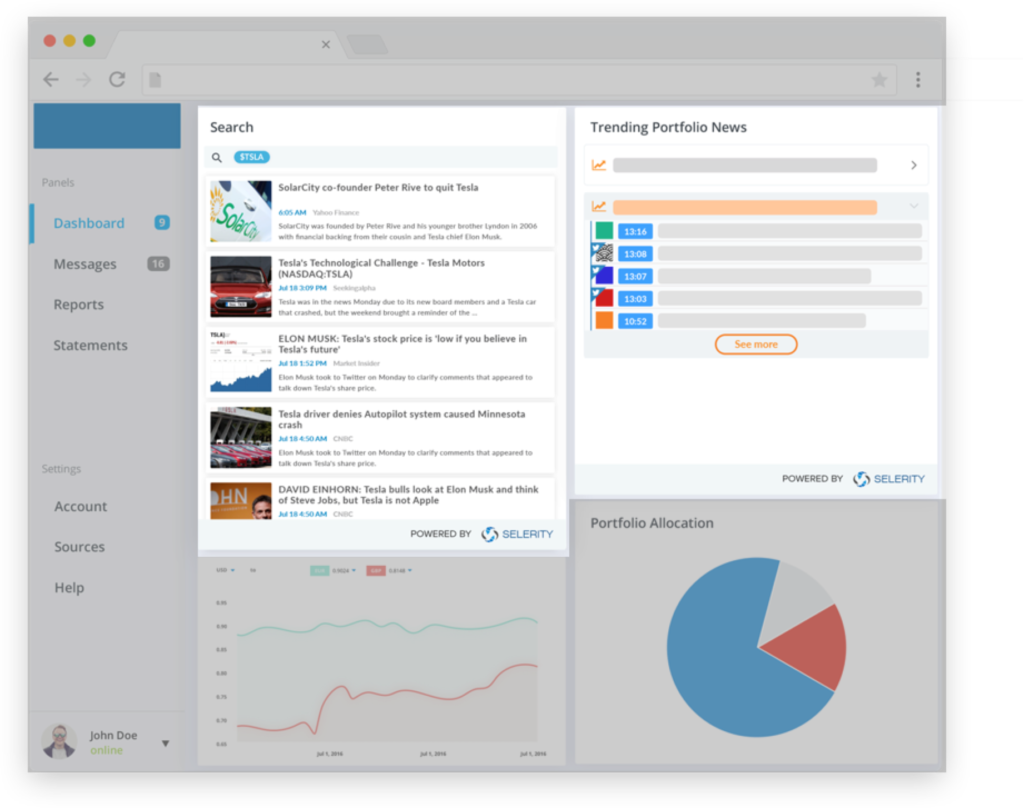

Selerity

Selerity uses proprietary AI to deliver content and data solutions designed to automate inefficient workflows in finance. The company’s flagship product, Selerity Context, offers contextual search solutions for the capital markets and digital wealth industries. It also offers the Private Context Engine (PCE), which analyzes digital communications to power workflow automation for finance professionals.

Selerity’s clients range from sophisticated asset management firms and banks on Wall Street, to media and technology companies serving retail investors.

Selerity Context platform

Featured image credit: Edited from Pixabay

The post Innovative Fintech Tools and Solutions for Financial Markets Insights appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments