Self-custody is an important and fundamentally native feature of cryptocurrency. A blockchain-based digital asset can be stored by its owner without the help of traditional financial intermediaries, such as banks, registered brokers/dealers or qualified custodians. But just because you can store all your coins yourself, should you?

The answer depends on many factors, for example, the variety of currencies, the frequency of transfer and the complexities and risks of self-custody which commensurate with the size of funds being stored. Moreover, your custody solution will differ depending on whether you are a typical consumer, a high net worth individual, an asset manager, a corporation, or a recently minted ICO project with cryptocurrency in your treasury.

While most consumers will often prefer the self-custody option, some will likely keep their deposits in hosted exchange accounts. ICO recipients will likely rely on self-custody methods, in addition to remote cold storage if the amounts are large enough and the team has long term hold requirements.

Cryptocurrency custody is more difficult to implement for investment managers. Due to the regulatory nature of their operations, funds require stringent custody methods that address risks such as security of the digital assets, counterparty risk and operational efficiency that comply with requirements of their regulator. Typically, these funds work with qualified (or licensed) custodians with audited control processes who exist to protect these assets and minimise the risk of their theft or loss, whether these are assets in physical or electronic forms.

From a technology perspective, blockchain technology could transform the role of the qualified custodian at many levels:

- High levels of security can be achieved via strong encryption (which is at the base of blockchain technology).

- Verification of funds can be granted to white-listed originators (e.g. auditors) via remote access of blockchain addresses that reveal transaction history via multiple levels of private keys access privileges.

- The proof of existence and control element of a fund audit can be accomplished quickly and almost in real-time, because the integrity of every transaction is easily verifiable via the record immutability feature of the blockchain. “Proof of existence and control of funds” on the blockchain has the promise of being a very efficient process.

- Digital assets can be quickly transferred to a broker, exchange, dealer, bank, or directly into a client-side relay for on-chain transaction processing.

- Specific compliance rules can be embedded in smart contracts or via cryptographically secure multi-signature rules, and they could be automatically enacted upon.

However traditional compliance regulation has not yet caught up to the above mentioned blockchain advances because these new blockchain properties have not been incorporated into new compliance rules that could benefit from using them. For those same reasons, funds are creating their own custody strategies and methods by combining new tech with traditional compliance processes.

In an ideal world, everyone could practice self-custodianship while providing auditors and regulators the required transparency, protection and proofs. But the reality is different: while technology “can” do this, purely cryptographic institutional practices are not here yet.

For these reasons, custody of crypto assets presents a high barrier to entry into the crypto market for institutional players. While self-custody is the preferred method for individuals, institutional money needs institutional level custody, but it’s not yet clear what the best solution is. As new players (hedge funds, VCs, exchange-traded funds, mutual funds, asset managers) are entering the market, many are seeking out third party custodians rather than opting for self-custody.

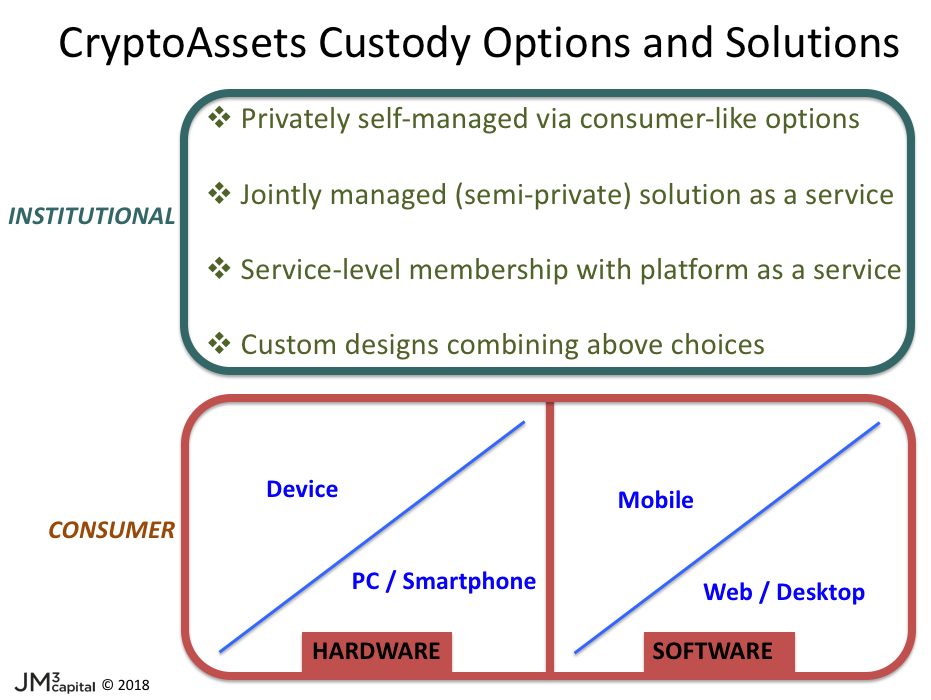

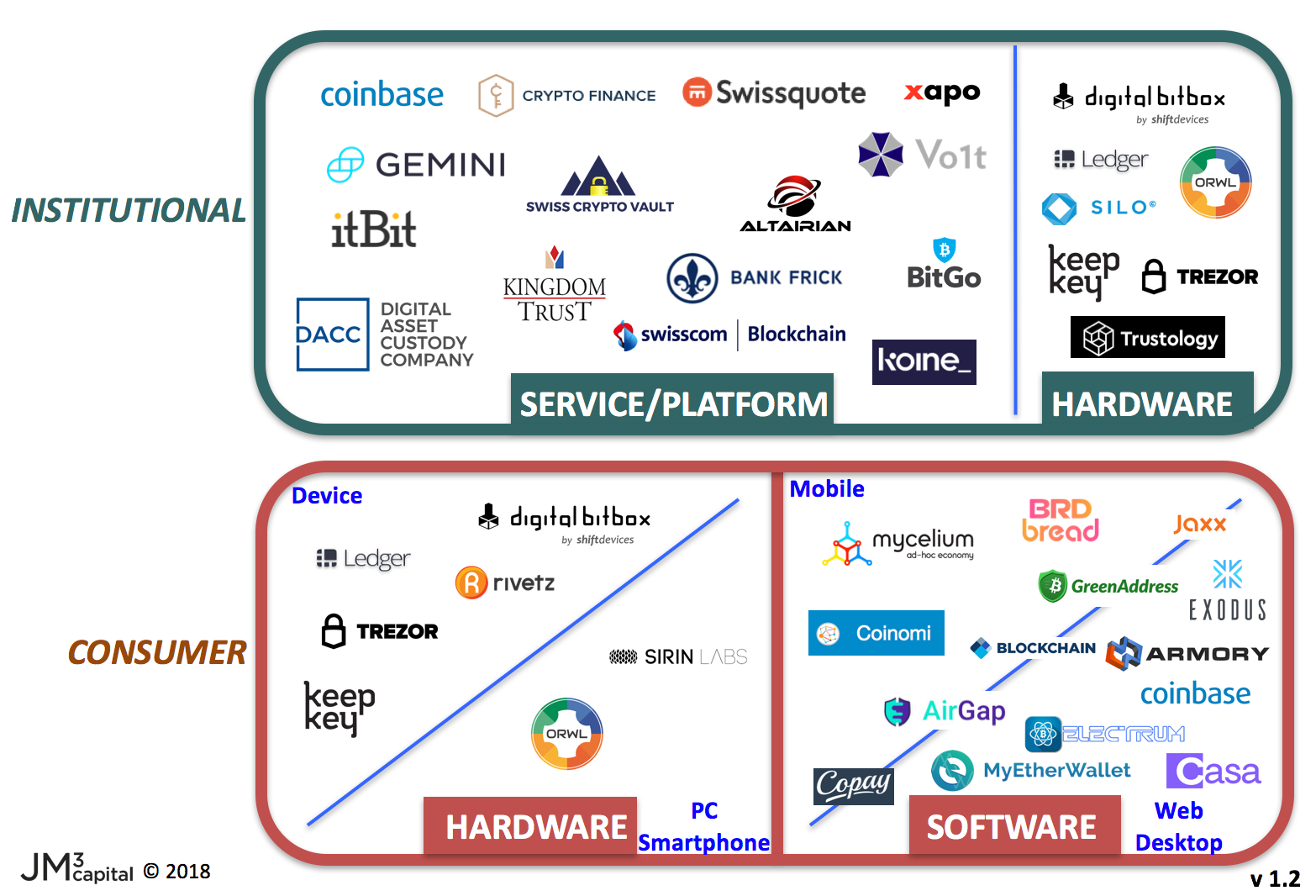

After analysing dozens of market players, we have categorised them as follows:

The consumer side of the market can be divided into hardware or software-based solutions, each with their respective sub-segmentation: special device vs. PC / smartphone, or mobile vs. web / desktop. The institutional side cannot be as easily dissected into clearly demarcated boundaries because the lines of functionality are overlapping between them. That said, we have found the following segmentation characteristics to be useful:

- Privately managed approach, via consumer-like options. Nothing prevents an institution from adopting the same methods as consumers, if they are satisfied with them.

- Jointly managed solution as a service, where the set-up and activation are semi-private, requiring co-ordination and approvals to be co-managed according to a set of rules and processes that govern the customer-provider relationship.

- Service-level approach equivalent to membership into a platform as a service, where the provider handles all requirements and the customer instructs them to conduct various actions.

- Custom design of a proprietary solution that might include a combination of the above choices.

The third-party custody market is relatively new and evolving quickly. The market is not short of options, but some homework is required for each case in order to figure out what works and what doesn’t.

Third-party custodians looking to offer custody for institutions are still in the process of developing their products and services, while institutions seeking third party custodians are still figuring out what features they need, and how to evaluate the advantages and disadvantages of these solutions, when compared to self-custody.

Most third-party custodians offer slight variations of a similar service as they approach the same problem from different angles. What this means is that we are now in an environment where some companies have regulatory status and others don’t, some companies offer more cryptocurrency choices than others, some offer fiat support, some have a prime brokerage service while others purely focus on custody. This is all to say that there is no obvious go-to institutional model yet.

Custody has been a popular topic here at JM3 Capital. The market is still developing and there isn’t one silver-bullet solution, so we believe a mix of custody solutions is the best option. As a result, our course of action has been to thoroughly investigate as many options as possible.

This process gave us a good understanding of the custody market, and we wanted to share our findings with the community. When researching third-party custodians, we considered key features including:

- Jurisdiction — Politically stable jurisdiction with a long history of recognising the rights of ownership

- Size of the organisation i.e. number of employees, clients and assets under custody

- Experience of the team operating the custody solution

- Regulatory status and Compliance– are they regulated? Relationship with regulators?

- Customer Support — Easily accessible? 24/7?

- Level of security — e.g. 2FA/Multi-sig. Operational process? Storage of assets?

- Disaster recovery scenarios

- Private key ownership/exclusivity

- Cryptocurrencies/tokens offered

- Fiat support

- Minimum amounts required for custody/transactions

- Pooling or segregation of digital assets

- Configurability of process and custom workflows for transfers

- Assessment of onboarding, setup, safekeeping, recovery and security procedures

- Costs including: setup costs, custody fees (as a % of AUC), transaction fees

- Liquidity: how long does it take to get access to your funds and/or make a transaction?

- Prime brokerage services offered

As well as completing a due diligence questionnaire covering all the relevant areas, the work of our operations team includes meeting with the custodians, reviewing control reports, following up with reference calls and continuously monitoring the financial health of selected custodians. The research made clear that what one custodian might have another is missing, and there is a general tradeoff between security and operational efficiency.

After surveying the market in-depth, we decided to share the complete list of our findings via a public Google Sheet, accessible on this link, and here is where these solutions are on the map:

Third-party custody is an area that will keep changing and evolving, and the spreadsheet will continue to be updated as JM3 Capital works and grows with the market. We might not have seen everything yet, but we see this as a useful resource that the community can contribute to.

Looking forward, we can expect to see an increase of next generation custody solutions that will be introduced in late 2018 and during 2019 (we know of a few that are in stealth mode).

This is a guest post from Jean-Philippe. He is part of the investment team at JM3 Capital, a brand under Blockchain Technology Ventures. The latter formed a division under Jabre Capital Partners SA.

This is a guest post from Jean-Philippe. He is part of the investment team at JM3 Capital, a brand under Blockchain Technology Ventures. The latter formed a division under Jabre Capital Partners SA.

This article first appeared on Medium.com

The post A List of Cryptocurrency Custody Solutions for Consumers and Institutions appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments