Professor Patrick Schueffel from the Institute for Entrepreneurship & Small and Medium Enterprises in Switzerland defines the word Fintech in his article, featured in Volume 4 in the Journal of Innovation Management. The article, which was published last year, attempts a definition, drawing from more than 200 scholarly articles referencing the term over a period of 40 years.

“The term Fintech has been applied in various business contexts, often inconsistently and ambiguously,”

wrote Schueffel.

“But if Fintech is truly meant to be meaningful and comparable, then the methodology and definitions used must be precise and uniform,”

he continued. He added that a definition must be set in order to create a solid foundation for scientific research. Besides, the definition would need to be understood by practitioners and policy makers.

What really is fintech?

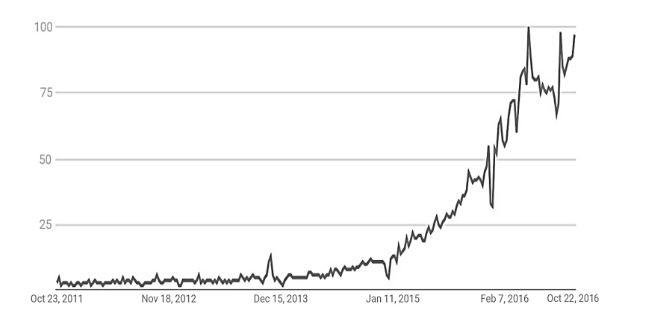

Despite the consensus on the major impact that Fintech will have on the financial industry, little academic literature has explored this area. Schueffel wrote that there has been a significant increase in Google searches for the word Fintech in the last five years.

Google receives monthly an average of 201,000 searches worldwide for the term. The term’s origin can be traced to an early 1990s project by Citigroup to facilitate technological cooperation efforts. An article published by media outlet American banker mentioned the project by the name Fintech.

Schueffel decided to conduct semantic analysis on the word Fintech. He did a systematic search for all major literature databases related to Management Sciences as well as Economics for all papers published until October 16 last year, using the keyword Fintech.

After analysing the literature, he found that they have claimed Fintech to be a sector or industry, a technology, as well as a type of action, be it a business, a service. It was also described as new, emerging, innovative or disrupting, and enhancing the efficiency of facilitating financial services.

The article concludes that Fintech is indeed a new financial industry that applies technology to improve financial activities. But such a definition itself could have some implications. He noted the term is not all-encompassing and there may be varying definitions of Fintech that are useful depending on the differing circumstances.

Definitions themselves will change over time, too. It was previously applied to the technology of back-end work of financial institutions. Now it Fintech has expanded to include even financial literacy and education and crypto-currencies like bitcoin. It is also limited in its use solely in the English language, when Fintech is a worldwide movement, said Schueffel.

With the shap rise in Fintech, some observers say there may be a bubble coming up. If the bubble were to burst, the technology would still remain and be adopted and turned into a business standard by the financial industry, in a similar vein to what happened in the Dot-com bubble, wrote Schueffel. “A good share of of innovations brought forward by Fintech firms will be aborbed by other players, such as incumbent banks, insurers and software companies and be kept alive,” he noted.

The post A Scientific Definition of Fintech appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments