Riding on the rise of sustainable finance, a new wave of climate-focused fintechs are emerging in Switzerland to provide customers with environmentally-friendly digital financial services and investment opportunities.

Thomas Ankenbrand and Marc Grau from the Institute of Financial Services Zug IFZ identify two prominent groups of green fintechs in Switzerland based on their offered services.

First, there are those that focus on the provision and analysis of environmental, social and corporate governance (ESG) data. Swiss actors active in this field include Carbon Delta, RepRisk, Covalence, and Impaakt.

Carbon Delta is an environmental fintech and data analytics firm specializing in climate change scenario analysis. It was acquired in October 2019 by rating provider MSCI.

RepRisk, based in Zurich, is another Swiss ESG data science company that specializes in ESG and business-conduct risk research and quantitative solutions. The company runs an online due-diligence database that allows clients to monitor and assess the risk exposure of companies, infrastructure projects, sectors, and countries.

Covalence, which was founded in 2001 in Geneva, offers investment solutions, ESG ratings and data based on artificial intelligence (AI), and portfolio advisory.

Meanwhile, rating provider Impaakt provides a collaborative platform relying on collective intelligence to produce research and assessments of the social and environmental impact of companies.

How it works, Impaakt.com

In addition to Swiss fintechs specializing in ESG data, others like Yova, 3rd Eyes, Greenmatch, Blueyellow and Pexapark, focus on impact investing and financing of renewable energy.

Yova, headquartered in Zurich, is a robo-advisor offering tailored investment solutions with a sustainable impact. Yova actively manages users’ stocks for a fee, acting as an online, sustainable asset management. The company launched in late 2020 and raised a CHF 4 million seed round in April 2020.

Yova mobile app illustration, via Yova.ch

In the business-to-business (B2B) category, 3rd Eyes provides financial institutions with a goal-based and sustainable investment suite using scenario-based asset and liability management methods.

Switzerland is also home to a few green fintech companies focusing on physical risk applications. Examples include CelsiusPro, an award-winning insurtech startup specialized in the industrialization of insurance solutions to combat adverse effects from weather, climate change, and natural catastrophes, and the South Pole Digital Lab, which focuses on the development and scaling of digital solutions for the management of climate-risk and other environmental risks.

Sustainable finance on the rise

The rise of green fintech in Switzerland comes on the back of growing interest in sustainable finance. Sustainable finance refers to the process of taking into account ESG considerations when making investment decisions in the financial sector.

Environmental considerations may refer to climate change mitigation and adaption, as well as the environment more broadly, while social considerations may refer to issues of inequality, inclusiveness, as well as human right issues. Finally, governance considerations aim to ensure the inclusion of social and environmental considerations in the decision-making process.

Sustainable finance has gained much traction over the past years, a trend evidenced by the rising importance of sustainable financial investments for both wealth management and investment advice as well as pension funds and insurance companies.

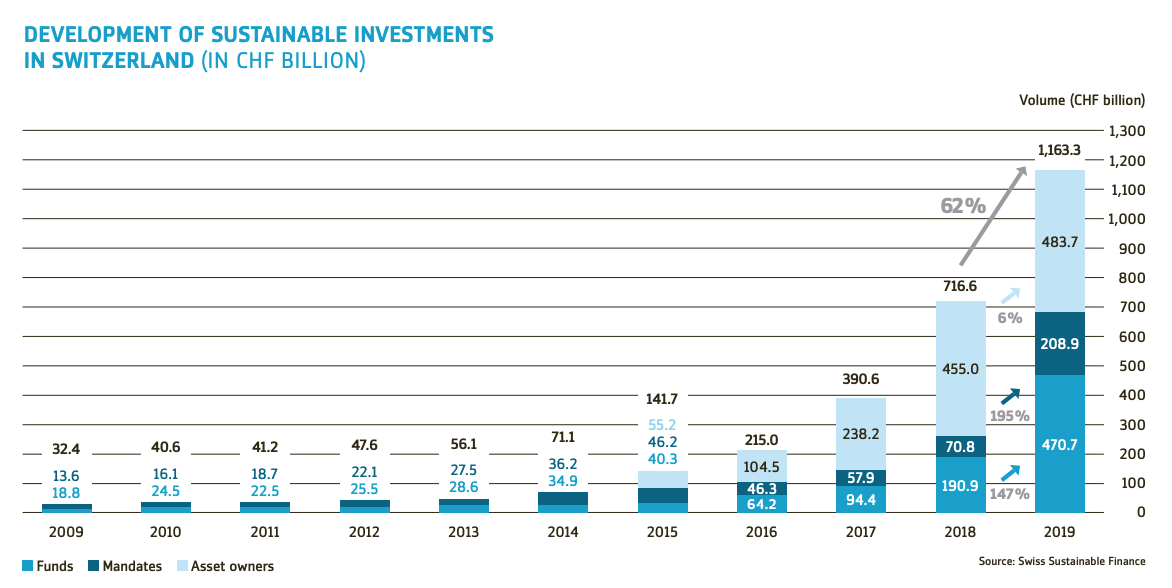

In 2019, the market for sustainable investments in Switzerland experienced double-digit growth with volume increasing by 62% to over CHF 1,163 billion, according to the Swiss Sustainable Investment Market Study 2020 prepared jointly by Swiss Sustainable Finance and the Center for Sustainable Finance and Private Wealth (CSP) at the University of Zurich.

Development of sustainable investments in Switzerland (in CHF billion), Source: Swiss Sustainable Finance, via Swiss Sustainable Investment Market Study 2020

Government support

Committed to supporting the development of sustainable finance, Switzerland’s Federal Council adopted a report and guidelines on sustainability in the financial sector in June 2020, a move that’s been focused on turning Switzerland into a leading location for sustainable financial services.

With technology becoming increasingly important for the Swiss financial center, the Federal Council launched the Green Fintech Network in November 2020 to speed up the development of environmentally-friendly fintech innovation.

The Green Fintech Network aims to bring together green fintech companies, associations, potential financial backers, academics, and consulting and legal firms. The body is to submit proposals to the government and finance industry on how to foster green fintech in Switzerland.

Featured image credit: Edited from Unsplash

The post An Overview of the Swiss Green Fintech Sector appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments