Although wire transfers might be the quickest and most convenient way to send money, it is also exorbitantly pricey, especially when it involves international transfers.

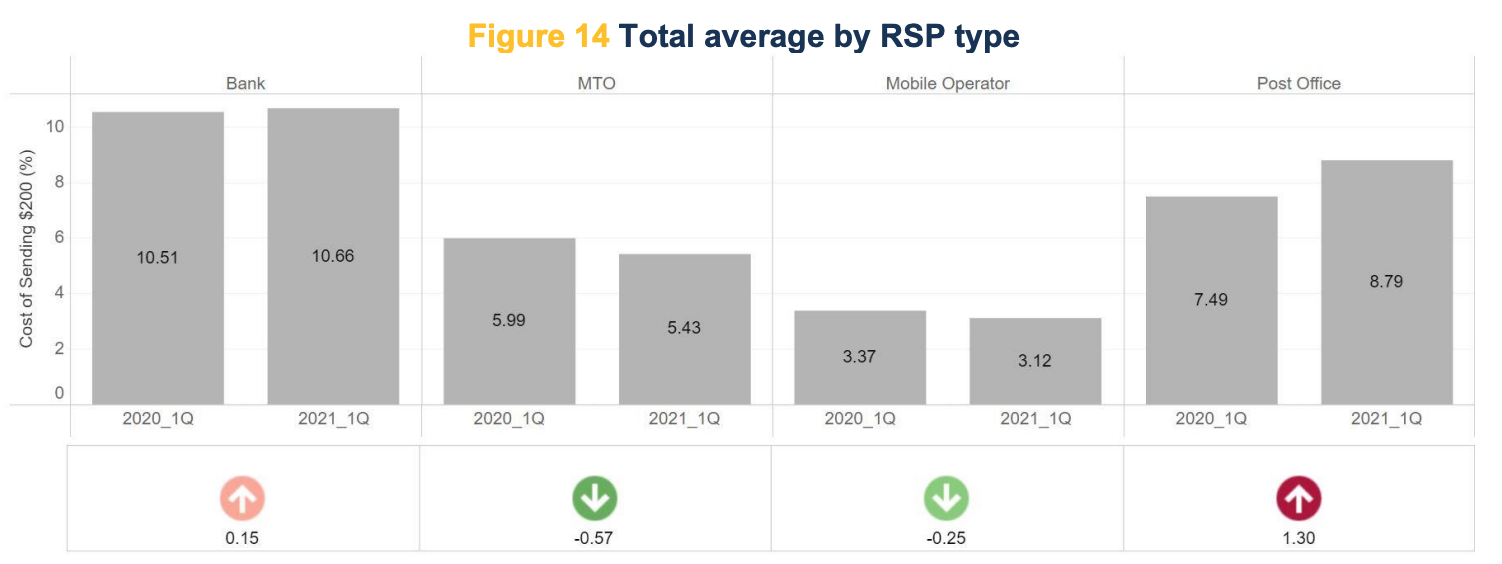

In fact, the World Bank’s Q1 2021 Remittance Prices World Quarterly report found that banks remain the most expensive type of service provider when it comes to remittances, with an average cost of 10.66%. Banks surpass post offices, with an average cost of 8.79%, money transfer operators (MTOs) (5.43%) and mobile operators (3.12%).

Total average by remittance service provider type, Source: Q1 2021 Remittance Prices World, World Bank, March 2021

The true cost of international bank transfers

To truly understand how much customers are actually paying when they send money to their loved ones overseas, money transfer comparison platform Monito has produced a detailed guide, breaking down the different fees banks charge customers for international transfers, giving concrete examples, and sharing key recommendations.

Generally, two types of costs are involved when it comes to overseas bank transfers, the guide notes: the wire transfer fees, and the exchange rates.

The wire transfer fee is the standard fee that a bank charges a customer for sending money aboard. This fee can also include correspondent and intermediary bank fees in the event that the wire transfer needs to go through several intermediary banks.

Wire transfer fees vary from one bank to another and from country to country. For example, US banks would typically charge a fixed fee in the range of US$25 to US$40 per international bank wire. Meanwhile, in South Africa, international bank transfers would typically involve a commission of around 0.5% of the transfer value, with minimum and maximum caps, in addition to a fixed fee in the tunes of ZAR 100 (US$7) to ZAR 200 (US$14) per transaction.

The second major cost when sending money aboard through international bank transfers is the exchange rate margin. This cost is the difference between the mid-market exchange rate or the “interbank exchange rate” – the exchange rate at which banks trade currencies between one another – and the exchange rate the bank actually offers the customer.

This costs vary from one bank to another, and also depends on whether the transaction involves major world currencies or more obscure, volatile ones. But generally, it tends to range from 1.50% of the transfer value to about 15%. The exchange rate margin is charged by practically every bank around the globe, even though it’s not displayed transparently.

Edgar, Dunn & Company estimates that each year, GBP 150 billion is unknowingly spent in hidden fees on foreign currency transfers. These fees are either extracted through an exchange rate markup, or a rate markup plus additional fees.

The same 2021 research further shows that only 4% of surveyed bank customers understand what they are being charged in these transactions.

In addition to the fees associated with sending money aboard, many banks also charge a separate set of fees for receiving money from overseas.

A transaction fee can be automatically debited in the receiving currency in the form of a fixed or commission fee. The receiver can also be charged the exchange rate margin in the event that the money that arrived into their account was in a foreign currency.

Using data it has compiled from banks around the world, Monito provides a list of the best banks for international wire transfers based on the country customers are sending the money from.

For those located in the US, the money transfer comparison platform recommends using Citibank. For consumers in the UK, Bank of Scotland, or its subsidiary Halifax, are considered to be the best options. In Australia, Monito names the National Australia Bank (NAB) as the best bank, while in New Zealand, it names Kiwibank. In Singapore, customers should opt for DBS Bank, especially its remittance service DBS Remit, or its subsidiary POSB. And in South Africa, Absa is considered as the best provider.

Money transfer specialists are the top choices

While some banks are better than others for sending money overseas, Monito nevertheless discourages consumers to use them altogether, arguing that better options exist on the market, such as money transfer specialists.

In particular, a previous research conducted by Monito named Wise, formerly TransferWise, as the best money transfer service in the world.

Wise secured the highest Monito Score, scoring perfectly in trust and credibility, and the highest in customer satisfaction as well as service and quality. Wise topped an extensive list of international money transfer services from all parts of the world, including TransferGo (ranked 2nd) and Remitly (ranked 3rd) and surpassed veterans Western Union and MoneyGram, as well as established fintechs Xoom and PayPal.

Featured image credit: Photo by Alistair MacRobert on Unsplash

The post Banks Remain Costliest Remittance Providers appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments