In Switzerland, although just a few consumers know what open banking is, consumers are showing strong interest in the use cases and opportunities the trend brings, signaling that future growth and adoption of open banking will be driven by consumer demand, a new study by Mastercard found.

The research, which polled more than 1,000 consumers from Switzerland in April 2021, found that despite low awareness of open banking general, with just 6% of respondents stating that they had heard of open banking, Swiss consumers indicated willingness to use open banking-enabled services when explaining to them what open banking was and its use cases.

Out of the respondents who had not heard of open banking before, 14% showed interest after being provided a generic definition, a level that increased significantly (52%) when consumers were given explanations of real use cases of open banking.

Swiss consumer awareness and interest in open banking, Source: Open Banking in Switzerpand Part I, Mastercard, Sept 2021

These results imply that as awareness of open banking and related services increases in the market and as consumers start to really understand their value in everyday life, demand will materialize and grow, the report says.

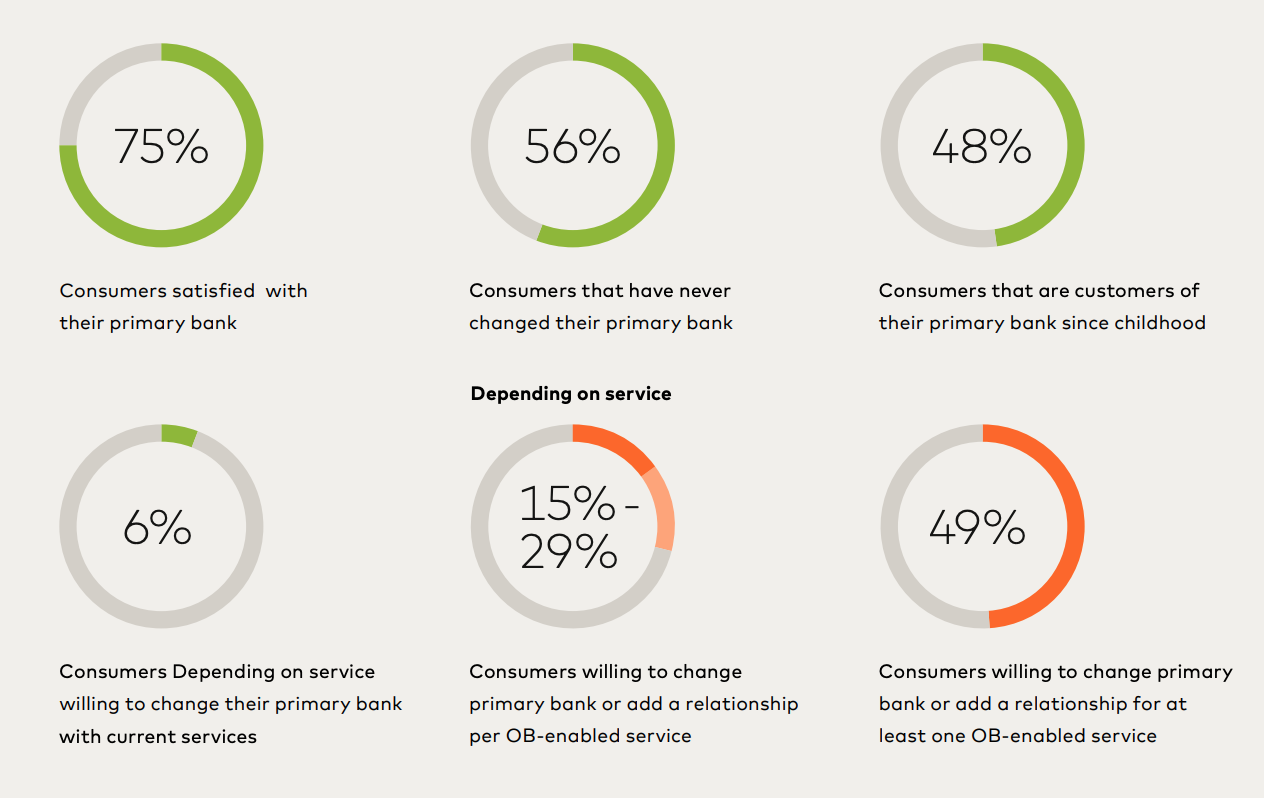

Not only that, but the study also found that, despite strong customer loyalty to their primary bank, a significant proportion of respondents (49%) said that they would be willingness to change their primary bank or add a new banking relationship to benefit from at least one open banking-enabled service.

Customer relationship with their primary bank and willingness to change, Source: Open Banking in Switzerpand Part I, Mastercard, Sept 2021

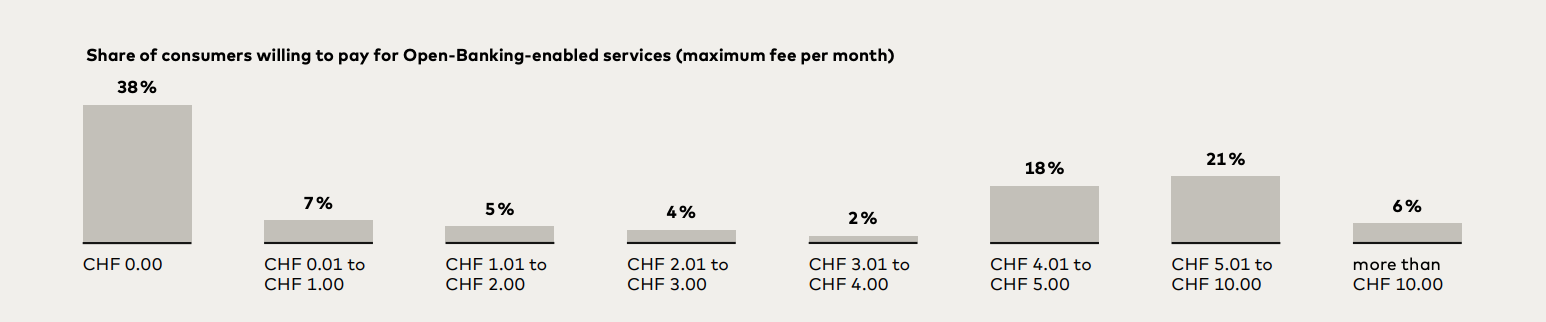

Apart from general interest, 62% of respondents even indicated that they would be willing to pay a fee for open banking-enabled services, with as many as 45% stating that they would be willing to pay more than CHF 4 on a monthly basis.

Share of consumers willing to pay for Open-Banking-enabled services (maximum fee per month), Source: Open Banking in Switzerpand Part II, Mastercard, Sept 2021

Security, data privacy as top concerns

Open banking, a concept pioneered by the European Union (EU) and the UK, is a banking practice that provides third-party financial service providers open access to consumer banking, transaction, and other financial data from banks and non-bank financial institutions through the use of application programming interfaces (APIs).

This allows for services such as account aggregation, where customers can get an overview of their various accounts, tailored personal finance management products, as well as streamlined onboarding through the sharing of customer’s bank details and information and quicker know-your-customer (KYC).

Although the sharing of consumers’ financial data is a prerequisite of open banking, data privacy and security remain for many consumers one of the main perceived threats of open banking.

In Switzerland, 88% of the 1,000+ respondents surveyed indicated having concerns when sharing their financial data with non-banks, a fear that stems from the potential use of their financial data for commercial purposes as well as potential security failures and data leaks, the study found.

No longer an “optional luxury”

Despite data security concerns and trust issues in non-bank, new entrants, the study’s results show that open banking can no longer be viewed as “an optional luxury that financial institutions can consider,” but instead has become “an inevitability that will drive competitive advantages and monetization opportunities,” the report says.

It notes that while deployment of open banking in Switzerland remains at a much earlier stage than in the surrounding regulatory-driven EU, many Swiss market participants have recognized the need to embrace the trend.

Furthermore, progress in standardization initiatives such as the OpenWealth API by the Open Wealth Association, the Common API by Swiss Fintech Innovations, and the Swiss NextGen API by Openbankingproject.ch, will incentivize current followers to join in, the report says.

The release of MasterCard’s two-part report on the Swiss open banking ecosystem comes at a time when the payment network is looking to extend its foothold in the European open banking scene.

Last week, it unveiled the acquisition of Aiia, a Danish open banking startup. Aiia offers a direct connection to banks through a single API, allowing third-party providers to build services on top of financial data with the consent of the end-users.

The post Swiss Consumers Show Interest in Open Banking-Enabled Services Despite Low Awareness appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments