The Canadian fintech industry has seen tremendous growth in recent years and is expected to continue to expand exponentially as collaborations between fintechs and traditional financial institutions, new and improved regulations, and leadership in the financial services space continue to stimulate fintech innovation in Canada, according to a new report by Global Risk Institute.

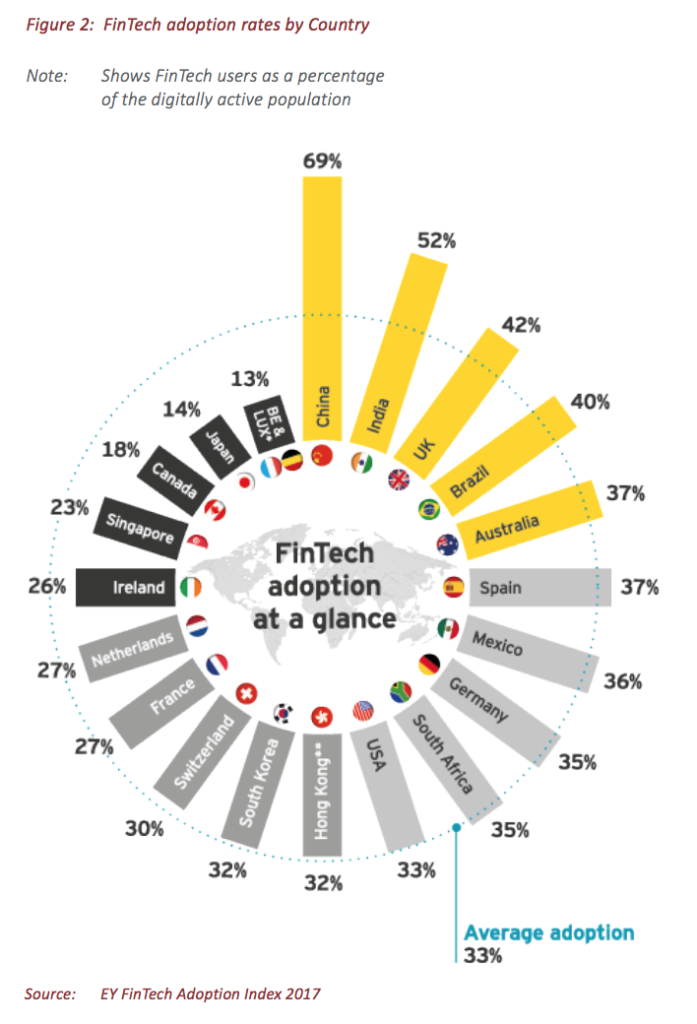

This report, titled An Overview of Fintech in Canada, claims that although fintech adoption in Canada remains slow, it has reached the Early Majority Adoption phase and is expected to continue to grow.

Canada’s “big six” financial institutions, which are the National Bank of Canada (NBC), Royal Bank of Canada (RBC), the Bank of Montreal (BMO), Canadian Imperial Bank of Commerce (CIBC), the Bank of Nova Scotia (Scotiabank), and Toronto Dominion Bank (TD), are expected to greatly influence the fintech adoption rate as Canadians are found to be more reluctant to change their banking habits than in other economies.

Canadian financial institutions lead fintech revolution

Canada is home to one of the largest international financial hubs and has some of the world’s top technological talent.

Canadian financial institutions have so far welcomed innovative technologies and have collaborated with fintech firms to improve efficiencies and product offerings.

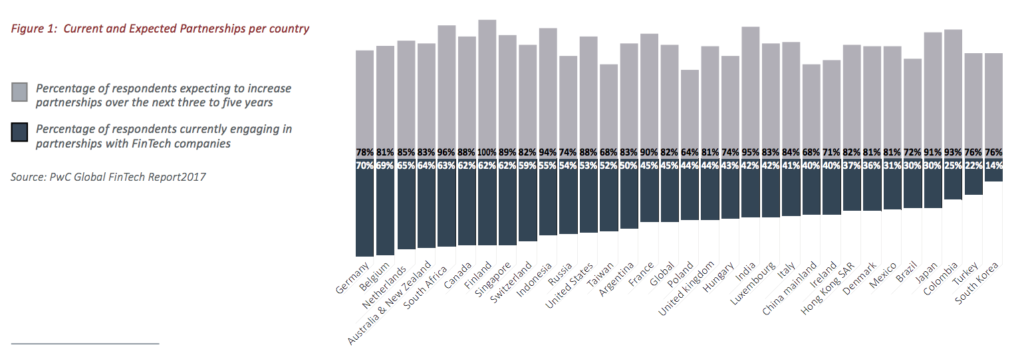

According to the report, the number of financial institution-fintech partnerships in Canada is much higher than in most other countries. 62% of financial institutions declared they are actively involved in partnerships with fintech companies, and 88% said they would increase partnerships going forward.

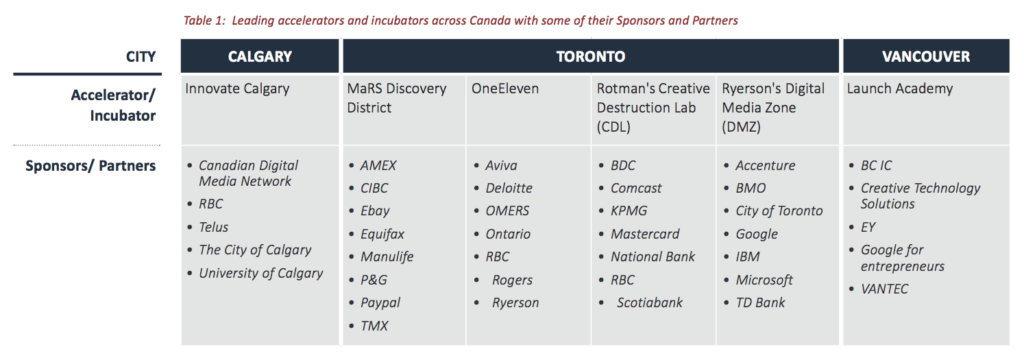

Canadian financial institutions have not only found it useful to collaborate with fintech firms, but also to invest in accelerators in order to gain access to top talent.

The birth of accelerators and incubators across the country are further aiding the development of fintech firms by providing fintech firms with services such as expert advice, networking opportunities, and direction within the regulatory landscape.

For the most part, incubators are focused on early-stage companies whereas accelerators are used by established firms looking to grow. These programs are generally run and funded by a combination of financial institutions, technology companies, consultants, and academics.

For instance, Ryerson University’s Digital Media Zone (DMZ) is partnered with BMO, TD, General Motors and the City of Toronto in the DMZ-BMO Fintech Accelerator initiative. Non-profit MaRs Discovery District claims to be the world’s largest urban innovation hub. The MaRS center, located in Toronto, supports over 1,000 startups with 62 being in the finance and commerce spaces. Partners of MaRS include CIBC, Manulife, Sun Life Financial and Canadian interbank network Interac.

Canadian fintech

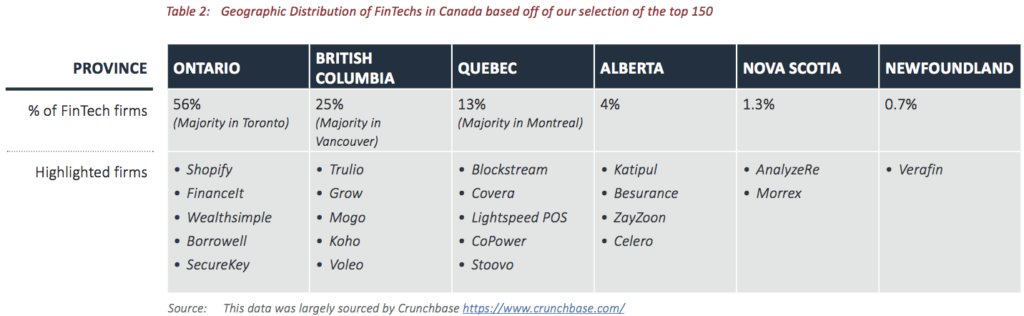

Ontario is the largest fintech hub in Canada with Toronto, the capital city of the province, being one of the largest financial centers in the world and southern Ontario producing top tech talent from leading universities. British Columbia and Quebec, with access to talent and resources from Vancouver and Montreal, are expected to become leaders in the space as well.

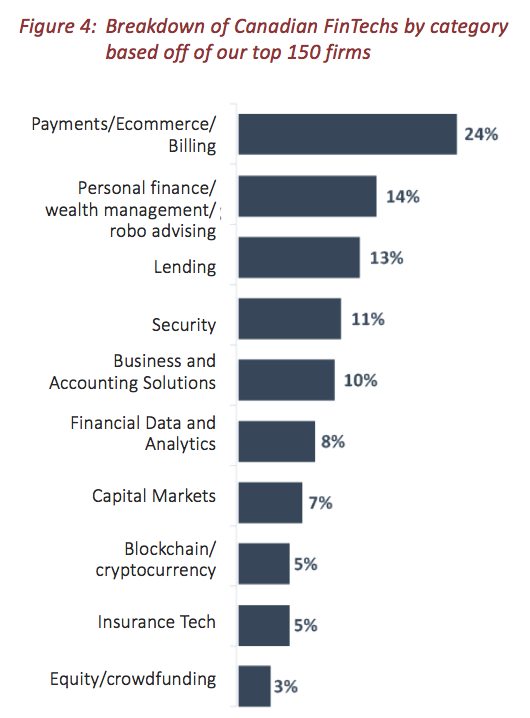

Across the various types of fintech products found in Canada, money transfers and payments are the most-used at this time. Roughly a quarter of the fintechs in Canada provide money transfer and payment services.

Shopify is a leading payment services provider in Canada and one of the few Canadian fintech to have gone public, raising $1.27 billion from their IPO in mid-2015. Shopify offers merchants software to develop their own e-commerce platforms.

Shopify is a leading payment services provider in Canada and one of the few Canadian fintech to have gone public, raising $1.27 billion from their IPO in mid-2015. Shopify offers merchants software to develop their own e-commerce platforms.

The second-largest category is saving and investment services, with 14% of the market. The sector of personal finance, wealth management and robo-advisory is seeing record funding, according to the report.

Wealthsimple, Canada’s largest robo-advisor, recently raised approximately $51 million in capital from Power Financial Corp. With roughly $1 billion in assets under management, Wealthsimple is currently the market leader.

Many of Canada’s major banks have also launched their own internal robo-advisors. BMO’s Smartfolio, for example, asks clients to fill out an online questionnaire before being assigned a portfolio manager who will then invest their money into BMO ETFs.

Featured image: Canadian flag, Pxhere.

The post Canadian Fintech Industry Set to Witness Strong Grow: Report appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments