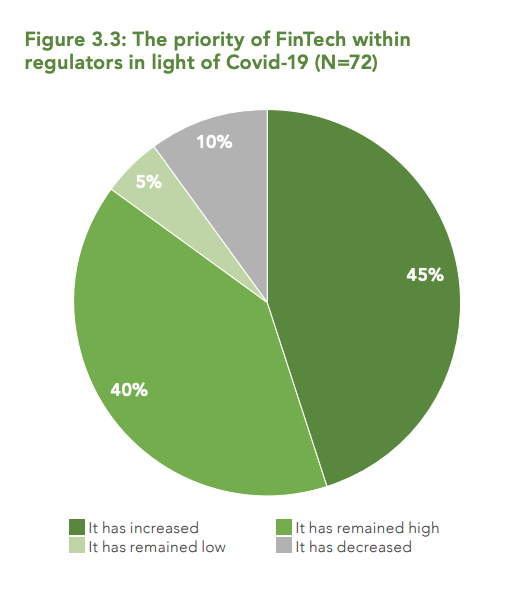

Amid COVID-19, central banks and financial regulators around the world are increasing their prioritization of fintech, with 85% of them indicating a high or increased focus on fintech in light of the pandemic, according to a new study by the World Bank and the Cambridge Centre for Alternative Finance.

In a report titled The Global COVID-19 Fintech Regulatory Rapid Assessment Study, the organizations share findings from a study conducted March and August 2020 of 118 regulatory authorities in 114 jurisdictions around the world.

The research found that across the globe, financial regulators are putting innovation as their number one priority as COVID-19 continues to have an extreme impact on our lives.

Image: The priority of FinTech within regulators in light of Covid-19 (N=72), The Global COVID-19 FinTech Regulatory Rapid Assessment Study, The World Bank and the Cambridge Centre for Alternative Finance, October 2020

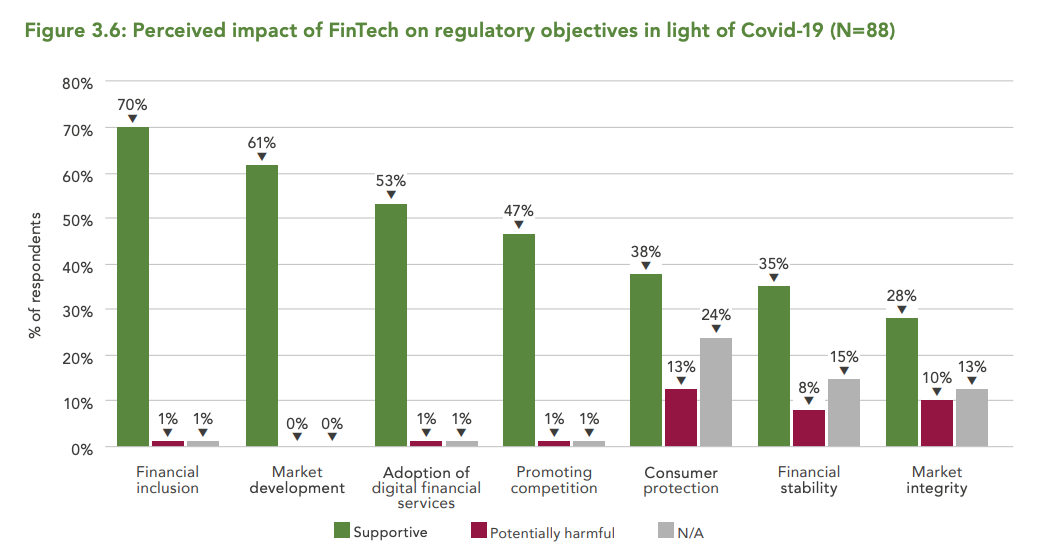

In particular, regulators perceive fintech as a key enabler for financial inclusion (70%), with the potential to support market development (61%), the adoption of digital financial services (53%) as well as promoting competition (47%).

Image: Perceived impact of FinTech on regulatory objectives in light of Covid-19 (N=88), The Global COVID-19 FinTech Regulatory Rapid Assessment Study, The World Bank and the Cambridge Centre for Alternative Finance, October 2020

COVID-19 regulatory response

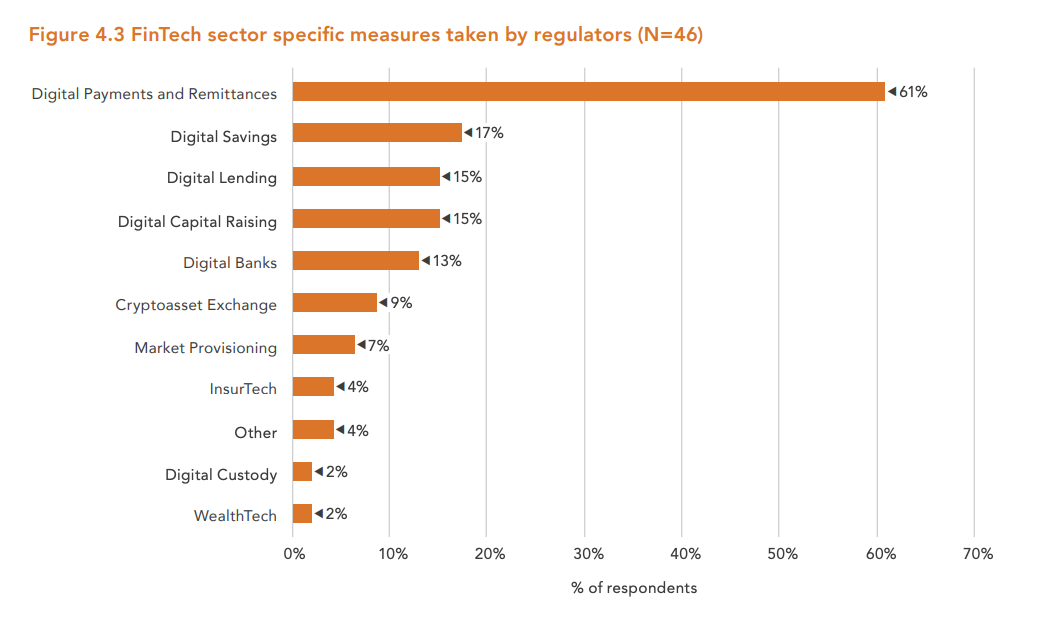

Amid COVID-19, 37% of responding regulators have undertaken at least one measure targeting one or more specific fintech activities or sectors, the research found. The digital payments and remittances sector was found to be the most commonly targeted (61%), followed by digital savings (17%), digital lending (15%), and digital capital raising (15%).

Image: FinTech sector specific measures taken by regulators (N=46), The Global COVID-19 FinTech Regulatory Rapid Assessment Study, The World Bank and the Cambridge Centre for Alternative Finance, October 2020

In the digital payments and remittances sector, measures that have been implemented include the temporary waiving of transaction fees as well as the increase of transaction limits/thresholds in a bid to encourage cashless transactions, the report notes.

It cites the example of the Central Bank of Kenya, which increased the transaction and balance limits by 114% in March, in addition to requiring mobile money providers to partially or fully waiving transaction fees. These moves, the central bank said, has led to “increased usage at higher amounts and greater convenience.”

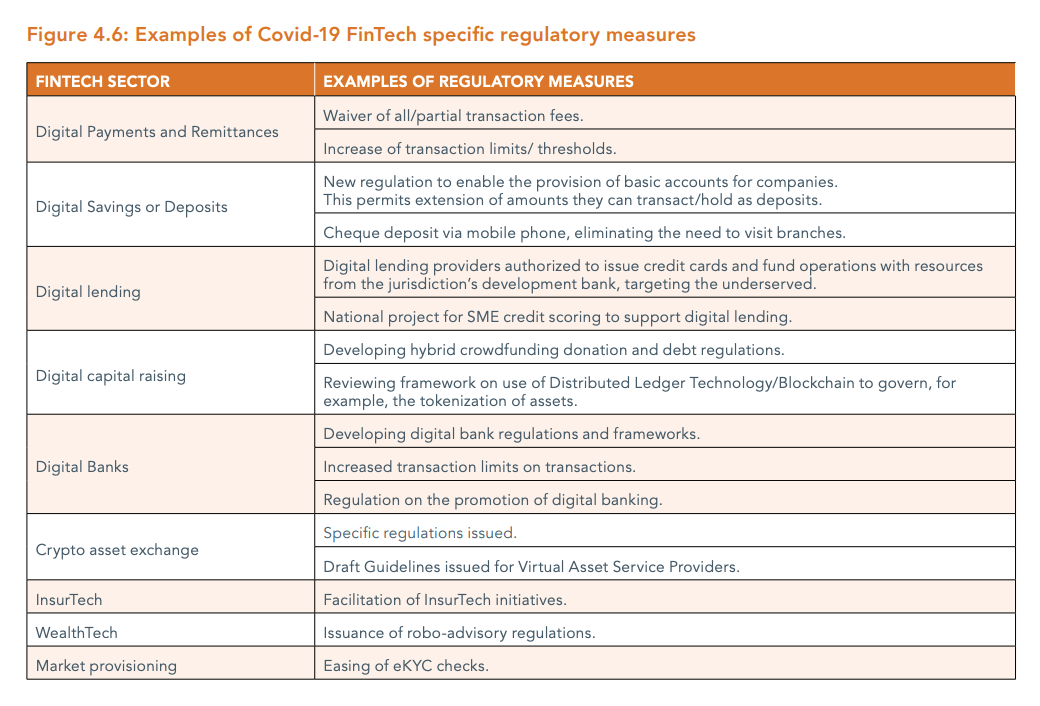

In other fintech sectors, the most frequently cited measure undertaken was the issuance of regulations and guidelines to govern activities in specific sectors, including digital savings and deposits, digital capital raising, digital banking, cryptoasset exchange services, and robo-advisory services.

Image: Examples of Covid-19 FinTech specific regulatory measures

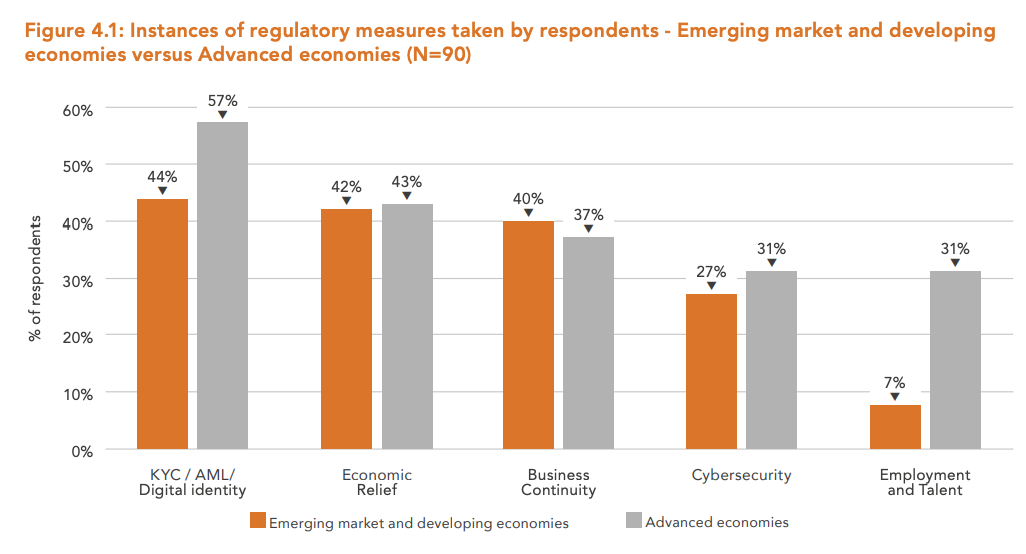

The research also found that the majority of respondents have introduced COVID-19 measures not directly targeting fintech but which have had an impact on the sector.

These measures fall into five main areas: know-your-customer (KYC), anti-money laundering (AML) and digital identity (49%); economic relief (42%); business continuity (39%); cybersecurity (29%); and employment and talent.

In particular, the report notes that COVID-19 has been a catalyst for digital adoption in financial services, which has prompted regulatory action with respect to KYC requirements.

Examples of this include facilitating or permitting electronic KYC (eKYC) processes or simplifying KYC processes and practices. Such initiatives have taken the forms of measures that support digital onboarding, digital/electronic signatures, as well as simplified and/or digital customer due diligence (CDD) checks using, for example, facial recognition technology.

Image: Instances of regulatory measures taken by respondents – Emerging market and developing economies versus Advanced economies (N=90), The Global COVID-19 FinTech Regulatory Rapid Assessment Study, The World Bank and the Cambridge Centre for Alternative Finance, October 2020

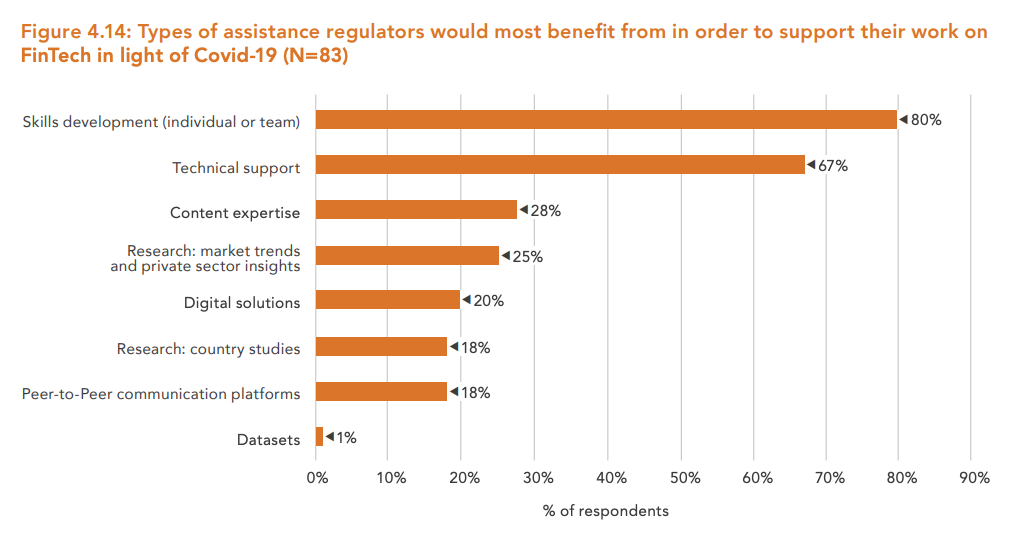

To help them in their work on fintech and digital financial services, regulators also indicated different types of assistance and support they would benefit from.

80% of respondents cited skills development as the most important type of support, followed by technical support (67%). Regtech and support were also popular themes with respondents requesting assistance to develop both road and strategies, but also specific tools, the report says.

Image: Types of assistance regulators would most benefit from in order to support their work on finTech in light of Covid-19 (N=83), The Global COVID-19 FinTech Regulatory Rapid Assessment Study, The World Bank and the Cambridge Centre for Alternative Finance, October 2020

Impact of COVID-19 on fintech

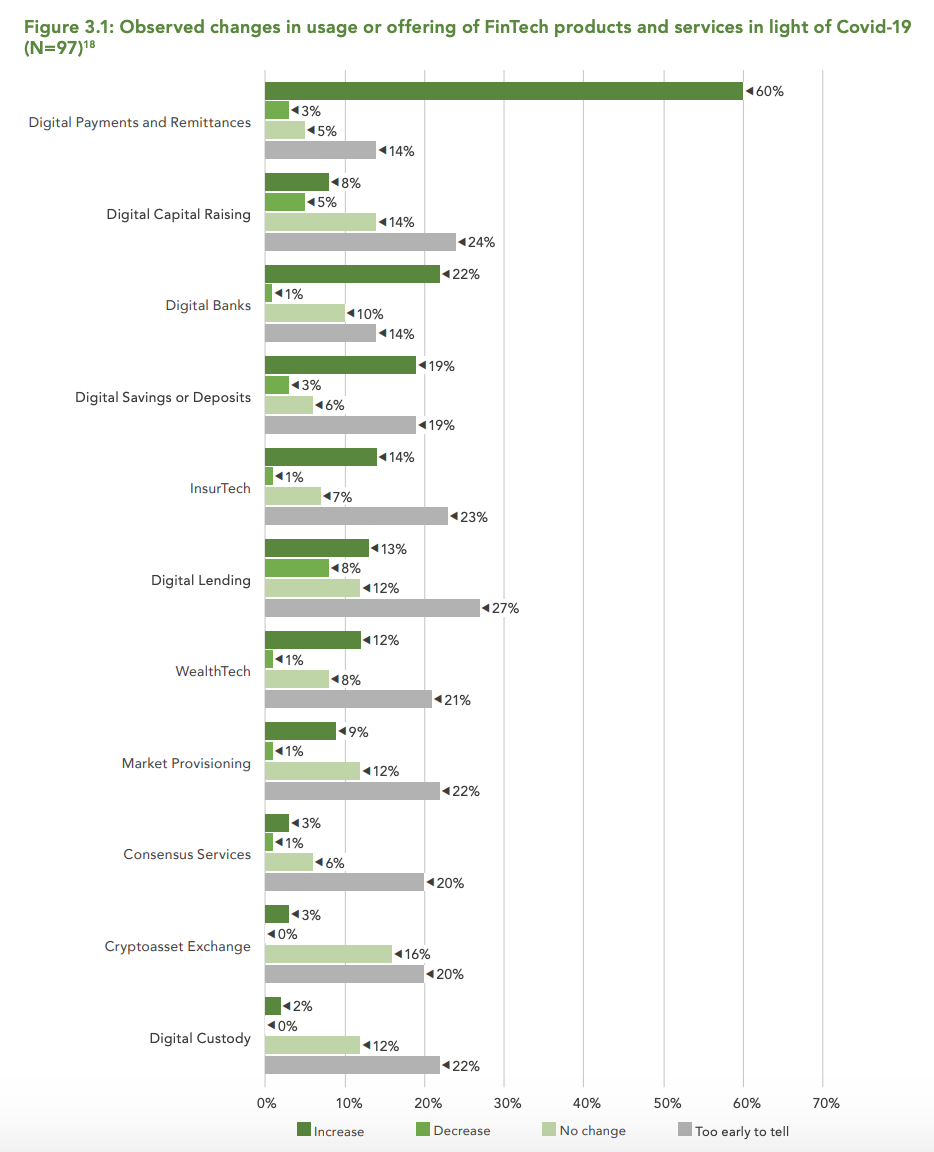

Central banks and financial regulators were also asked about the changes in usage or offering of fintech products they have observed since the beginning the pandemic.

More than 60% of respondents indicated that they saw an increase in the digital payments and remittances sector, while 22% observed rising activities in the digital banking sector.

Out of those that reported an increase in the usage or offering of digital payments and remittances, 65% were respondents in emerging markets and developing economies. In addition to this, respondents these markets were also found to be more likely to see an increase in digital banking activities (24% versus 18%), as well as digital savings or deposits (22% versus 12%).

On the other hand, 14% of respondents witnessed a decreased in activities in the digital capital raising sector, 16% in the cryptoasset exchanges sector, and 12% in the digital custody sector.

Image: Observed changes in usage or offering of fintech products and services in light of COVID-19 (N=97), The Global COVID-19 FinTech Regulatory Rapid Assessment Study, The World Bank and the Cambridge Centre for Alternative Finance, October 2020

This article first appeared on fintechnews.sg

The post COVID-19 Has Caused Financial Regulators from Around the World to Prioritise Fintech appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments