Fintech is experiencing rapid growth in Uzbekistan, playing a pivotal role in improving financial inclusion, driving digital transformation, and contributing to economic development. But despite the growth, the domestic fintech sector remains small and nascent, presenting opportunities for players to tap into, a new report by Mastercard says.

The report, titled “Fintech Market Uzbekistan” and released in December 2023, provides a comprehensive analysis of the Uzbekistan fintech market, offering insights into the trends, challenges, regulatory environment, key ecosystem players and emerging fintech startups.

According to the report, fintech adoption in Uzbekistan has accelerated over the past years, owing to the development of digital infrastructure in the country, including internet and mobile services. This trend accelerated at the COVID-19 pandemic, which fueled demand for remote access to financial and banking.

Evidence of this is the significant expansion of digital payments and the development of digital wallets. Between 2020 and 2022, the volume of transactions through QR-online systems grew by a remarkable 119% average annual growth rate. Total value skyrocketed by a staggering 1,500% during the period.

Transactions through QR-online system, Source: Fintech Market Uzbekistan, Mastercard, Dec 2023

Remote banking has also experienced significant growth, revealing untapped opportunities for enhancing financial services. In 2018, only 8 million people out of the country’s 32 million population used remote transactions, a number that rose to 30 million in 2022 and which implies an annual growth rate of 30% between 2018 and 2022. Total POS transaction value, meanwhile, grew by 56% between 2021 and 2022, reaching US$14 billion, reflecting the shift to digital payments and cashless transactions.

Remote and POS-terminal transactions, Source: Fintech Market Uzbekistan, Mastercard, Dec 2023

The Mastercard report identifies several critical trends driving the growth of fintech in Uzbekistan. It notes that the government is actively promoting financial inclusion and working on establishing a conducive foundation for fintech to strive. Recent developments in this regard include a banking reform strategy for 2020-2025 which has spurred the entry of foreign entities and prompted local banks to diversify their loan and deposit portfolios, and develop newl products, deposits, loans and other commission-based products to attract new customers and enhance experiences.

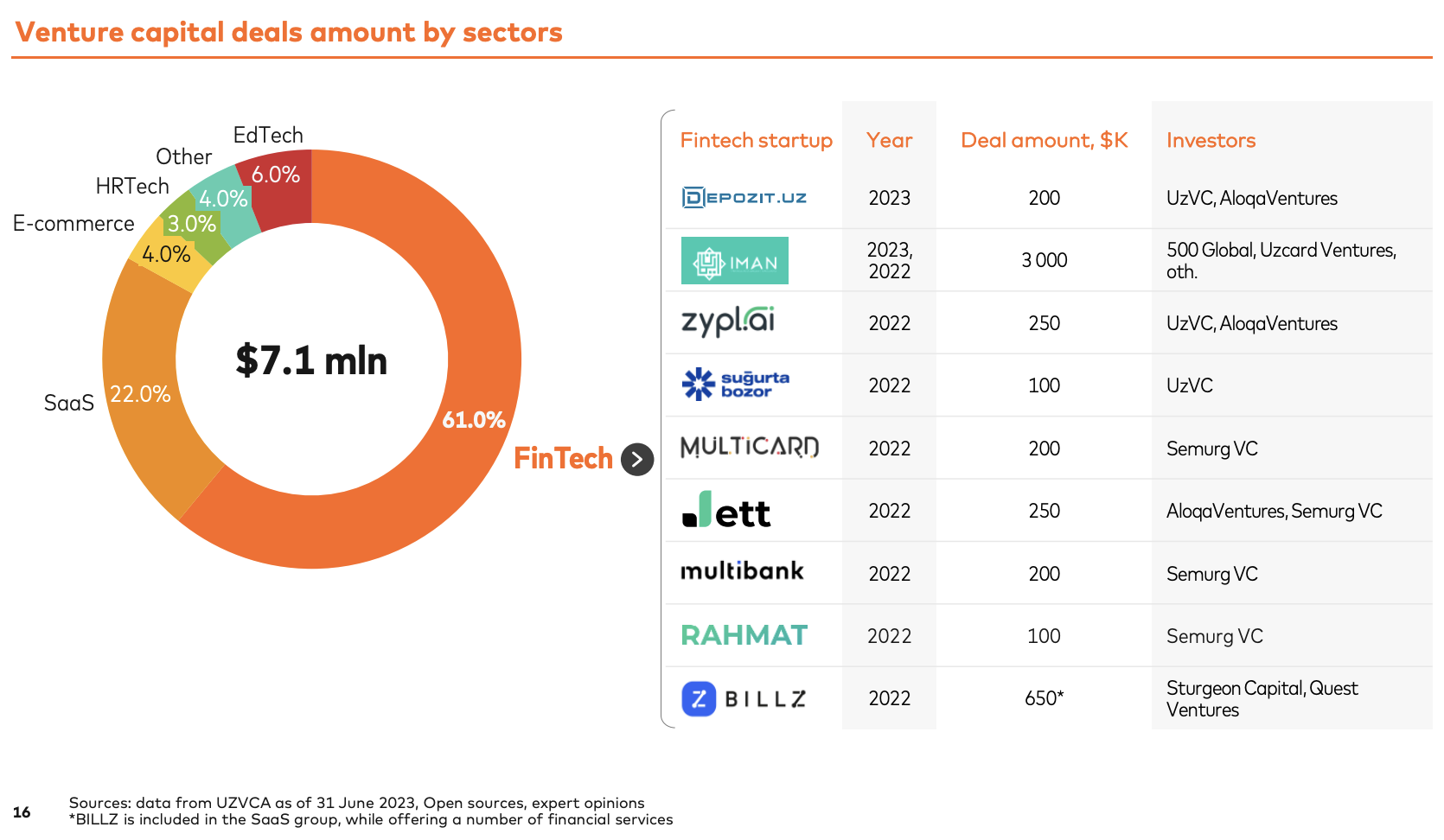

The rise of fintech in Uzbekistan has also been fueled by increased investment in the country’s startup ecosystem. From 2022 to 2023, venture capital (VC) funding in domestic startups totaled US$7.1 million, with 61% of that amount going towards fintech companies.

According to the report, notable fintech rounds secured during that period include a US$3 million round raised by banking infrastructure provider Iman, US$650,000 secured by Billz, a startup that provides easy-to-use tools for retail management; and US$250,000 secured by Zypl.ai, a credit scoring startup.

Uzbekistan venture capital deals by sectors, Source: Fintech Market Uzbekistan, Mastercard, Dec 2023

Uzbekistan’s fintech ecosystem

A fintech landscape map produced by Mastercard as part of the report reveals a dynamic and diverse Uzbek fintech ecosystem. This ecosystem comprises a number of segments including payment, mobile banking, buy now, pay later (BNPL), wealthtech and blockchain, as well as various stakeholders such as industry trade groups, international organizations, startup programs and VC firms.

Uzbekistan fintech ecosystem map, Source: Fintech Market Uzbekistan, Mastercard, Dec 2023

The report also delves into specific fintech trends shaping the landscape in Uzbekistan. Notably, the rise of digital payments is driven by the government’s commitment to financial inclusion and is being fueled by the slow pace of bank digitalization. Notable players in the space include payment company Click, digital services ecosystem Uzum, and online payment service Payme.

Simultaneously, neobanking is experiencing significant growth, serving both individuals and businesses. Digital bank Anorbank, for example, offers a mobile app that facilitates a diverse range of online payments for various services including online card ordering, online credit application and approval, and online deposit account opening. Multibank, a neobanking company, provides a digital solution for micro, small and medium-sized enterprises (SMEs) encompassing banking services, electronic document management and invoicing.

Another key trend outlined in the report is the growing popularity of BNPL services which have become a significant catalyst for e-commerce, offering Sharia-compliant options and swift online installment approvals. Popular options in Uzbekistan include halal installment service Uzum Nasiya, which boasted more than 350,000 customers in April 2023, and ZoodPay BNPL, a product launched in 2019 as part of the Zood digital ecosystem.

Finally, in the digital lending segment, companies like ZoodPay are filling the gap left by traditional institutions, offering digital consumer lending services, while Oasis Microcredit is contributing to the fintech ecosystem by providing SME lending opportunities.

The report also puts the spotlight on rising Uzbek fintech stars, emphasizing the growth of Zood, an ecosystem that combines an e-commerce lending platform (ZoodPay), a marketplace (ZoodMall), delivery and logistics services (ZoodShip), and a digital bank; Marta, a startup that provides mobile acquiring services for small businesses; Billz, an all-in-one store management automatization solutions for companies in retail business; Iman, a digital investment and financing startup; and Sug’urta Bozor, an insurance marketplace.

The Mastercard report concludes that while the Uzbek fintech sector is still small and nascent, the landscape presents numerous opportunities for both local and international players to contribute to the evolution of the country’s financial services sector. This growth will be supported by strategic government initiatives, a conducive regulatory environment and the presence of a burgeoning ecosystem of startups.

Featured image credit: edited from Unsplash

Comments