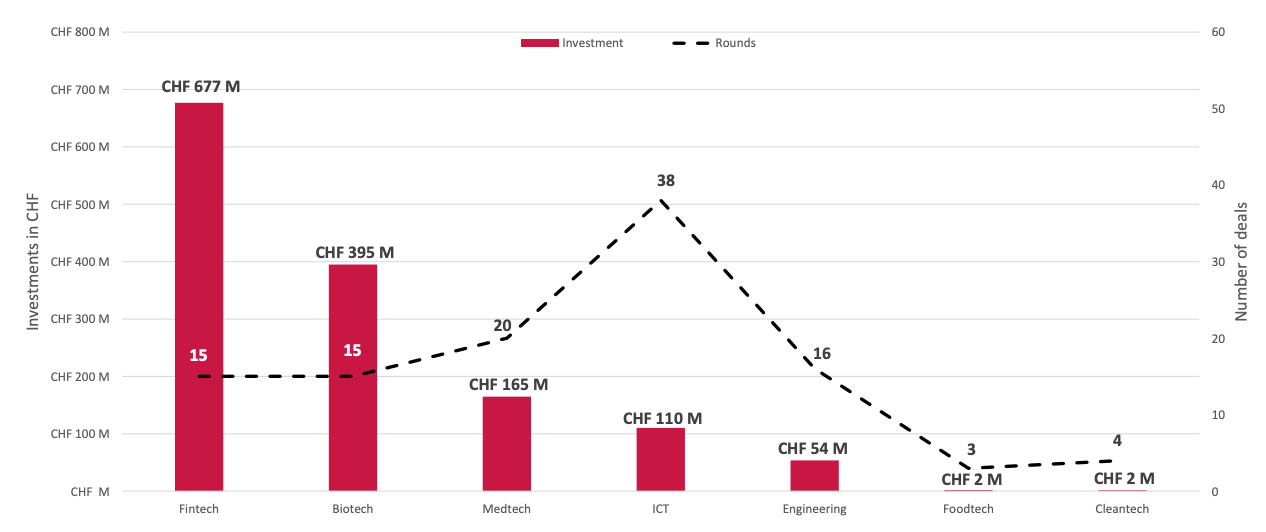

Out of the CHF 1.4 billion raised by Swiss startups in Q2 2021, CHF 677 million, or nearly half of that sum, went towards fintech companies, according to a new report by Startup.ch, Switzerland’s largest startup directory and a leading news platform.

Wefox’s massive CHF 588 million Series C funding round pushed the fintech sector to the top, overtaking biotech and information and communications technology (ICT), two industries that have historically led in venture capital (VC) investment.

Swiss VC funding in Q2 2021 by segment, Source- Swiss Venture Insights Report 2021 – Q2, Startup.ch

The Wefox deal was by far the largest round in that quarter, far ahead of the second largest one (CHF 106 million) which went to medtech company Cequr. It’s the only fintech round that made it into the top ten VC rounds list.

The deal gave Wefox a post-money valuation of US$3 billion and represents the largest Series C to date for an insurtech globally, the company said in its media release.

Wefox, formerly known as FinanceFox, was founded in Switzerland in November 2014. It’s a fully licensed digital insurance company that sells insurance products through intermediaries. In 2020, the company reached profitability and saw its revenue double to US$143 million.

Wefox, which is currently active in Switzerland, Germany, Austria and Poland, plans to use the proceeds from its latest fundraising to expand into the US and Asia within the next two years.

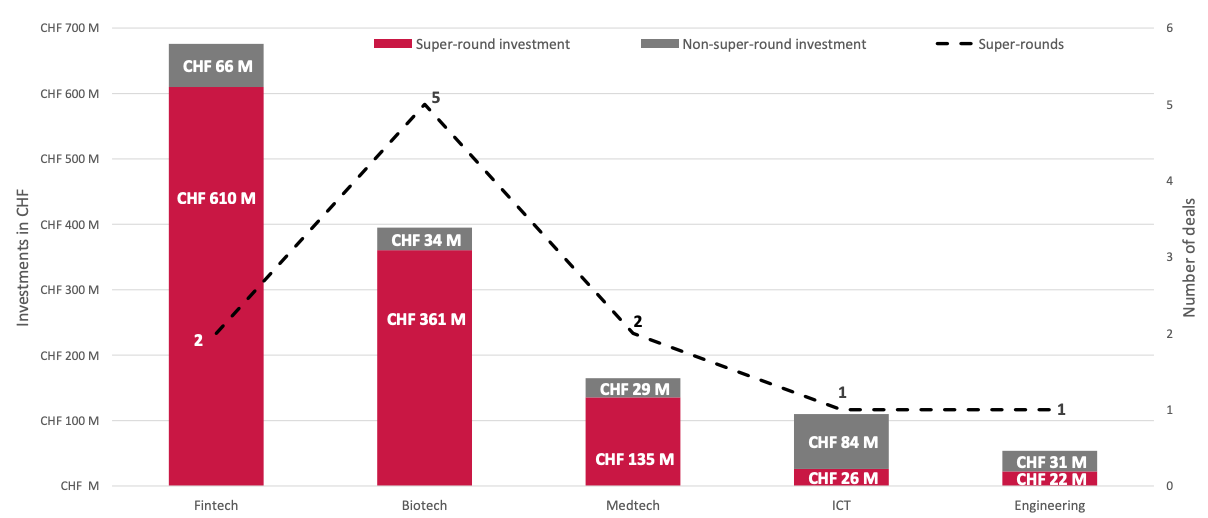

“Super-rounds” of more than CHF 20 million drove most of Switzerland’s VC funding activity in Q2 2021, contributing a total of CHF 1.15 billion through 11 deals, data show. Two of those deals involved fintech companies. Alongside Wefox, the other fintech super-round went towards unicorn startup Numbrs, which announced the closing of CHF 27 million round in January 2021.

Founded in 2014, Numbrs is a personal finance app that allows users to connect their bank accounts, crypto wallets and loyalty cards into one platform to have better view of their finances. As of May 2020, the app had an aggregated of EUR 11 billion in client assets, recorded 2.2 million downloads and had 1.8 million bank accounts linked to it.

Swiss VC super-rounds in Q2 2021 by segment, Source: Swiss Venture Insights Report 2021 – Q2, Startup.ch

Q2 2021 also saw Deutsche Boerse acquiring a majority stake in Swiss digital asset startup Crypto Finance. The US$108 million+ deal sees Germany’s stock exchange operator hold a two-thirds majority in the fintech company, and allows it to extend its offering for digital assets by providing a direct entry point for investments, including post-trade services such as custody, the group said on June 29.

A record year

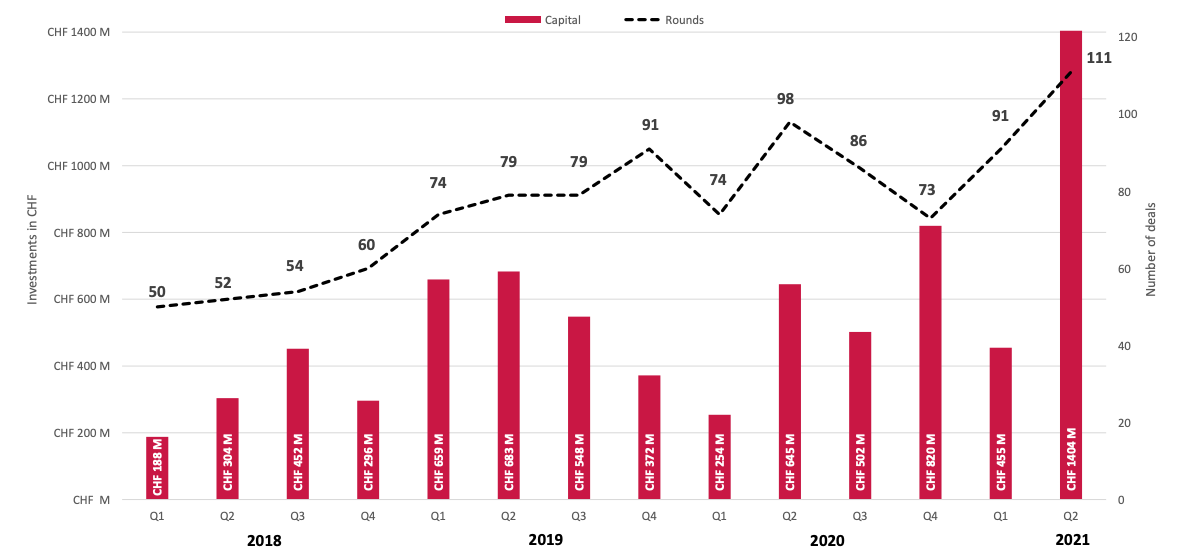

Q2 2021 was a record quarter for Switzerland’s VC funding activity, which grew 118% in volume and 13% in deal count compared to the same period last year.

Swiss VC deal activity from 2018 to Q2 2021, Source: Swiss Venture Insights Report 2021 – Q2, Startup.ch

The trend in Switzerland is consistent with the broader European region where startup investment boomed in H1 2021.

An analysis by Sifted, a Financial Times-backed media site focused on European startups, shows that total funding raised by tech startups in H1 2021 skyrocketed to US$57.5 billion, or three times more than in the same period last year.

For some of those countries, fintech represented a big chunk of their VC funding activity in H1 2021.

Sweden secured some of the region’s largest funding rounds in H1 2021 with buy now, pay later (BNPL) giant Klarna raising two massive rounds of US$1 billion and US$639 million.

In the UK, London-based fintech companies secured US$5.3 billion out of the US$18.8 billion raised by all UK startups in H1 2021, demonstrating the capital’s resilience as a fintech hub post-Brexit. Five of the country’s top ten largest funding rounds came from fintechs: neobank Starling Bank (US$444 million), blockchain startup Blockchain (US$300 million), and payment startups SaltPay (US$478 million), Checkout.com (US$450 million) and Rapyd (US$300 million).

In the Netherlands, online payment company Mollie came neck and neck with enterprise social network MessageBird, both raising US$800 million, the largest deals in H1 2021. And in Germany, neobrokers Trade Republic and Scalable Capital raised two of the ten biggest rounds: US$750 million for the former and US$180 million for the latter.

The post Fintech Takes Lion’s Share in Q2 2021 Swiss VC Funding appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments