Applications of blockchain and distributed ledger technology (DLT) in finance have proliferated in recent years, forcing policy makers around the world to step in and formulate rules in regard to asset tokenization.

In a report released in January 2021, the Organisation for Economic Co-operation and Development (OECD) documents and analyses the range of policy responses to the emerging tokenization market, outlining the main strategies that have been adopted by regulators around the world so far.

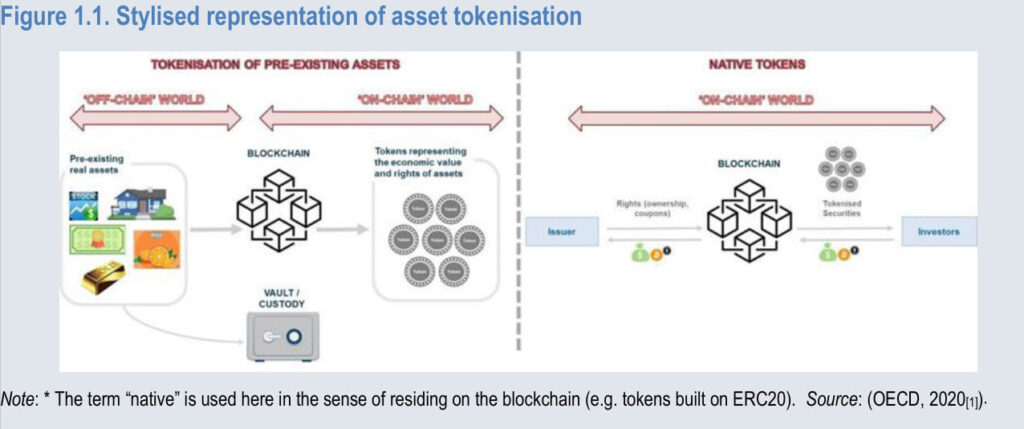

Stylised representation of asset tokenisation, Regulatory Approaches to the Tokenisation of Assets report

A technology-neutral approach to regulating financial services

According to the study, most regulators around the world, including the European Commission (EC), the UK Financial Conduct Authority (FCA) as well as US regulators, have opted for a technology-neutral approach to policies and risks where existing financial regulations are applied to tokenized assets.

Under this principle, the regulatory perimeter and the treatment of financial products and services and activities are not influenced by the technological medium – in this case, blockchain – through which the services or products are provided.

In the European Union (EU), for example, the European Banking Authority (EBA) and the European Securities Market Authority (ESMA) published a report in 2019 that clarified the circumstances under which a given crypto-asset would qualify as a MiFID (Markets in Financial Instruments Directive) financial instrument, and thus be subject to the EU financial securities rules. Crypto-assets with attached profit rights, for instance, are likely to qualify as MiFID financial instrument, implying that firms undertaking activities involving these must comply with EU financial securities rules.

The UK FCA, the Swiss Financial Market Supervisory Authority (FINMA), and the Polish FSA have adopted similar technology-neutral approaches in their policymaking around crypto-assets and tokenization.

Dedicated regulatory frameworks for tokenized assets

Policy makers in other jurisdictions, including France, Luxembourg, Malta, Switzerland and Germany have introduced new, tailored frameworks for tokenized assets and DLT-based markets.

In France, the Blockchain Order of 2017 established a regulatory framework governing the representation and transmission of unlisted financial securities via DLTs.

In Germany, the government passed in December 2020 new legislation allowing all-electronic securities to be recorded using blockchain.

In March 2019, Luxembourg enacted a similar law to the Blockchain Order in France, recognizing that token transfers via blockchain were equivalent to transfers between securities accounts.

In Liechtenstein, the so-called Blockchain Act came into force on January 2020, providing a comprehensive regulatory framework for the tokenized economy.

In Switzerland, some parts of the DLT bill entered into force on February 1, 2021, allowing for the introduction of ledger-based securities represented in a blockchain-based platform. The remaining provisions of the DLT bill will enter into force on August 01, 2021 and will see the introduction of a new authorization category for “DLT trading facilities” among other key regulatory changes.

In September 2020, the EC released a comprehensive package of legislative proposals for the regulation of crypto-assets. The proposed Markets in Crypto-assets Regulation (MiCA) would update certain financial rules for crypto-assets and create a legal framework for a pilot regime for the use of DLTs in trading and settlement of securities.

The new legislation intends to replace national rules to prevent fragmentation across the region and cover all participants in the value chain including crypto-asset issuers, wallets operators and exchanges.

The booming tokenized asset market

The tokenization of assets refers to the process of issuing a blockchain-based token that digitally represents a real tradable asset. The practice came to the forefront with the initial coin offering (ICO) frenzy of 2017 and 2018, but has since emerged as the most prominent use case of DLTs in financial markets.

A research paper by crypto media platform Forkast.news estimates that the tokenized asset industry surpassed US$18 billion in Q4 2020 and was largely dominated by tokenized currencies or so-called stablecoins.

Regulators themselves are exploring the potential of tokenization with sandbox-based and proof-of-concept (PoC) projects such as Project Ubin in Singapore and Project Jasper in Canada.

In Switzerland, Project Helvetia by the Swiss National Bank (SNB), the BIS Innovation Hub and the SIX Digital Exchange (SDX) aims to demonstrate the feasibility and legal robustness of issuing a wholesale central bank digital currency (CBDC) onto a DLT digital asset platform and linking that platform to the existing wholesale payment system.

Phase I of Project Helvetia, which focused on settling tokenized assets in CBDC leveraging the near-live SDX digital asset platform, was completed in December 2020.

The post How Policy Makers Around the World are Addressing Asset Tokenization appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments