Despite its little-deserved reputation as the sleepy corner of financial services, insurance can be a disorientating industry to work in as Insurers and Insurtechs alike contend not just with cyclical adjustments but massive seismic shifts in the business.

Low interest rates continue to constrain carriers’ investment profits, while, in our globalising and increasingly interconnected societies, risks are becoming trickier to understand and price. Meanwhile, the growth of digital distribution – in financial services and much more broadly – is driving a far-reaching re-evaluation of the insurer-customer relationship. And, as every challenge is also an opportunity, we find Insurtechs and outside-of-industry players waiting on the wings.

29% of (re)insurers report losing market share to new entrants…

With the industry at a crossroads, Insurance Nexus set out to comprehensively map the state of insurance in 2017. After 50 interviews with the industry’s leading influencers and an international survey attracting over 1000 responses, the Insurance Nexus Global Trend Map is finally ready and available to download free of charge.

Get your copy of the Insurance Nexus Global Trend Map here

Contributing to the Trend Map are representatives of fifteen major (re)insurers, brokers, associations, VCs and, of course, Insurtech, with insights from Spiros Margaris, Cindy Forbes, Sabine VanderLinden, Charlotte Halkett, Matthew Josefowicz, Steve Tunstall, Stephen Applebaum and others.

In this brief intro we highlight, through a range of stats, the overarching themes of the Trend Map: low interest rates, the complexification of risk and insurers’ overwhelming move towards customer-centricity.

The majority of carriers have diversified their investment portfolios in the face of low interest rates…

Cutting across all the world’s insurance markets are the low interest rates that have endured since the 2007/8 financial crash. The poor investment climate this creates is forcing carriers to seek higher underwriting margins, which is difficult in today’s soft market where excess competition is putting strong downwards pressure on premiums. This is driving investment into new technologies, such as robotics and analytics, many of which are essential not just for cost-cutting but also to deliver the service levels demanded by today’s ever more demanding customers.

The top three 3rd-party service types for carriers are: Digital Innovation, Analytics and Internet of Things…

On top of adverse market conditions, we also point towards the steady complexification of risk: the world is moving fast for people and businesses alike, hastening us towards a more turbulent, less predictable future. We need look no further than the ballooning global population and the ongoing shift towards megacities to see that the future will bring higher pollution levels, increased political instability and greater movement of people; in these circumstances, existing liability classes will likely become more problematic, with greater accumulation risk.

Commercial currently trails other insurance lines on IoT platform implementation…

The above consideration applies also to global supply chains, which come with numerous points of failure and ample chaos potential. IoT can expedite risk management and mitigation in this field, although it is early days for the technology still.

Providing adequate cover to enterprises is becoming harder, due to the volume of customer data in play and the proliferating attack vectors (especially through IoT). Cyber incidents and data breaches are rising year on year (take this year’s high-profile Wanna Decryptor and Petya ransomware attacks), so Cyber represents a massive, albeit challenging, new product opportunity. At the same time though, insurers must ensure they keep their own shop in order from a security perspective.

75% of carriers are confident they are adequately protecting customer privacy & data security…

As the nature of risk evolves, and the insurance market and interest rates move through their time-honoured cycles, the ground on which carriers fight is changing. This is not all though; the way they fight must change too. If we had to pick, the overriding theme throughout the Trend Map, regardless of the specific topic under discussion, would be: customer-centricity.

Only 45% of (re)insurers believe their organisations are truly customer-centric…

The advent of digital channels has broken what was formerly a captive market wide open, fuelling competition both among incumbents and from new entrants. Especially in the personal lines, insurance customers can easily shop around – and if they don’t like the prices, the products or the services offered by their existing insurer, they can easily churn to another.

Nearly three quarters of insurers have a direct-to-customer offer…

Today’s customers expect strong digital offerings from all their brands, and financial services are no exception. The impact of digital far exceeds raw sales figures given consumers’ widespread use of multiple touchpoints across their research and buying cycle – so, in addition to being available both online and face-to-face, today’s insurers must also be consistent across these channels.

Customer experience (CX) in claims is ‘very important’ for over two thirds of carriers…

Positive customer experience starts with marketing and distribution but encompasses the entire customer journey, from underwriting through to claims and renewals. The stakes are particularly high with claims, where positive customer experiences, regardless of outcome, can count double.

So what insurance paradigm do we see emerging in response to these industry pressures? Broadly speaking, we are moving towards usage-based models wherein client and insurer are ‘risk partners’ and it is in each party’s interest to share as much information with the other as possible, so as to work together proactively to reduce exposures.

So what insurance paradigm do we see emerging in response to these industry pressures? Broadly speaking, we are moving towards usage-based models wherein client and insurer are ‘risk partners’ and it is in each party’s interest to share as much information with the other as possible, so as to work together proactively to reduce exposures.

32% of insurers have Usage-Based Insurance (UBI) strategies…

Personalisation, especially on price – an area naturally fraught with regulatory hurdles – is as much a part of customer-centricity as consistent, positive experiences across channels, and this all goes together with insurers’ quest for lower-cost operating models. AI, IoT and Blockchain all have roles to play realising this new model.

28% of carriers are using machine-learning/AI…

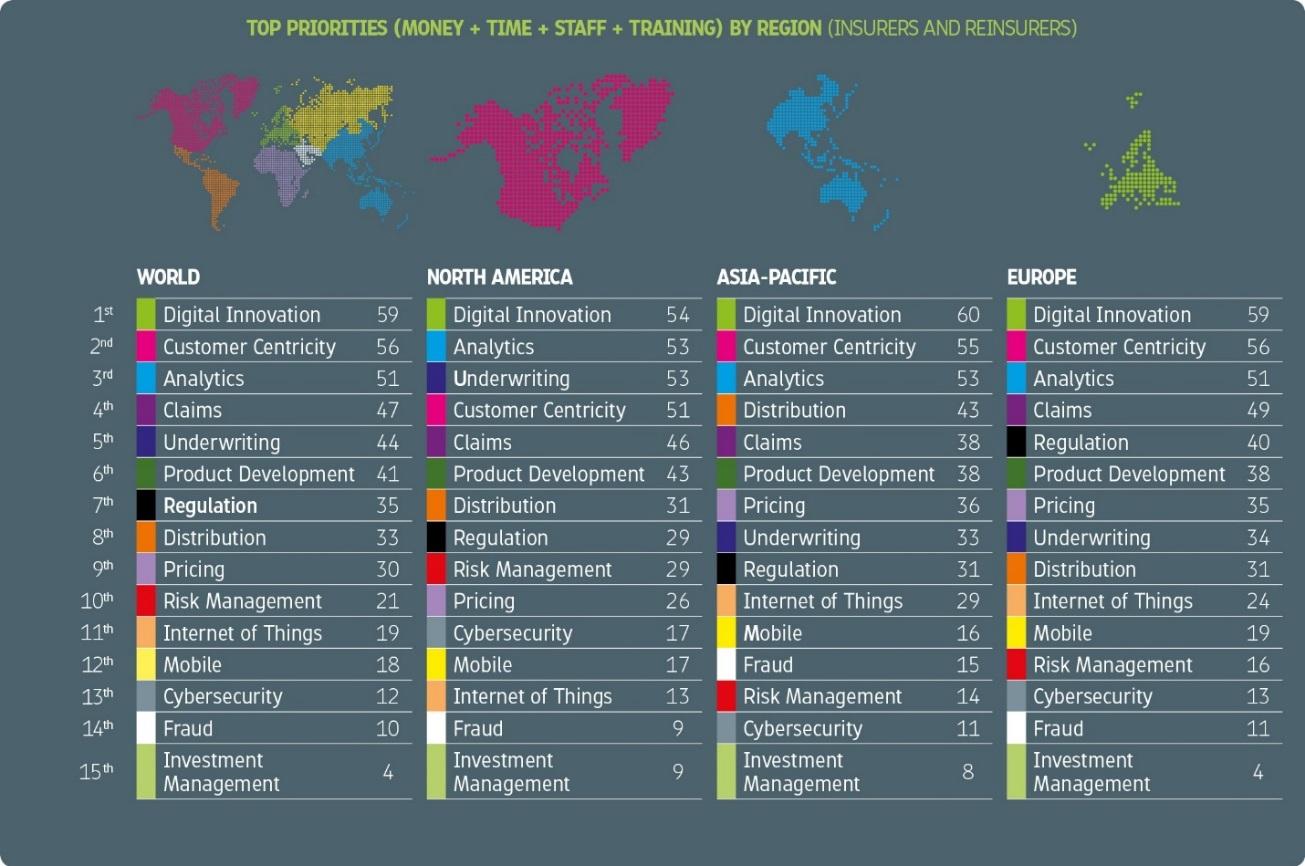

In addition to covering the ‘megatrends’, the Trend Map addresses functional and technological developments across all the world’s major regions, through a blend of influencer commentary, industry analysis and shareable infographics.

The post Introducing the Insurance Nexus Global Trend Map appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments