Initial coin offering (ICO) has surge in popularity in the cryptocurrency world as an effective method for blockchain startups and projects to quickly and easily raise funding by distributing a percentage of the initial coin supply.

According to CoinDesk, US$103 million was raised in 2016 through 64 ICOs. Notable ones that year included Iconomi, which raised US$10 million, Waves at US$15.9 million, and SingularDTV at US$7.5 million.

But the ICO craze has also sparked concern among experts who warn that the lack of transparency around the issuance of cryptocurrencies is a concern for both investors and regulators. The US Securities and Exchange Commission is reportedly taking a hard look at the phenomenon.

The overall value of the cryptocurrency market is estimated at over US$90 billion. Critics have likened the phenomenon to the dotcom bubble in the 1990s.

Another startup that raised funding in 2016 through an ICO is Lykke, a Swiss startup seeking to disrupt the retail trading market using blockchain technology to enable near instant settlement and lower costs.

The company ran an ICO that raised 1.161 million CHF through the selling of over 23 million Lykke Coins (LKK) to some 700 investors. On this time ICO were not yet that popular and it took quite a while until they got the funding.

Lykke Coins are currently trading at around 0.37 USD/LKK for a market capitalization of 60 million USD, a 640% increase compared to the price in April of 0.05 USD/LKK. But globally still not many know Lykke, Probably as they have with Richard Olson a Swiss founder, the Swiss mentality is deliver first, then speak.

Lykke is building a global marketplace where users are able to trade all classes of financial instruments issued in the form of Colored Coins, a technology that allows to associate real world assets with addresses on the Bitcoin network.

Lykke is building a global marketplace where users are able to trade all classes of financial instruments issued in the form of Colored Coins, a technology that allows to associate real world assets with addresses on the Bitcoin network.

By leveraging blockchain technology, Lykke provides users direct ownership and immediate settlement. The Lykke Exchange doesn’t charge any commission fee.

The exchange currently lets users trade conventional currencies such as CHF, EUR, GBP and USD, as well as cryptocurrencies including Bitcoin, SolarCoin, WorldView and Chronobank’s Time token.

New: Trade Ether or a Student via Lykke

Lykke added ether trading earlier this month. Ether (ETH), the cryptocurrency of the Ethereum network, is the world’s second largest cryptocurrency with a market capitalization of 31 billion USD. Ether is currently trading at 344 USD/ETH, a 2,193% increase compared to the price in March of 15 USD/ETH.

Lykke has also deployed offchain settlement at Lykke Exchange. Offchain settlement allows for even cheaper and faster settlement time. In the process, counterparties freeze funds as a collateral on the blockchain and provide so-called “commitments” to each other. When both parties agree to the terms of the new trade then commitments are updated. Commitment transaction can be broadcasted at any time on the blockchain to get frozen funds back and close the channel.

Also now in theory even student loans can be settled via Lykke. Swiss based Splendit announced a partnership to settle via Lykkes Blockchain. This means thanks to this partnerhisp Splendit will be able also to finance students in other countries as Switzerland.

This examples shows in the future nearly everything might be traded and settled via the Lykk Platform

The company further announced that by end of summer, Lykke will be an ERC20-token wallet and will be able to engage with all smart contracts on the Ethereum blockchain.

These include for instance much-popularized Gnosis, a prediction market, Aragon, a platform that creates software and solutions to manage companies, and Golem, a project that aims to create a global decentralized market for computing power.

In Europe, Lykke is currently applying for a European Investment Firm (CIF) license and an Electronic Money Institution license for its subsidiary in Cyprus.

In Singapore, Lykke is in the final stages of choosing legal council to assist it with Singapore regulatory applications and enable it to launch “a fully tokenized securities exchange.”

“This would allow us to handle security related ICO/ITOs as well as provide a venue for secondary trading,” the company said.

Lykke is working on adding margin trading to the Lykke Exchange.

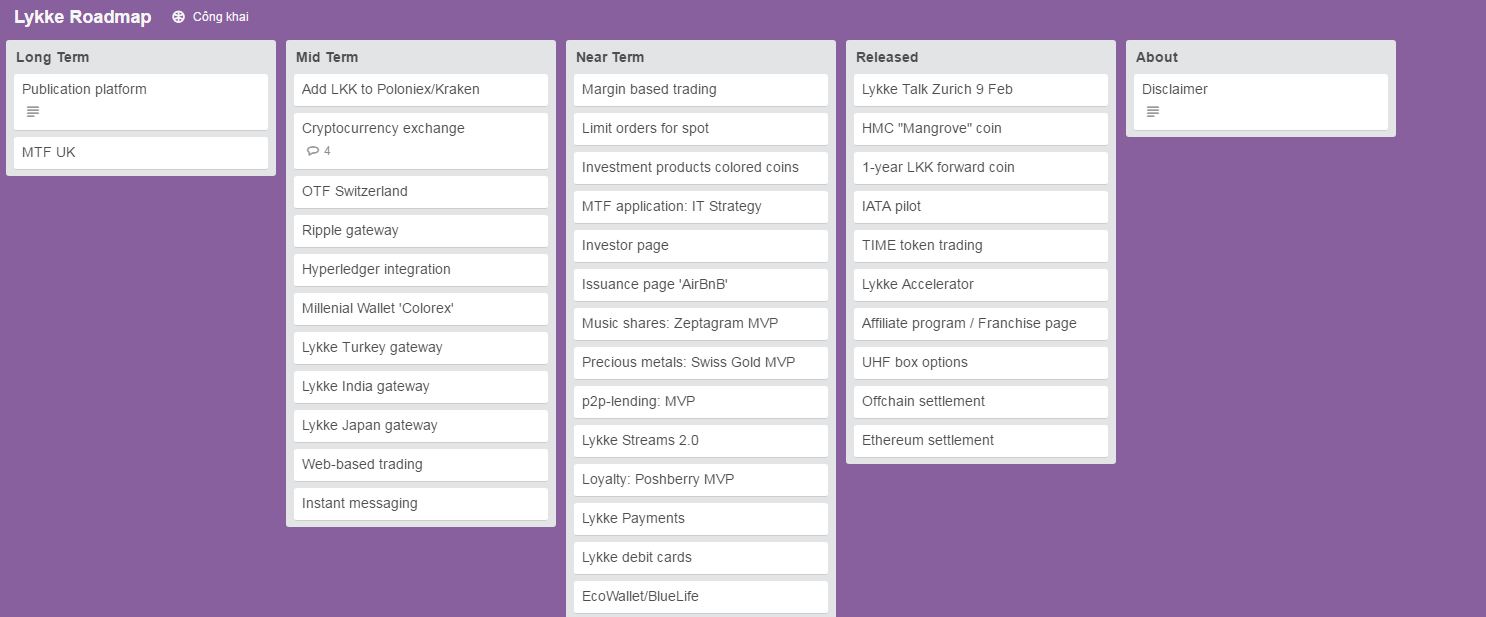

Lykke Road map:

Source: Trello

The post Lykke, the Undiscovered Coin Made in Switzerland appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments