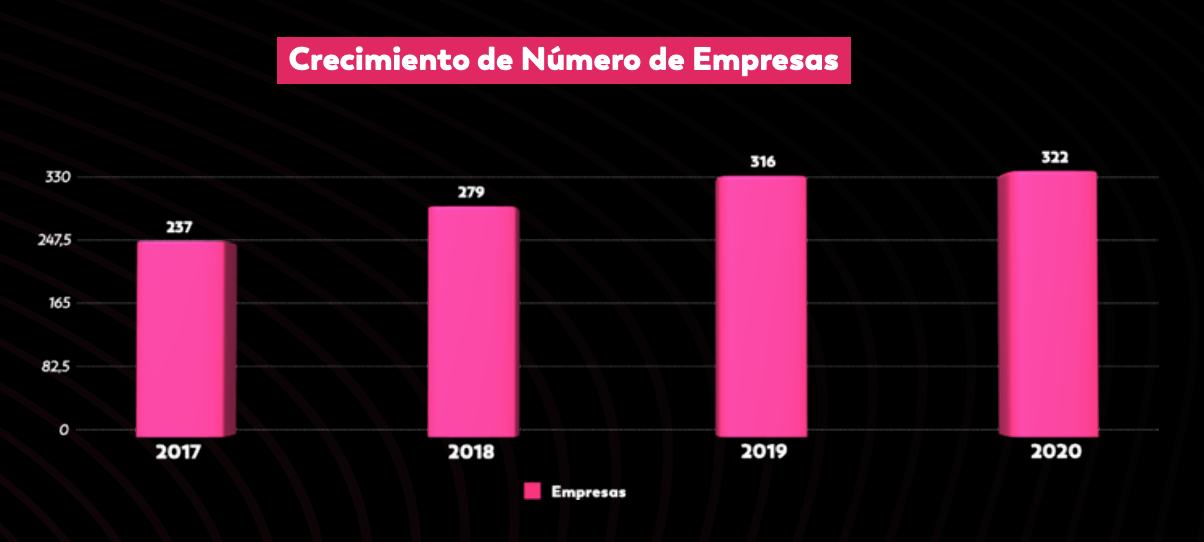

Colombia’s fintech sector is growing at a fast pace with now more than 320 companies operating in various segments ranging from online lending and digital payments, to business finance and wealthtech. This makes Colombia the third largest fintech hub in Latin America (LatAm) after Brazil and Mexico, according to a recent report by industry trade group Colombia Fintech.

The figure represents a 37% increase in the number of fintech companies since 2017. Though growth slowed down between 2019 and 2020, recording just a shy 2% rise, Erikc Rincon Cardenas, the president of Colombia Fintech, believes that the 2020-2021 period should see a new boom in fintech activity as COVID-19 forces businesses to move online, he told local business newspaper La Republica.

The global pandemic has driven a rise in innovative, technology-enabled business models, he said, and many were not formalized in 2020. The surge should be reflected in the coming year’s report.

Number of fintech companies in Colombia (2017-2020), Source: Informe Sectorial Fintank 2020, Colombia Fintech, 2021

Jose Manuel Ayerbe, vice president of corporate marketing at Grupo Aval, one of Colombia’s largest financial groups, told the media outlet that the fintech ecosystem is rapidly expanding and emerging as one of the key drivers of the country’s development. He noted that over the past year, the digital banking sector has recorded a strong 59% growth rate.

Digital payment is another area that has witnessed significant traction with COVID-19. Diego Navarro, director of Mercado Pago Colombia, an e-commerce and digital payment specialist, said that digital payments have helped improve financial inclusion, mentioning that in Q1 2021, online payments grew triple digits, while QR code payments surged five times.

According to Colombia Fintech, investors have poured more than US1 billion into fintech companies in the past three years, US$300 million of which came during the first five months of the pandemic.

So far, the fintech industry has created about 9,300 new jobs, the Colombia Fintech report says, and the 2019-2020 period saw a significant increase of 38% in new jobs creation. This rise can be explained by booming demand for digital financial services and a need to strengthen business capabilities with new hirings, the report says.

Fintech jobs growth in Colombia (2017-2020), Source: Informe Sectorial Fintank 2020, Colombia Fintech, 2021

Growth in demand for fintech solutions is also reflected in providers’ sales, which totaled US$540 million in 2019, up 29% from 2018, and 54% from 2017, the report notes.

Colombia fintech sales growth (2017-2019), Source: Informe Sectorial Fintank 2020, Colombia Fintech, 2021

A closer look at Colombia’s fintech industry

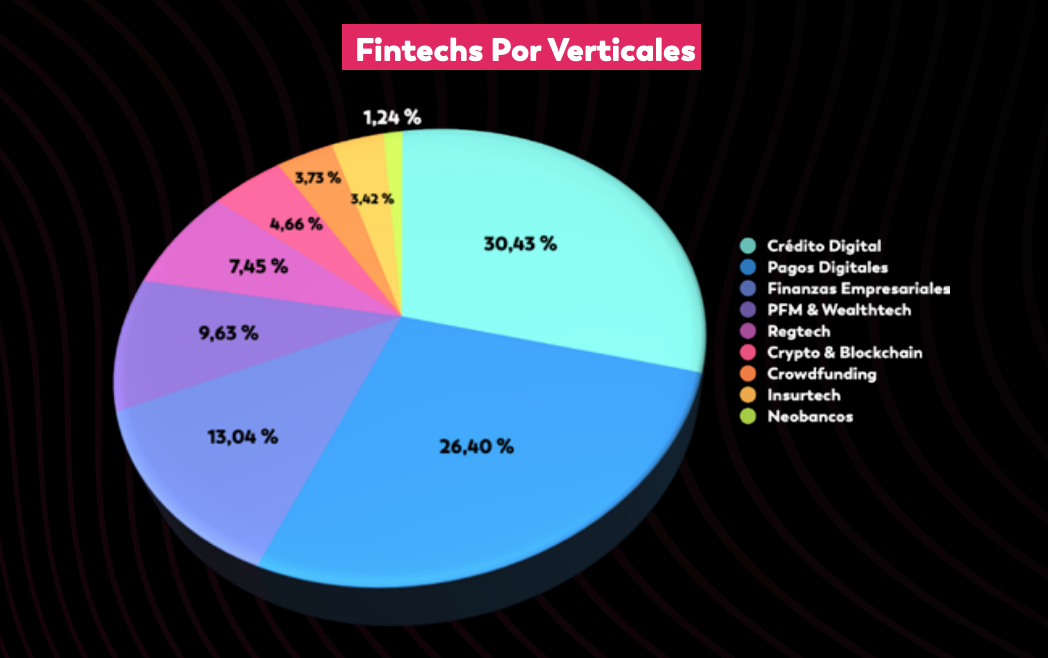

In Colombia, online credit is the most developed and crowded fintech segment, making up for 30% of fintech companies. Key players in the space include Rapicredit, which recently reached the milestone of one million loans granted to individuals, as well as Sempli, which provides small and medium-sized enterprises (SMEs) with working capital.

Last year, Sempli expanded its portfolio of products, adding Sempli Business, a virtual credit card for startups and SMEs in Colombia, as well as insurance products for businesses.

After online lending, digital payment is the second most developed fintech segment, representing 26% of all companies. The category includes players such as Puntored, which provides financial transactions services including payment, withdrawal, deposit, and virtual services through a nationwide network of partners, and Tpaga, a mobile wallet specialized in payroll payments.

Colombian fintechs per vertical, Source: Informe Sectorial Fintank 2020, Colombia Fintech, 2021

Movii is another fast-growing Colombian fintech startup. Founded in 2018, Movii is an online banking platform offering mobile payment services, third-party services, and a prepaid debit card. It’s the first provider in the country to offer 100% digital financial services and is amongst the first fintechs to be granted a Specialized Electronic Deposit and Payment Institution (SEDPE) license, according to business news outlet BNamericas.

Movii serves 1.5 million customers but projects it could reach 3.2 million users by the end of this year based on the current growth spurt.

Buy now, pay later (BNPL) startup Addi has also started picking up steam, growing over five times since the beginning of the year. In May 2021, the company raised a US$35 million Series B funding round and US$30 million in debt funding to fuel its expansion into Brazil where it launched earlier this year.

Colombia has been amongst the most proactive jurisdictions in LatAm when it comes to fintech regulation. It was the first country in the region to launch a regulatory sandbox, allowing startups to experiment with new business models under relaxed rules and requirements.

It also offers a special certificate for fintech companies to operate temporarily under minimum requirements before they can obtain a full license.

Featured image: Photo by Jorge Gardner on Unsplash

Featured image: Photo by Jorge Gardner on Unsplash

The post Momentum Continues in Colombia’s Fintech Ecosystem appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments