Neobanks and digital banks have set new standards in customer experience and expectations, pushing incumbents to get out of their comfort zone and innovate. After accumulating an estimated 39 million users worldwide, neobanks are now coming after the next generation, launching child- and teen-focused offerings.

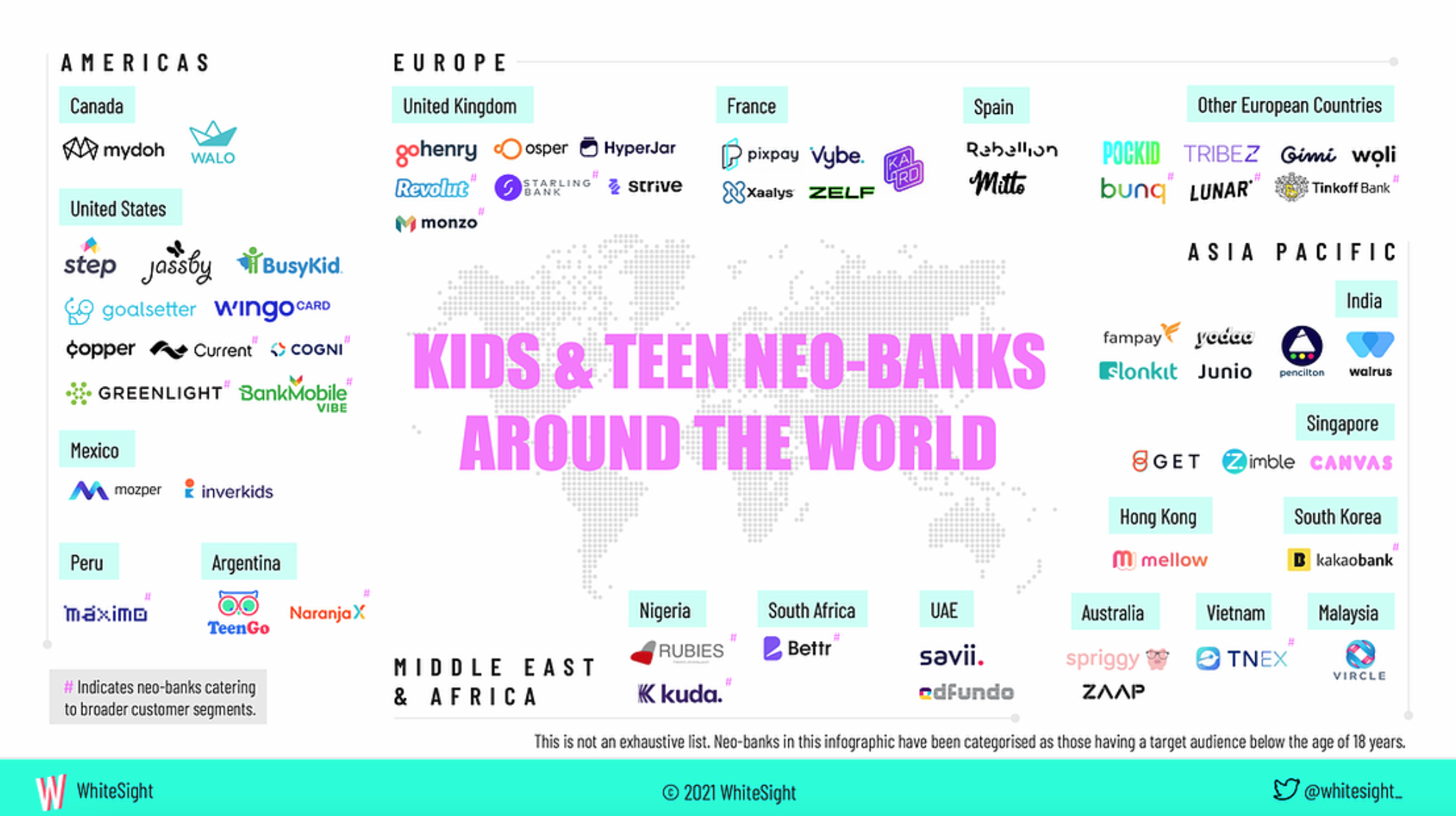

Fintech intelligence startup WhiteSight identifies more than 50 neobanks providing products and services targeted at an audience below the age of 18 years old. The group includes over 40 ventures that focus solely on children and teenagers. The rest cater to broader customer segments but have launched kids-focused digital offerings. These include Current (USA), Naraja X (Argentina), Revolut (UK), Lunar (Denmark), Kakao Bank (South Korea) and Bettr (South Africa).

Kids and teen neobanks around the world, Source: WhiteSight, 2021

Europe leads the world with nearly half of all of child-focused neobanking startups based in the region. Providers include Gimi (Sweden), Go Henry (UK), Kard (France), Osper (UK), Pixpay (France) and Xaalys (France).

Gimi is an app that teaches children and young adults about money. It counts some 1.2 million users globally. Pixpay offers a digital bank card for 10-18 year old teenagers that is managed by their parents.

Kard is a mobile banking alternative for the new generation, providing teenagers with a bank account, an IBAN and an accompanying Mastercard debit card. Kard raised EUR 3 million in September 2020, bringing the total amount of money raised by the startup to EUR 6 million.

In Asia Pacific (APAC), there are Mellow, a mobile platform from Hong Kong for parents to teach kids how to build money habits, FamPay, which claims to be India’s first neobank for teenagers, and Zimble, a rewards-based pocket money platform for parents and children up to 18 years of age from Singapore.

In the Americas, players include Mydoh and Walo from Canada, Jassby, BusyKid and Wingocard from the US, and Mozper from Mexico. In the United Arab Emirates (UAE), there is Savii, a digital bank account for teens.

These neobanks are surfing on the hyper-personalization trend. Hyper-personalization refers to the use of real-time data and cutting-edge technologies like artificial intelligence (AI) to deliver more relevant product or service information to users.

Fintech companies and neobanks are already at the forefront of this trend, especially those targeting true digital natives and younger generations.

In Spain, Mitto is a neobank focused on teens and young adults. It offers a carbon footprint measuring tool that tracks the CO2 impact of user’s purchases and compares it with that of their friends. Mitto rewards sustainable shopping with cashback. Mitto launched in Spain in 2019 and brought on about 80k users. The startup is reportedly looking to launch in the UK and the rest of the Eurozone later this year.

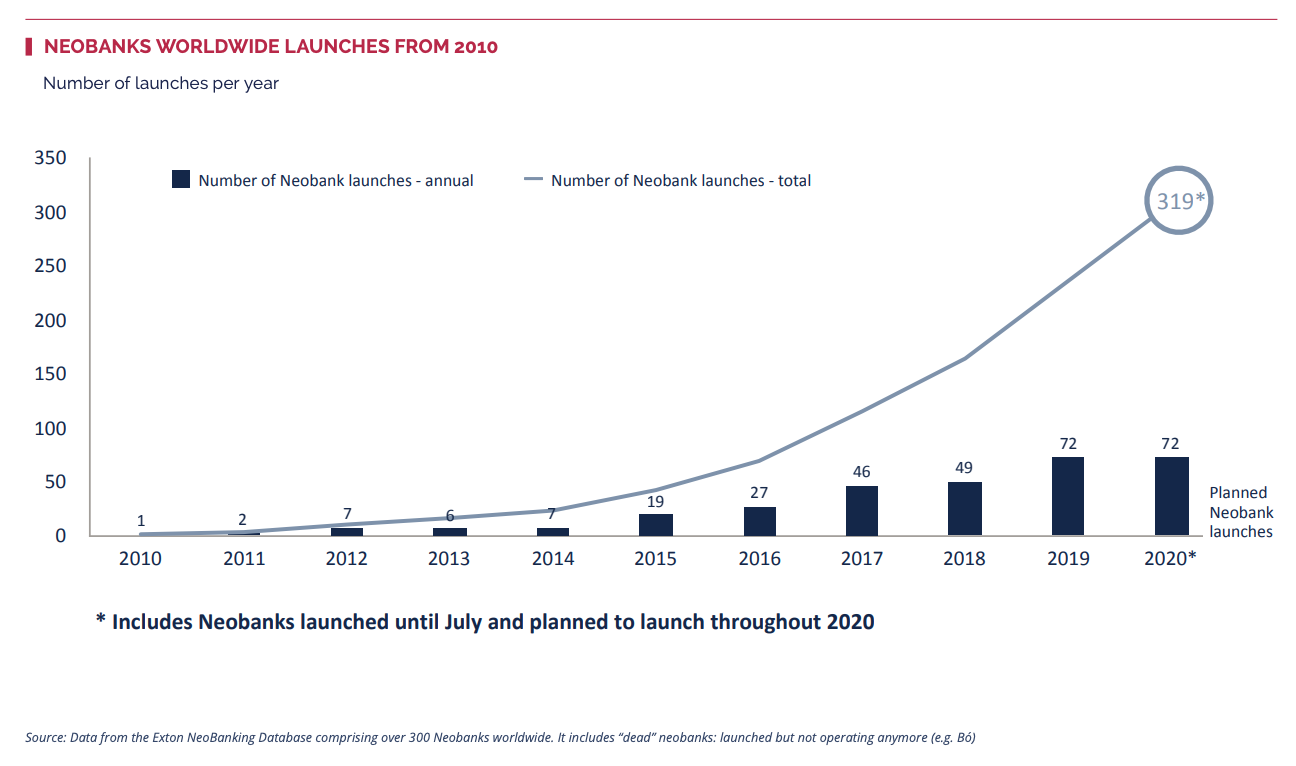

Neobanks have ballooned in number. The number of neobanks worldwide has more than tripled since 2017, surging from 100 to now more than 300, according to Exton, a consultancy firm which manages a global database of consumer banking apps.

Neobanks worldwide launches from 2010, Source: Exton, Jan 2021

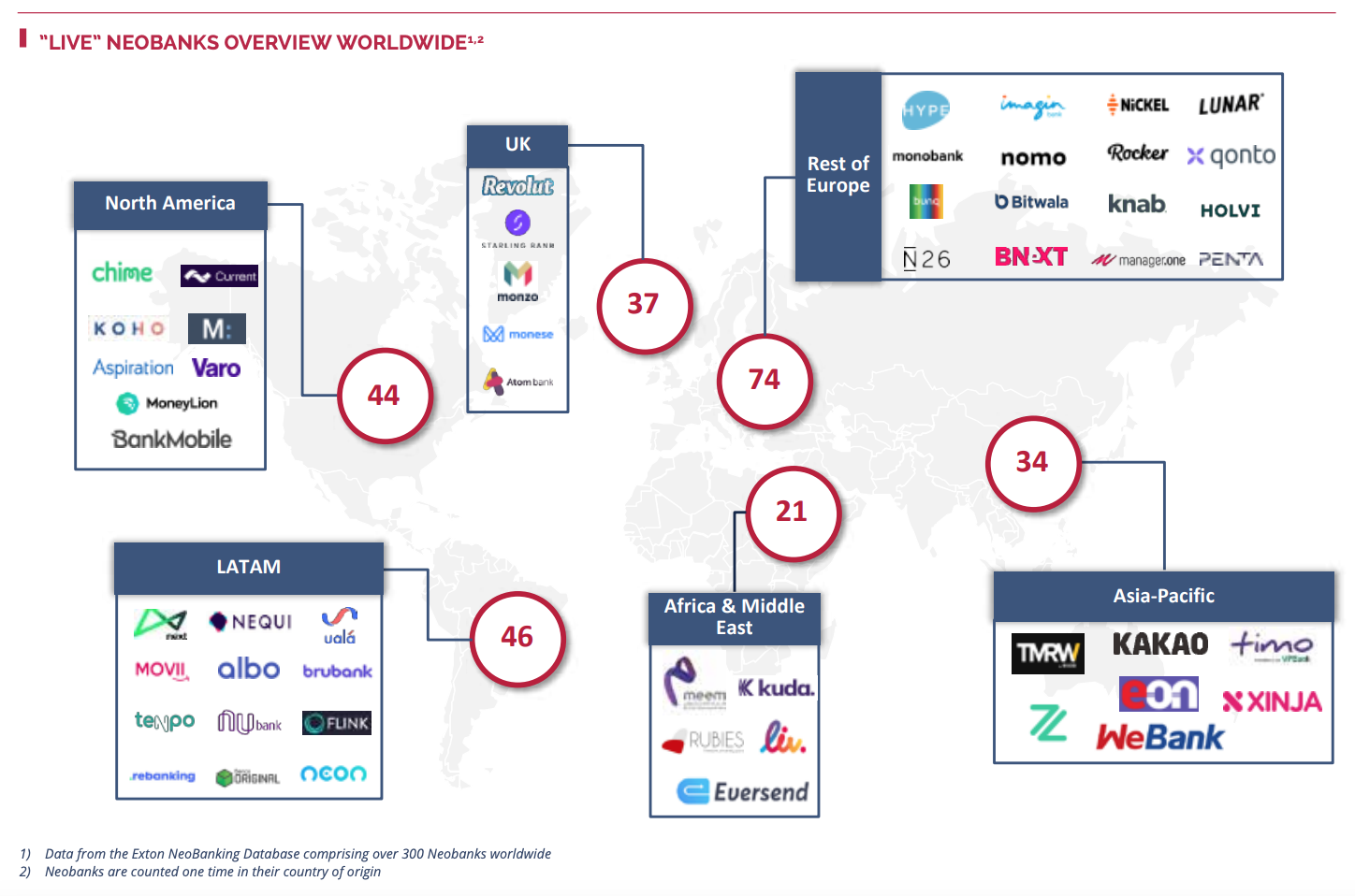

Europe, the birthplace of neobanking, is the world’s largest neobanking hub with 111 players. The region is followed by the Americas with 90 neobanks, APAC with 34, and Africa and the Middle East with 21.

Live neobanks overview worldwide, Source: Exton, Jan 2021

The post Neobanks Come for Kids and Teens appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments