Portugal’s fintech ecosystem continued to grow and mature in 2020 with several new developments including the establishment of fintech hub Fintech House as well as the release of the framework for a regulatory sandbox.

Committed to supporting the development of a healthy fintech ecosystem, the government has set out plans to launch regulatory sandboxes. In April, the country’s Council of Ministers published the framework for a sandbox which will test emerging technologies including artificial intelligence (AI), blockchain, big data and 5G.

“The objective is to create a legislative framework that promotes and facilitates research, demonstrations and testing activities, in a real environment of technologies, innovative products, services, processes and models, in Portugal,” André de Aragão Azevedo, Secretary of State for Digital Transition, told industry trade group Portugal Fintech.

There are also plans to introduce so-called Technological Free Zones (ZLTs), which will have tailored regulatory regimes for each sector or industry, de Aragão Azevedo explained. ZLTs are part of Portugal’s Digital Action Plan that seeks to create a favorable environment for innovation and strengthen Portugal’s economic competitiveness.

“This measure … will help promote Portugal’s positioning in research and development (R&D), national resources and the participation in international projects, as well as the attraction of innovative projects and investment related to emerging technologies,” he said.

Portugal Fintech Report 2020: survey findings

The interview of de Aragão Azevedo was conducted as part of the Portugal Fintech Report 2020, an annual report which shares industry statistics, trends and experts insights.

This year’s survey found that the Portuguese fintech startup landscape is rather young with 42% of fintech companies founded in 2018 or later. 56% are either in pre-seed or seed stage.

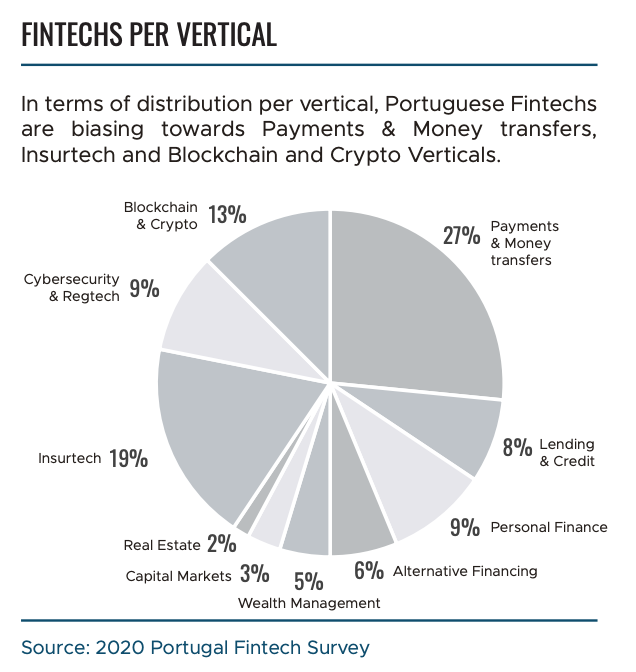

The research also found that payments and money transfers is the most developed fintech segment, representing 27% of all fintech startups in the country. Payments is followed by insurtech (19%), and blockchain and crypto (13%).

Fintechs in Portugal per vertical, Source: 2020 Portugal Fintech Survey, Portugal Fintech

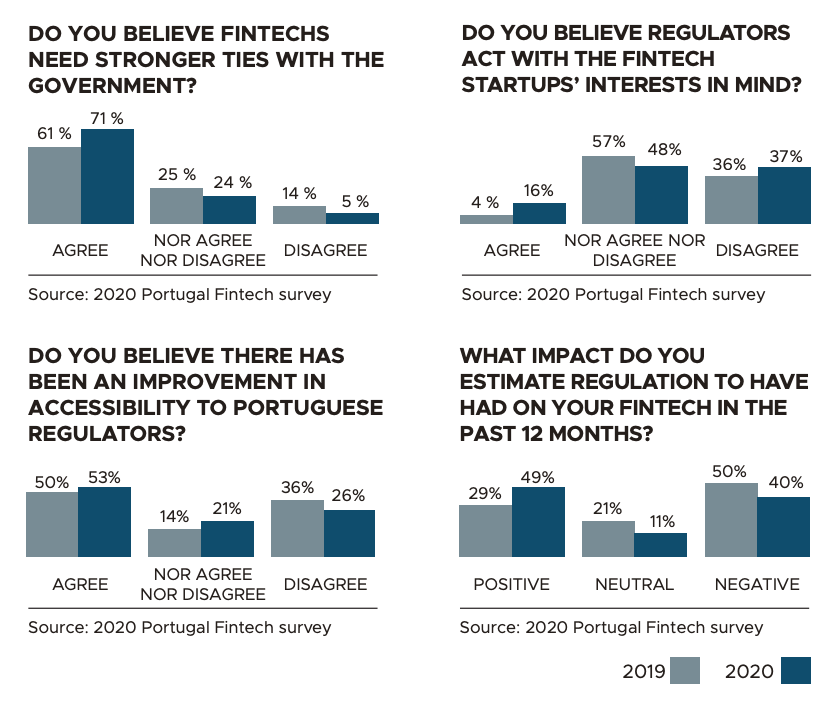

The survey, which asked fintech startups their views on the regulatory landscape, found that although fintechs believe efforts have been made to improve accessibility to regulators over the past year (53% in 2020 compared to 50% in 2019), a majority feels like there needs to be stronger ties between the sector and the government (71% in 2020 compared to 61% in 2019).

While in 2019 half of respondents felt like regulation had had a negative impact on their business, this year’s results showcase a more positive sentiment in this regard, with 49% stating that regulation has had a positive impact on their business over the past 12 months.

Policy and regulation, Source: 2020 Portugal Fintech Survey, Portugal Fintech

7 emerging Portuguese fintech startups

The report names seven emerging Portuguese fintech startups to watch for. These were all founded in 2020 and operate across various segments including human resources and employment benefits, insurtech, wealthtech and blockchain.

Swood, for example, provides a platform for companies to manage employment benefits. Finlayer is developing a wealth management software-as-a-service solution for managers, securities agencies and financial advisors.

In insurtech, Lifin provides customers with self-service insurance policies. Subscriptions and claims are done entirely digitally though the Lifin platform. Meanwhile, startup P4lpro is targeting brokers and insurance companies with an all-in-one platform that comes with customer relationship management (CRM), marketing, sales and business tools.

In blockchain and crypto, three startups made the list, including CodingLibra, a business-to-business (B2B) software development company that develops digital asset solutions for institutional clients, Revault, a Bitcoin security company specialized in custody software and integration for institutions, and ImpactMarket, an open crowdfinance infrastructure targeting vulnerable communities including refugees and impoverished populations.

Featured image credit: Unsplash

The post Portugal’s Fintech Industry Continues to Grow and Mature on the Back of Favorable Regulation appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments