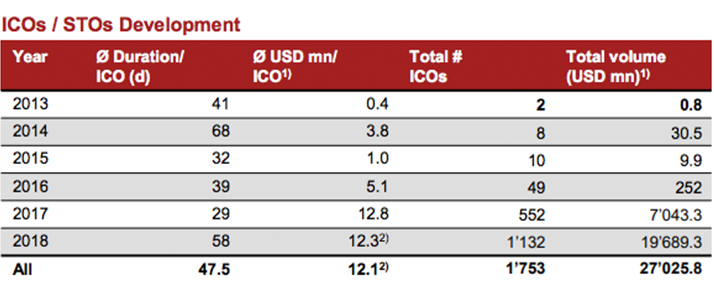

In 2018, 1’132 Initial Coin Offerings (ICO) and Security Token Offerings (STOs) were successfully completed, twice as many as in 2017 (552 in total) – as shown in the fourth ICO / STO report by PwC Strategy in collaboration with Crypto Valley Association (CVA).

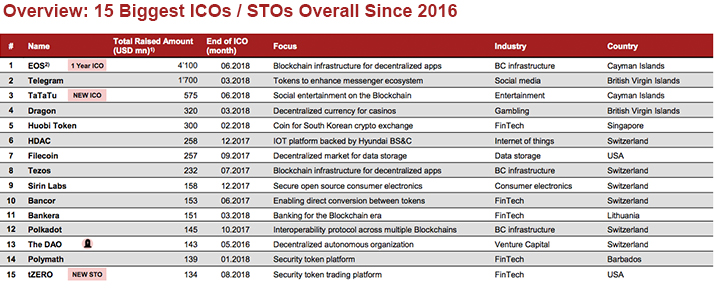

After crypto-crowdfunding continued its growth course in early 2018 and reached the total volume of the previous year in March 2018, the number and volume declined considerably in the second half of the year. Two startups, EOS and Telegram, have generated a combined 5.8 billion as so-called “unicorns”.

After crypto-crowdfunding continued its growth course in early 2018 and reached the total volume of the previous year in March 2018, the number and volume declined considerably in the second half of the year. Two startups, EOS and Telegram, have generated a combined 5.8 billion as so-called “unicorns”.

New token models are gaining momentum

The continued decline in value of digital currencies by the end of the year has led to a state of so-called “crypto-winter” in the global crypto community. However, the declining investment volumes were not only caused by the valuation of digital currencies.

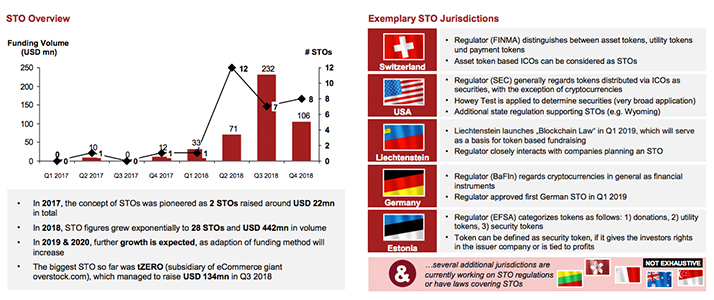

STOs are gaining popularity in the cryptocurrency industry. Although, STOs as token offerings for securities and rights in rem are not fundamentally different from ICOs, they are a more regulated version of it. STOs combine many features of ICO such as low entry barriers for investors as well as traditional VC/PE fundraising characteristics, e.g. regulations based on local security laws including KYC/AML.

In addition to securities, there is a trend towards tokenization of assets like commodities (gold, oil, etc.) and the tokenization of intangible goods (e.g., music rights).

The regulatory landscape and infrastructure must “level up”

Swiss FINMA has addressed the topic of tokenization early on and differentiates between payment, use and investment tokens.

In addition to increased protection, market participants demand new services such as flexible custody solutions, market data services, reliable rating services and research. With the increasing expectations and the increased regulatory requirements of STOs, the existing infrastructure, for example for trade and custody, must also develop further. This opportunity has been recognized by established stock exchanges and financial institutions and is expanding its services in the crypto sector.

For example, the Swiss stock exchange operator SIX announced in the summer of 2018 a platform for the issuance, trading, settlement and custody of digital assets. Another Swiss bank was authorized in January 2019 to become the first global crypto custodian bank.

15 Biggest ICOs since 2016

Featured image credit: Unsplash

Featured image credit: Unsplash

The post Report: 1132 ICO and STO’s in 2018 Completed appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments