A new paper by industry trade group Swiss Fintech Innovations (SFTI) shares the association’s forward looking vision for the coming ten years in the digital asset industry, exploring the concept of “tokenized finance” and detailing ways and recommendations to create a financial system that’s more inclusive, transparent and efficient than the traditional financial system.

The SFTI paper, titled “Vision of Tokenized Finance”, investigates the idea of a tokenized financial system, putting forward the idea of a new infrastructure for the financial services industry, platforms and applications that allow for the creation and exchange of products based on digital assets, including tokenized shares, stablecoins, central bank digital currencies (CBDCs), staked cryptocurrencies and non-fungible tokens (NFTs). This system, the report says, promises faster and cheaper transactions, greater transparency, and more accessibility for people who are currently underserved by the traditional financial system.

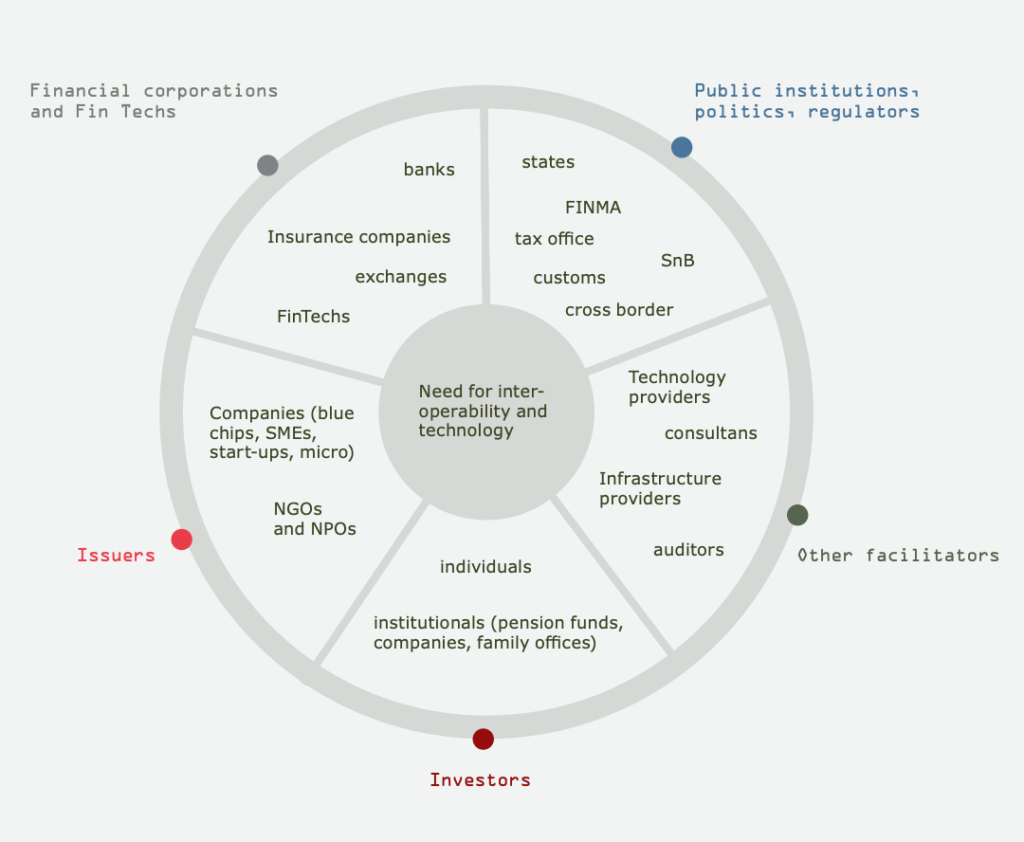

Tokenization ecosystem

SFTI’s vision of tokenized finance

Tokenized finance involves the use of digital tokens on decentralized or distributed ledger technology (DLT), commonly known as blockchain. Tokenized finance is similar to decentralized finance (DeFi) in that it runs on blockchain platforms and makes use of smart contracts. However, it defers from DeFi in that tokenized finance can involve intermediary functions or parties at certain interaction points in the ecosystem.

The report outlines the main elements of its tokenized finance vision, starting with issuing tokenized assets, addressing custody and safekeeping, and progressing to trading, payment, lending, and staking.

In tokenized finance, assets would be issued on various blockchain-based business networks. These networks would interconnected, facilitating streamlined processes with intermediaries offering specialized token-enabled services. In terms of custody and safekeeping, investors would have the freedom to choose between two main options: self-custody or custody with a regulated party.

The SFTI also emphasizes the importance of reliable means of payment for the future development of DLT. In particular, the organization foresees the emergence of stablecoins pegged to local currencies, and expects these stablecoins to be fully interoperable with various blockchain protocols. Alongside stablecoins, retail CBDCs are also set to play a role in the broader adoption of tokenized finance.

The trading landscape in Switzerland is also poised to undergo significant transformations through blockchain enablement. These developments are expected to include the emergence of new-generation exchanges built on blockchain infrastructure, the availability of atomic settlements, greater integration between traditional finance and digital assets and the advent of hybrid trading platforms.

The SFTI also anticipates an increase in the demand for cryptocurrency lending services as crypto gains broader acceptance and mainstream adoption. This will prompt traditional banks to join the crypto lending space. Several financial institutions, including Swissquote and Julius Baer, have already started exploring or integrating crypto lending services, a trend which SFTI expects will accelerate as crypto becomes more integrated into the global financial system.

Prerequisites for tokenized finance

After providing the main elements of tokenized finance, the report gives contextual elements and prerequisites to achieve the vision.

In particular, it notes that proper regulation is crucial in shaping and adapting to the challenges associated with tokenized finance. These regulatory frameworks should address concerns such as fraud, market manipulation, money laundering, and cybersecurity, and should focus on establishing trust in these emerging ecosystems.

A strong and secure digital identity and know-your-customer (KYC) foundation is another prerequisite to tokenized finance. This foundation should enable smooth transfer of tokenized digital assets, and should focus on streamlining client due diligence, identification and verification process, allowing both individuals and businesses to easily onboard onto different platforms.

In the current scenario, client due diligence processes are primarily non-digital, lacking common standards, and are often repeated at various institutions.

The vision for KYC and digital identity in tokenized finance involves a solution where clients would possess their own self-sovereign identity based on a recognized electronic identification. This identity would be connected to various DLT systems, giving clients control over their identification data in a tokenized format. Clients would be responsible for managing and updating their data, and would be able to decide which institution is allowed to access specific details and for what purpose. This information would be securely linked to DLT systems in compliance with data protection regulations, accessible only by the data owner and temporarily by associated institutions, with transparent access logs.

Cyber and token security is another critical issue to address. In this context, the focus should be on implementing robust security measures to protect clients’ digital assets and ensure that only authorized parties can access and transfer tokenized assets. These measures should prevent misuse, enable clear identification of asset ownership and be user-friendly for clients.

The SFTI’s envisioned solution for digital asset safeguarding encompasses a number of best practices. First, the solution should give clients full control over who can access and view their assets. Private keys should be stored securely and linked to a client by a financial institution or an intermediary of the client’s choice. And assets kept during a prolonged period of time should be moved to a cold storage, reducing exposure to potential cyber threats. Lastly, enhanced insurance coverage should be provided by custody providers to address concerns related to potential losses stemming from cybersecurity breaches or operational interruptions.

In recent years, Switzerland has taken significant strides to establish itself as a global leader in blockchain technology and tokenization. Notable initiatives include the creation of the Crypto Valley, an area in the canton of Zug known for its concentration of crypto and blockchain-related businesses, startups and organizations, as well as the implementation of a regulatory framework known as the “DLT Act”.

The legislation, which came into force in August, 2021, provides legal certainty for businesses and individuals engaging in activities related to DLT activities, allows for the tokenization of traditional securities, and imposes anti-money laundering (AML) and KYC obligations to entities operating in the blockchain space, among other things.

Featured image credit: Edited from freepik

Comments