Observers are saying that there is a Bitcoin bubble, and that the virtual currency has risen to such high levels that the a bubble burst is imminent. Shorting coins is one way to profit from falling prices as well as using hedging to protect Bitcoin investments.

In July last year, Bitcoin was valued at levels of around US$600. Today, the value of one Bitcoin has shot up to US$2500, making it seem as though Bitcoin is the easiest way for buyers who just want to get rich quick.

This has prompted fears that a Bitcoin bubble is just around the corner. Would the creators of Academy Award-nominated film The Big Short, which chronicled how a few renegade fund managers bet against the housing market in the lead up to the 2007 subprime crisis, make a sequel about Bitcoin?

Is there a bubble to begin with?

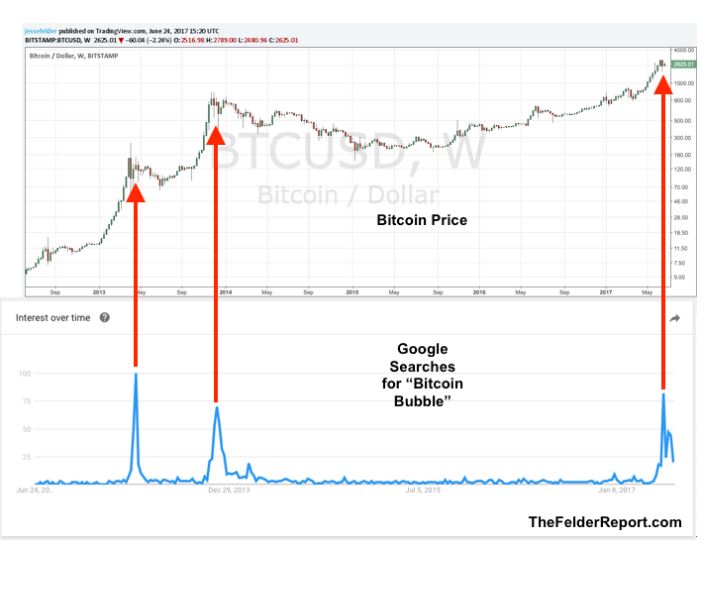

The term bubble is something most asset owners and investors try to avoid. When one acknowledges that there is a bubble, it is almost inevitable that prices would come plummeting down. According to former Bear Stearns banker and now finance blogger Jesse Felder, comparing recent Google searches for the term Bitcoin to its price surges imply that Bitcoin has indeed reached bubble status.

In his blog The Felder Report, Felder notes that “initial coin offerings” (ICOs), the unregulated means of raising funds for cryptocurrency ventures, are nothing more than thinly-veiled ponzi schemes. In the graphic below, he suggested that there is a direct connection to spikes in Google searches on housing bubbles to spikes in housing prices.

“Now some will make the argument that it can’t be a bubble when so many are calling it a bubble. These folks should have learned this lesson during the housing bubble,” wrote Felder. “The fact is it’s only a bubble once everyone acknowledges it’s a bubble. And by the time they do the game is up.”

There is also word of an impending “fork”, wrote Wealth Daily, where new software updates introduced to the system are expected to increase the number of blocks to the existing blockchain. This would require modifying the program in order for Bitcoin to trade. The move was in response to scaling issues, which have caused slow transaction speeds for BitCoin, according to WealthDaily.

What if it bursts?

Unlike the housing crisis of 2007, or the dot-com bubble burst, Bitcoin Skeptic Mark Cuban argues that there is value for Blockchain technology, which gave rise to the Bitcoin cryptocurrency. The Economist also argued that are real uses for Bitcoin, with its increasing legitimacy and usefulness in the tech marketplace. “Cryptocurrencies both embody innovation and give rise to more of it,” wrote The Economist.

They are experiments in themselves of how to maintain a public database (the “blockchain”) without anybody in particular, a bank, say, being in charge,” wrote the Economist. ICOs, for instance, can generate interesting innovations. “Fans hope that they will give rise to decentralised upstarts taking aim at today’s oligopolistic technology giants, such as Amazon and Facebook.

While it might be a risky way to innovate, the article also argues that Bitcoin functions in a self-contained system, and the effects would not be as widespread as a more openly-traded assets such as housing, stocks or foreign exchange.

How do you short a Bitcoin?

For those who want to profit from the potential backlash form Bitcoin’s inflated position, there are only a handful of avenues for them to do so. Bitcoin can’t be shorted in pairs, like how you would with stock trading, where you can “borrow” stock at a certain price to sell in the market, buying back the asset at a lower price so you can pocket the difference.

With a shortage of bitcoins and their trading exchanges, there is also a limited number of bitcoins being produced at the moment, so its low liquidity has not drawn more established institutional traders. For now, platforms that allow for shorting include Bitfinex, which leverages margin trading to short-sell Bitcoins. Trading can also be done through ETFS, CFDs and binary options.

The post The Big Coin Short appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments