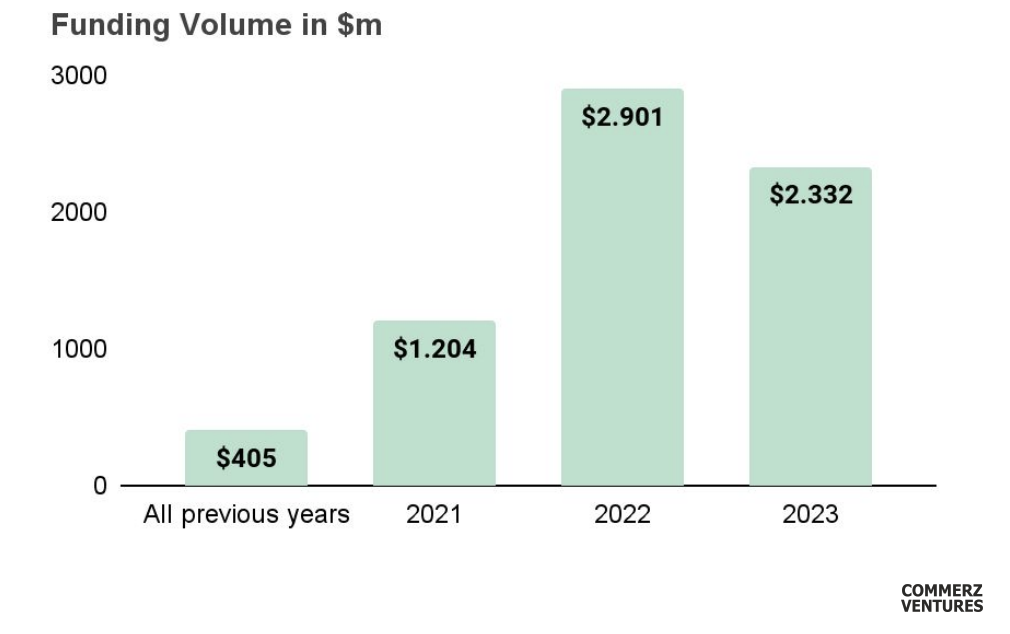

In 2023, global climate fintech investments totaled US$2.3 billion, declining by a slight 19% compared to the previous year, data from CommerzVentures, a venture capital (VC) firm backed by German banking group Commerzbank, reveal.

The rate is much lower than the 38% slump recorded for the overall venture capital (VC) market, indicating that climate fintech investment volume held up well throughout 2023 despite the massive VC funding pullback.

Global climate fintech funding volume, Source: Climate Fintech Report 2024, CommerzVentures, Mar 2024

These data were shared in the newly released Climate Fintech Report 2024, a report which explores the growth of the global climate fintech sector and which analyzes funding dynamics across geographies, sub-sectors and company stages.

According to the report, European companies continued to dominate the global climate fintech scene in 2023, raising 1.5x more VC funding than the US at US$1.4 billion versus US$881 million. European climate fintech companies also secured 3.3x more financing rounds (109) than the US (33).

Climate fintech funding volume EU versus US in US$ million, Source: Climate Fintech Report 2024, CommerzVentures, Mar 2024

Within Europe, German startups attracted the most funding in 2023 (US$710 million), surpassing the UK (US$210 million). These countries are followed by France (US$134 million), Finland (US$77 million) and Denmark (US$56 million).

Climate fintech funding volume by country (top 10) in US$ million, Source: Climate Fintech Report 2024, CommerzVentures, Mar 2024

CommerzVentures data also show that climate fintech is no longer an emerging sector, with the share of Series B and later-stage investments reaching 31% in 2023, up 13 points from 18% in 2022. Similarly, the share of pre-seed and seed stage climate fintech startups that raised funding in 2023 declined to 42%, down 14 points from 56% in 2022.

Climate fintech funded companies by stage, Source: Climate Fintech Report 2024, CommerzVentures, Mar 2024

In 2023, carbon markets were the favored segment, with startup in the sector raising a total of US$720 million. Energy management came in second with US$530 million in funding, followed by carbon accounting with US$333 million, and environmental, social and governance (ESG) data reporting with US$197 million.

Climate fintech funding volume by country (top 10) in US$ million, Source: Climate Fintech Report 2024, CommerzVentures, Mar 2024

Besides fundraising trends, the Climate Fintech Report 2024 also features a selection of the world’s most promising and impactful green fintech startups.

The Climate Fintech 50 list showcases the climate fintech startups with the strongest business models and the highest potential for growth. These startups are delivering positive impact to their customers, and have secured notable rounds of VC funding from prestigious investors. They are categorized in nine sub-sectors, namely carbon markets, energy management, carbon accounting, climate risk management, ESG reporting, supply chain analytics, climate mitigation management, natural capital management and climate investing.

Carbon markets:

- Abatable is a carbon offsetting procurement platform from the UK that connects companies with carbon project developers of high quality carbon offsets.

- Arbonics is an Estonian nature tech specialist building a high-quality, scalable forest carbon removal platform in Europe.

- Opna is a London-based startup that offers a climate financing platform that empowers corporates to discover, finance, and manage pre-assessed carbon removal and reduction projects to accelerate the journey to net zero.

- Ecosystem Restoration Standard (ERS) is a French company that assesses and monitors the impact of restoration projects on climate, biodiversity, and local livelihoods.

- Agreena is a Danish startup that helps farmers to plan, track and validate their transitions to regenerative agriculture practices that store soil carbon.

- Klimate.co is a Danish startup that aims to address climate change through innovative carbon management solutions.

- Isometric is a London-based startup developing a carbon removal registry and science platform built to ensure the transition to carbon removal happens responsibly and fast.

- Open Forest Protocol is a Switzerland-based company developing a scalable open platform that allows forest projects of any size, from around the world to measure, report and verify their forestation data.

- Ocell is a Munich-based climate tech startup that offers data-driven, high-quality carbon credits to support local landowners.

- Single.Earth is an Estonian startup using blockchain technology to create a marketplace that protects nature by making carbon removal and biodiversity tradable.

- Pachama an American harnesses artificial intelligence (AI) and satellite data to empower companies to confidently invest in nature.

- Cloverly is an American advanced digital platform that launched the first application programming interface (API) for carbon credits.

- Mantle Labs is an UK-based company building a firm fintech platform that offers banks and insurance companies a complete risk assessment solution for managing their agriculture portfolios.

- Choose is a Norwegian startup building digital tools so that everyone, anywhere, can easily integrate climate action into everyday life and business.

- Veritree is a Canadian startup offering a platform providing registered users with access to integrated planting and reforestation verification and tracking tools to manage projects, share and publicize planting and reforestation initiatives and view planting and reforestation initiatives of other users.

- Oka is an American carbon insurance company.

Energy management:

- Cloover is a Stockholm-based climate fintech startup that enables vendors of renewable energy technologies to offer their services as a subscription.

- Ostrom Climate is a Berlin-based startup providing carbon management solutions.

- Enpal is a German startup offering the first integrated package for a climate-neutral home including photovoltaic (PV) systems, energy storage, electric vehicle (EV) chargers, green electricity tariffs and smart energy management.

- Predium is a Munich-based startup offering a platform for sustainable real estate management.

Carbon accounting:

- Tanso is a Munich-based climate tech startup that offers a climate intelligence suite to industrial companies.

- CarbonChain is an UK-based startup building technology for companies to track, report and reduce their supply chain emissions, covering the most carbon-intensive industries, including metals and mining, agriculture and manufacturing.

- Cleartrace is an American energy data and carbon accounting platform providing companies with the digital infrastructure to enable decision-making to mitigate environmental risk, prove their climate achievements and create new market opportunities within the evolving energy landscape.

- Sinai is a San Francisco-based technology startup focused on transforming the way companies price, analyze, and reduce carbon emissions around the world.

- Doconomy is a Stockholm-based company that helps banks, brands and consumers better understand their environmental impact.

- Coolset is a Dutch startup that helps small and medium-sized enterprises (SMEs) to measure, analyze, reduce, and eliminate their carbon impact.

Climate risk management:

- Climate X is an UK-based startup that’s helping companies identify, assess, and manage climate-related risks to their business and assets.

- Mitiga Solutions is a Spanish startup providing climate risk intelligence that combines science, AI, and high-performance computing.

- Terrafuse AI is an American startup developing an advanced climate and weather risk prediction solution.

ESG reporting:

- Atlas Metrics is a German startup building tools that make it easy for companies to measure and share the impact of their activities.

- Briink is a German startup building an AI toolbox for ESG standards teams.

- Apiday is a French startup helping businesses collect all ESG data in one place, automate ESG reporting and certification processes, and collaborate with third parties, such as specialized ESG consultants, to improve ESG scores or make specific ESG improvements.

- Coolset is a Dutch company helping growing companies measure and improve on sustainability swiftly.

- WeeFin is a French company providing a software-as-a-service (SaaS) for financial institutions to implement and oversee ESG strategies, ensuring compliance with national and international regulations.

- Novisto is a Canadian startup offering an end-to-end enterprise software for smarter sustainability management, empowering companies to create value from their ESG data and reporting.

- Mavue is a Frankfurt-based startup developing sustainability compliance software designed to collect, analyze, and report sustainability data in a simple and secure way.

- Novata is an American public benefit corporation created to help private equity firms and private companies navigate the ESG landscape by providing relevant reporting metrics, a contributory database to store information, and tools for analysis and reporting to key stakeholders, including limited partners and regulators.

Supply chain analytics:

- Orbio Earth is an American startup that uses satellite imagery to track methane emissions from the oil and gas industry.

- Hydrosat is an American startup providing daily, high resolution thermal data and analytics for food security, public safety, and the environment.

- Chloris Geospatial is an American company that uses remote sensing, machine learning (ML) and ecological science to measure forest carbon stock, gains and losses.

- Overstory is a Dutch startup applying ML to satellite imagery to create insights about the quantity and quality of forests and other natural resources.

- IntegrityNext is a German startup providing an all-in-one platform for supply chain sustainability management.

- Treefera is a London-based startup that uses AI algorithms to map trees globally, collecting data that can then be used to measure, report and verify carbon credits, which are bought by companies to fund carbon reduction projects to offset emissions.

Climate mitigation management:

- ClimateView is a Swedish climate tech company providing SaaS insights to accelerate cities’ transition to net zero.

Natural capital management:

- Nala is a German startup that helps companies measure, manage and report their impact on nature & biodiversity.

- NatureMetrics is an UK tech startup using genetic techniques to monitor biodiversity.

- Pivotal is a UK startup developing ways to measure biodiversity and turn it into a tradable asset.

Climate investing:

- Carbon Equity is a Dutch fintech platform that democratizes access to impact private equity.

- Earthly is a London-based startup that connects businesses to high-quality nature-based solutions that remove carbon, restore biodiversity and support local communities.

- EnverX is a German startup providing a marketplace connecting capital, carbon projects and monitoring providers.

Featured image credit: Edited from freepik

Comments