The recent Weath and Asset Management Report 2021 by Oliver Wyman and Morgan Stanley sheds light on emerging industry trends as the global market is poised to grow significantly over the next few years.

According to the report, wealth and asset managers face a common set of challenges and opportunities. For wealth managers, there is a noticeable shift towards providing holistic financial advice and planning.

This requires them to move away from offering standardised portfolios and providing more customised solutions using a myriad products and technologies to fit the needs of the lower wealth band, the report notes.

For ultra-high net worth (UHNW) and high net worth (HNW) investors, private markets and Environmental, Social, and Corporate Governance are emerging as the biggest opportunities, the report finds.

On the other hand, for asset managers, the opportunity lies in delivering differentiated, in-demand products to retail investors.

These products are designed to offer better economics than those provided by institutional asset managers and signifies a growing share of total industry assets under management (AUM), the report said.

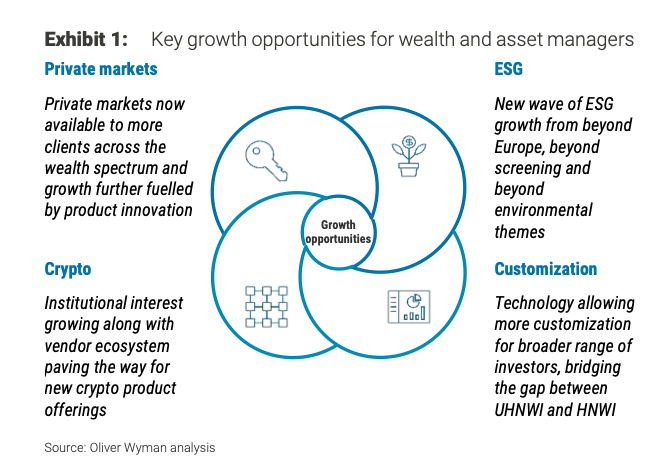

The study has found that wealth and asset managers are in competition for common growth opportunities.

The report forecasts rapid growth in each of these spaces. By 2025, the report expects the total private market fund AUM to reach US$13 trillion.

During the same period, total ESG fund AUM is expected to reach US$6.5 trillion. Moreover, Bitcoin Exchange Traded Fund (ETF) and direct indexing managed accounts AUMs to reach U$0.3 trillion and US$1.5 trillion by 2025 respectively.

Private markets to continue their upward growth

According to the report, private market grew steadily through 2020 and now exceeds US$7 trillion in total AUM. The study expects this robust growth to continue till 2025. The growth will be driven by demand for yield, inflation protection, and the increasing access to retail wealth investors.

Historically, HNW individuals have had limited access due to entry barriers like illiquidity, high minimum thresholds and limited diversification.

However, these challenges are now being tackled and the report expects HNW investors to play a more crucial role in the space.

By 2025, HNWs are expected to allocate and additional 5% of their portfolios to private markets, signifying US$1.5 trillion in AUM or a US$21 billion revenue opportunity.

Next wave of opportunity in ESG to come from three macro shifts

According to the report, while wealth and asset managers have already found a significant opportunity in ESG considerations, the next scope of growth will come from three macro shifts: beyond Europe, beyond screening, and ‘beyond E.’

ESG Success Factors

Beyond Europe:

The growth of ESG considerations has been predominantly noticed in Europe so far. In fact, Europe represented roughly 85% of the US$2 trillion worth of total ESG AUM at the end of 2020, the report notes. However, the growth of ESG in the US has been accelerating and represents the next space of growth opportunity.

Beyond screening:

While ESG investments are undergoing a geographical shift, they are also transitioning from less mature strategies such as screening and exclusion to mature strategies like assessing impact and thematic investments, the report notes.

To adapt to this change, wealth and asset managers need to look beyond high-level scores. They have to use more quantitative and outcome-oriented data to monitor and report on real, tangible impact of ESG investments.

Beyond ‘E’:

Wealth and asset managers can carve out new opportunities through differentiation by using more mature strategies, the report notes. They can help investors focus on specific themes and goals they prioritise and care about. For instance, they can target UN’s Sustianable Development Goals across ESG.

Cryptocurrencies present a booming opportunity

Institutionalisation of crypto represents a significant opportunity for wealth and asset managers, the report notes. With cryptocurrencies experiencing a record bull run earlier this year, market capitalisation of cryptocurrencies reached US$2 trillion in April 2021. This is compared to a market capitalisation of US$50 billion four years ago.

Traditional institutional investors are increasingly attracted to crypto due to strong returns, low correlation and growing institutionally suitable products. This adding to the momentum already created by strong retail trading activity and family office investments.

However, barriers to entry continue to exist, hindering wider adoption of crypto by institutional investors and wealth managers. Some of the biggest challenges include the evolving regulatory landscape and legislative uncertainty, high volatility, and sustainability concerns.

According to the report, crypto could generate a US$1 billion revenue opportunity from ETFs, based on bitcoin’s ability to replace stores of values like gold. Asset managers looking to tap into the crypto market should consider a range of offerings.

This could include crypto assets as part of an existing multi-asset fund, or having dedicated active or passive crypto products and other structured solutions, the report said.

Customisation is the need of the hour

Customisation is the need of the hour

Historically, access to customised portfolios have been limited to institutions and UNHWIs due to the high cost and sophisticated model required, as well as their limited scalability.

Investors belonging to the lower wealth band, on the other hand, are looking towards increased standardisation through model portfolios, the report noted.

As technology improves, asset managers will need to decide how to scale their customised offerings for smaller account sizes.

These offerings need to provide sufficient customization flexibility at low cost.

Delivering these products creates greater options, and hence more potential value for clients. But it also increases the burden on asset managers to help investors and their advisors to best utilise that customisability.

Featured image credit: Photo by Freepik

The post Wealth and Asset Managers Will Go Head to Head as Their Opportunities Converge appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments