Wealth managers and private banks need to ‘democratise’ their service and product offerings to a wider audience to compete and grow in the new hyper-digital world according to a report by Avaloq.

If firms do not democratise their proposition, they risk losing market share according to findings comes from the report “Democratization of Wealth Management – a Unique Business Opportunity”.

According to the report, the wealth management sector faces deep structural margin and transformation pressures, rooted in a mix of rapidly changing client demands, tighter regulations and new, fiercer competition from a combination of fintechs, neo-banks and ‘big tech’ all trying to gain a foothold in the market.

For Avaloq, these challenges can be traced back to four megatrends: wealth shifts, socio-behavioural changes, technological evolution and economic & monetary turmoil.

Martin Greweldinger

“A new generation of tech-savvy, wealthy clients, with a high demand for seamless digital services, is behind the unstoppable nature of these megatrends. But rather than be an obstacle to growth, we see a significant opportunity for wealth managers that bring high-end wealth management services to the affluent segment. This democratisation requires wealth managers to deliver personalised advice at scale while addressing the specific needs of this new affluent clientele through a balance of industrialization, innovation and individualisation,”

says Martin Greweldinger, Group Chief Product Officer at Avaloq.

Avaloq warns that ‘plain-vanilla’ value propositions are no longer acceptable for a diverse clientele that ranges from an evolving, tech-savvy ultra high-net-worth individual segment to affluent high-earning millennials. Used to superior, digital-first experiences from ‘big techs’, these clients take bespoke, holistic, and impactful advice for granted.

To satisfy their demand for hyper-personalised services, traditional financial data needs to be combined with datapoints like client lifegoals. Conversational banking, portfolio modelling tools, behaviour-based risk assessments and virtual assistants have become the key tools needed to support such value propositions.

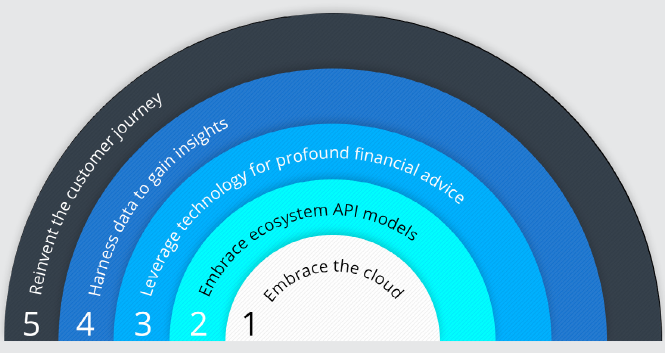

In its report, Avaloq lists a five-step agenda, balancing industrialisation, innovation and individualisation efforts to successfully democratise wealth management:

Avaloq’s five-step recipe to take advantage of the democratization of wealth management

The post Wealth Managers Need to ‘Democratise’ Their Services If They Want to Survive appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments