Banks from around the world are teaming up with fintech companies to expand their payment offerings in a bid to enhance customer experience and respond to rising competition, a new analysis by FXC Intelligence, a financial data company specializing in international payments, payment cards, cryptocurrency and e-commerce industries, shows.

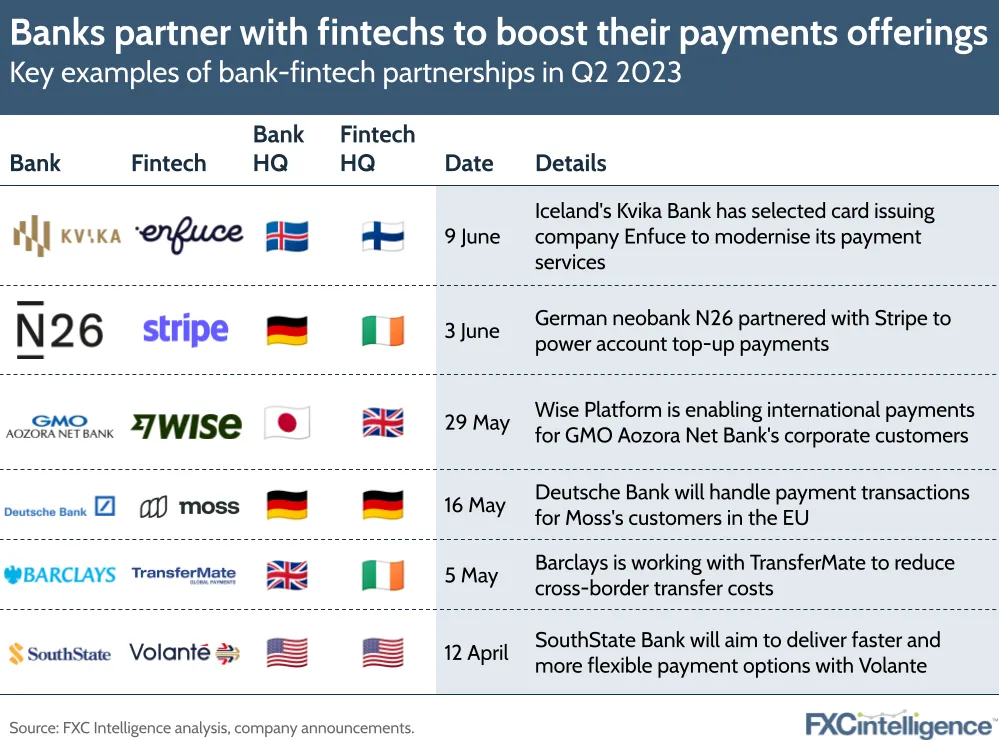

A new report released on June 16, 2023 looks at bank-fintech partnerships announced in Q2 2023, highlighting trends that emerged in the last quarter.

According to the report, banks are actively pursuing partnership opportunities with digital players as they seek to stay relevant.

In Q2 2023, several partnerships were announced, focusing on helping banks to either launch new payment products, improve their cross-border payment offerings or prepare for a future where real-time payments are the norm, the analysis shows.

Iceland’s Kvika Bank, for example, announced in June a collaboration with Finnish card issuing and processing company Enfuce to offer a range of modern card and mobile payment solutions, including new subscription-based services, a Visa consumer credit card and Apple Pay and Google Pay integration.

Through the partnership, Kvika Bank will also be looking to revamp Aur, a mobile payment app that the bank acquired in 2021, and add “compelling features and benefits that customers want to enjoy,” the bank said in a statement.

In Germany, digital bank N26 turned to Stripe to offer more options and a more seamless experience to its customers. The partnership, announced in June, focused on enabling credit card, debit card, and digital wallet top-up options in the N26 app.

Other banks, such as GMO Aozora Net Bank, from Japan, and Barclays, from the UK, unveiled new collaborations in Q2 2023 to enhance their cross-border payment offerings. GMO Aozora Net Bank teamed up with money transfer specialist Wise in May to leverage the company’s business-to-business (B2B) offering, Wise Platform, and provide more efficient and lower-cost international transfer services to 80,000 corporate customers.

Barclays, meanwhile, announced that same month a collaboration with B2B paytech company TransferMate to bring its international receivables solution to the bank’s corporate customers.

Meanwhile, banking incumbents such as SouthState are tying up with payment fintech firms to lay the foundations for instant payments and the forthcoming launch of FedNow. Regional bank SouthState announced a partnership with cloud payments and financial messaging startup Volante Technologies in April to ramp up its payment capabilities, gain in efficiency and attract new customer segments, the bank said. FedNow, a new interbank instant payment infrastructure developed by the US Federal Reserve, is scheduled to go live later this month.

Bank-fintech partnerships in Q2 2023, Source: FXC Intelligence, June 2023

These new partnerships are being inked at a time when competition is ramping up the banking space, fueled by the rise of the fintech sector and digitalization.

In Asia, banking incumbents are transforming their payment strategies in response to evolving customer demands and technological advancements. A 2023 interview conducted by McKinsey and Company questioned executives from three leading banks in Asia, namely ICICI Bank, DBS Bank and the Commonwealth Bank of Australia (CBA), on their payment strategies.

Findings from the interviews show that, across the region, banks are leveraging the rise of digital payments by expanding their digital payment offerings and collaborating with fintech companies to provide innovative solutions.

Another trend outlined by the banking executives is the advent of open banking initiatives, a phenomenon that’s encouraging incumbents to team up with digital players to offer customers a broader range of payment options and personalized services.

Finally, as real-time payments are becoming the norm, Asian banks are investing heavily in infrastructure and tech to facilitate faster and more efficient payments.

Demonstrating the growth of bank-fintech partnerships, Wise said in January 2023 that its Wise Platform B2B offering recorded strong growth in 2022, launching 15 new partnerships last year for a total of 60 partners globally. The company said that nearly 10 million new customers gained access to Wise’s cross-border payment infrastructure via the platform in 2022 alone.

Featured image credit: Edited from Freepik

Comments