E-commerce platforms and digital payment services providers are enjoying explosive growth on the back of social distancing requirements put in place in response to the COVID-19 pandemic, according to a new report by PPRO, a London-based business focused on cross-border payments for merchants.

In a report titled Payments in a Time of Social Distancing, PPRO says that COVID-19 has acted as a catalyst for digital transformation, stressing that these changes will likely be permanent.

According to the paper, e-commerce retailers have seen witnessed significant growth since the beginning of the crisis and new shopping habits are rapidly taking roots.

Across Europe’s three largest markets, namely France, Germany and the UK, up to 80% of shoppers are now making at least half of their purchases online, the report notes, while in the US, e-commerce sales are expected to climb 18% in 2020. PPRO says that between January and June 2020, it had seen a staggering 85% increase in online purchases of food and beverages.

The PPRO report echoes findings from a new MasterCard study which found that US e-commerce spending grew by a whopping 93% year-over-year in the month of May. In the UK, e-commerce as a share of total retail sales reached an all-time high of 33% in April and May.

Though COVID-19 and the measures put in place to control the spread of the virus have forced people to adopt new ways of shopping and spending, these changes will be long-lasting, the PPRO report says.

In the UK, 74% of consumers think they will continue to prefer online shopping even after the lockdown restrictions lift. Similarly, in the US, 40% of consumers said they will shop online more than in-store going forward.

Digital payments on the rise

The pandemic has also led to increased use of contactless, digital payments methods, including e-wallets, mobile wallets and bank transfers.

In Brazil, contactless payments have grown five times over one year, the PPRO report says. In Vietnam, domestic payment via bank cards jumped by 26.2% in volume and 15.7% in value in the first four months of 2020.

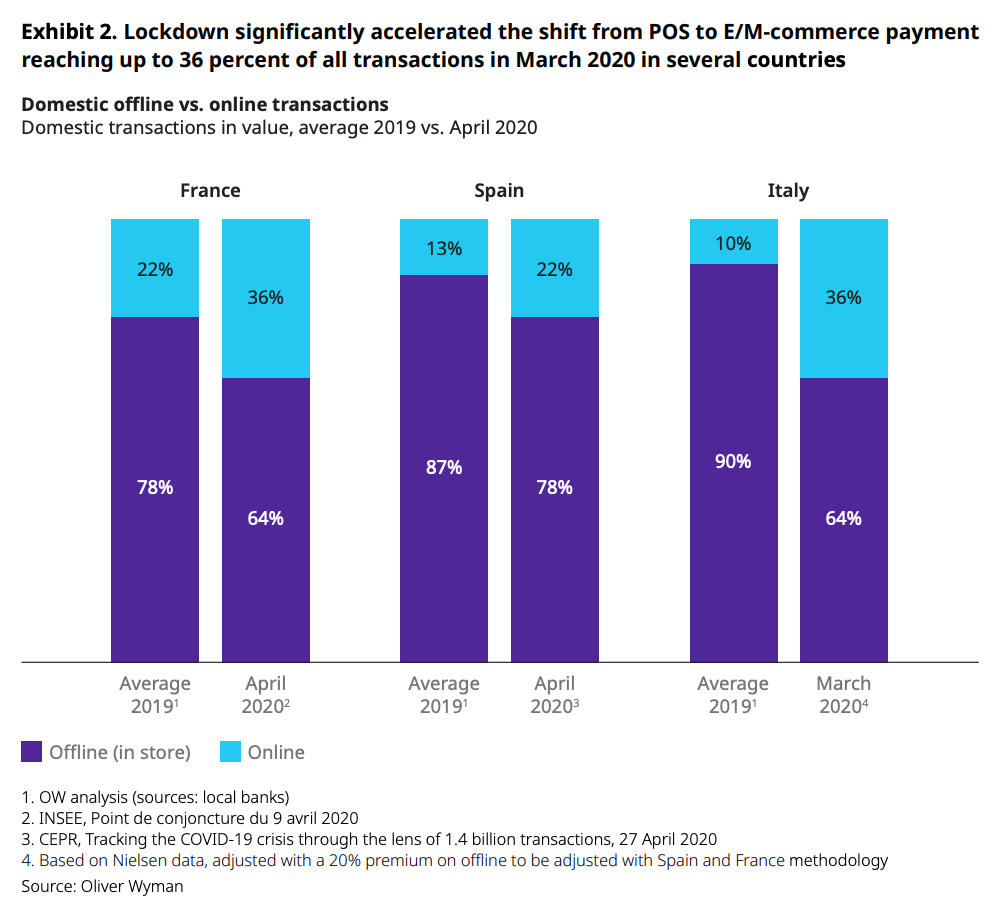

In Europe, cash usage is forecast to decline between 9 to 11% in 2020, according to Accenture. An analysis by Oliver Wyman of offline and online transactions across three European markets earlier this year shows a clear shift towards e/m-commerce payments. According to Oliver Wyman, these new payment modalities will continue to develop and gain market share after national lockdowns.

Lockdown significantly accelerated the shift from POS to E:M-commerce payment reaching up to 36 percent of all transactions in March 2020 in several countries, Source- Oliver Wyman, June 2020

According to a Mastercard weekly survey launched April 27, almost seven in ten consumers globally believe the shift to digital payments will likely be permanent. Nearly half of consumers plan to use cash less, even after the pandemic subsides.

Featured image credit:People photo created by prostooleh – www.freepik.com

The post COVID-19 Fuels Global E-Commerce and Digital Payments appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments