New players on the financial market like neo-banks and fintechs are reshaping the landscape and accelerating digitalization of many services and processes. In this rapidly changing environment, customer experience (CX) has emerged as a major differentiator with digital onboarding being propelled to the center stage.

Digitalization has taken the world by storm, and today’s customers are demanding a seamless, digital-first onboarding experience. The advantages of digital customer onboarding are obvious: quick and easy operation from a home PC or mobile device, without the hassle of waiting or wasting time.

Yet, despite massive investment in digital transformation, banks and financial institutions in Europe are still struggling to get it right.

According to a research by Signicat released in June 2019, 38% of all financial services applications in Europe were abandoned before being complete over the prior year, with the main reason cited as the time it takes them to fill in the required details.

The rise of challengers

The urgency to offer a seamless digital customer onboarding experience is even more so at this time where challenger banks and fintechs are rapidly gaining ground and winning market share.

These new entrants have been focusing on making their offerings simple and user-friendly, and their efforts have paid off. Of the 30% of consumers who had used a “mobile-first” financial service, 70% say the service is better than what they had before, the Signicat research found.

With this rate of customer satisfaction, mobile-first services have a good chance of retaining customers once they are onboarded, the report says, putting further pressure on incumbents.

Digital onboarding in Germany

Germany was one of the first jurisdictions in the world to allow video verification back in 2014. Amid demands for more convenient onboarding processes, Germany’s Federal Financial Supervisory Authority (BaFin) passed a directive that year, which was updated in 2017 to further tighten process security.

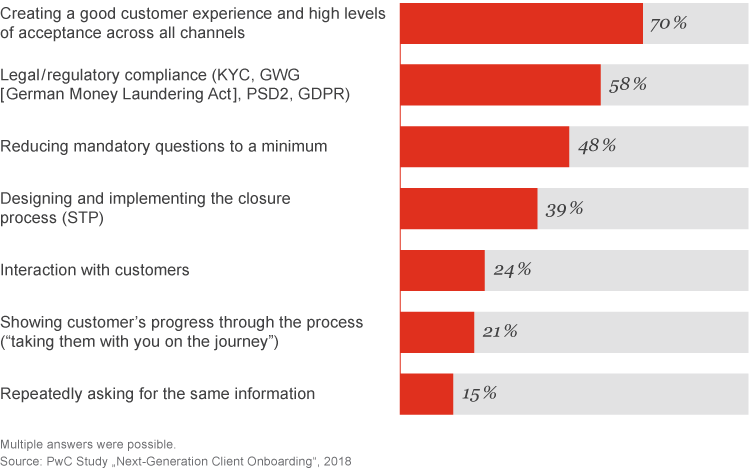

Today, digital client onboarding is firmly established in the German financial sector, with direct banks and private banks leading the way, according to a study by PwC.

The industry is now moving towards what PwC refers to “next-generation client onboarding,” where financial institutions are gradually developing their onboarding into a multichannel process that is accessible from all devices. The end goal here is to merge all customer interaction channels to form a single channel in order to provide an overall superior digital customer experience.

eKYC providers in Germany

With digital onboarding rapidly becoming the norm, the German market has seen the emergence of a thriving electronic know-your-customer (eKYC) industry.

eKYC refers to the digitalization and online conception of KYC processes, and constitutes a critical step in the digital onboarding journey.

In Germany, several startups operate in the field, with perhaps the most notable player being IDnow. Based in Munich, IDnow offers an identity-as-a-service platform that can verify in real time the identities of more than 7 billion people from 193 different countries. The startup’s patent-protected video identification and e-signing solutions are currently used by some of the world’s leading banks and fintechs including UBS, SolarisBank, Fidor Bank, N26, and Smava.

KYC Spider is another prominent startup serving European markets, including Germany and Austria. Headquartered in Zug, Switzerland, KYC Spider provides a digital platform designed to fulfil customers’ anti-money laundering/combating the financing of terrorism (AML/CFT) and sanctions compliance requirements.

The startup’s comprehensive KYC solution suite offers all the necessary compliance services relevant not only for financial intermediaries and banks, but also fintechs and industrial corporations. KYC Spider serves the likes of Yapeal, Bitcoin Suisse and Lykke.

Other eKYC providers from Germany include Trust Fractal, a Berlin and Singapore-based identification management company providing a KYC/AML platform specifically built for finance 3.0 services including blockchain fintechs, and 4Stop, which has created a one-stop solution for enterprise level KYC, compliance and anti-fraud.

The post Digital Onboarding Becoming the Norm in Germany appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments