SIX, the financial services provider best known for operating the Swiss stock exchange, has released a new whitepaper that explores possible scenarios for the future of the stock exchange over the next five to ten years.

Titled Future of the Securities Value Chain, the paper is part of a series focusing on assessing the potential impact of the many complex and concurrent developments that are affecting the financial landscape today, including emerging technologies.

“It is vital to have a clear understanding of the challenges that lie ahead in order to be able to prepare for them today,” said Jos Dijsselhof, CEO of SIX.

“The white paper therefore aims to promote discussion and to inspire reflection on new business opportunities, especially in the interaction between startups and traditional players. It is important that we keep the debate on progress open and ongoing.”

“The white paper therefore aims to promote discussion and to inspire reflection on new business opportunities, especially in the interaction between startups and traditional players. It is important that we keep the debate on progress open and ongoing.”

According to SIX, new technologies including artificial intelligence, advanced analytics, big data and cloud computing will play a major role in the securities value chain. Distributed ledger technology (DLT), which have long been praised for its disruptive potential in the field, will likely not replace central ledgers but rather co-exist with traditional infrastructures.

“The big question remains whether DLT can replace central ledgers,” the report says.

“What is certain is that both models can be successful only in a regulated environment with registered (permissioned) users. In all cases, however, the different ledgers communicate with each other and are therefore fully synchronized and up-to-date at all times. In addition, the ledgers do more than just record transactions, they can also contain lines of code that represent voting rights, for example.”

Worldwide, three quarters of the financial market infrastructure (FMI) operators are working on DLT pilots of already using the technology, according to a Financial Times report.

The Australian Securities Exchange is the first major stock exchange to commit to replacing part of its settlement infrastructure with DLT with a roll out scheduled for March 2021. Other exchanges currently considering DLT include the Abu Dhabi Securities Exchange, and the Shanghai Stock Exchange, the world’s fourth largest, which announced plans to use DLT in July 2018.

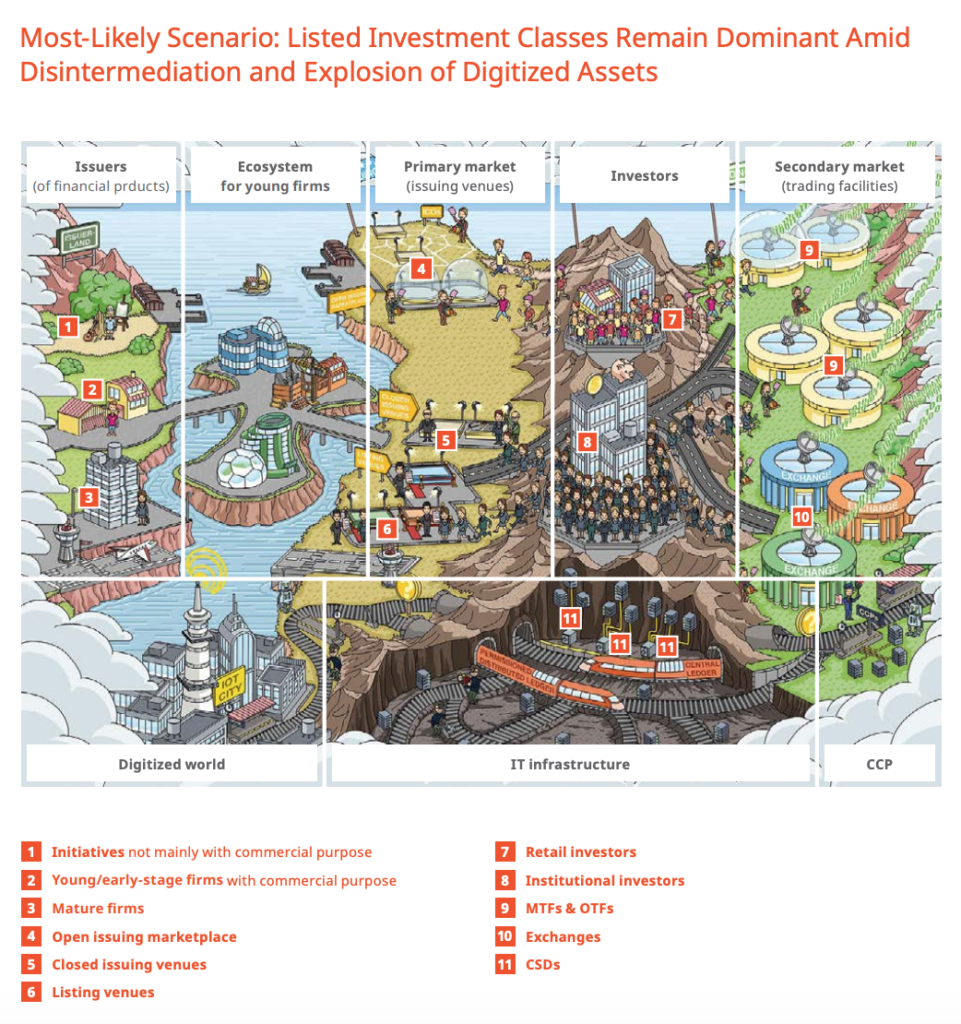

According to the SIX research, the most likely scenario for the future of the securities value chain is that listings will continue in the future but thanks to automation and digitalization, the direct costs of listing will fall sharply.

SIX sees direct-access, platform-based primary markets becoming dominant and disrupt traditional broker and middleman functions for listed financial products.

It also predicts that global tech companies will emerge as new competitors as they set up issuing venues to support activities in their ecosystems. They will become important retail investor-focused investing gateways by leveraging their global client bases, their analytics-as-a-service infrastructure, and proprietary data of their retail customers.

The report cites the case of Amazon, which launched Amazon Lending in 2011 to provide loans to sellers on Amazon’s e-commerce marketplace but also Amazon Consumer Lending, which provides loans to consumers. Launching an issuing venue would be a natural extension for Amazon’s lending services to access a broader supply of capital and avoid fees by taking out intermediaries, the research says.

SIX also expects the number and variety of digitalized assets (digital representation of rights to real assets) to increase exponentially, as it facilitates the trading, financing, sharing, lending, collateralization, and pricing of assets.

Crypto-assets will retain some popularity as investment assets due to their potential for diversification, high volatility promising rapid/high returns, and due to governments around the world having clarified the regulatory framework.

But the wide adoption of new technology will lead to increased cyber-risks as cyber-attacks become more sophisticated and quantum computing become a reality.

Most-Likely Scenario: Listed Investment Classes Remain Dominant Amid Disintermediation and Explosion of Digitized Assets, SIX

The second most-likely scenario, according to SIX, is that listing will no longer be viewed as an indicator of quality by many investors and non-listed financial investments classes will become highly popular as a result.

Open issuing marketplaces, or issuing venues on which only non-listed financial products can be issued such as AngelList, Lending Club and Seedrs, will displace traditional exchanges as the dominant issuing venues as investors become overserved in terms of protection and underserved in terms of choice on listing venues.

The post New SIX Paper Outlines Tech Trends Shaping the Future of Securities Value Chain appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments