Swiss fintech companies raised a total of CHF 220.1 million in 2020, a 38% decrease compared the CHF 360.3 million raised in 2019, new data from local startup portal Startupticker.ch show.

The decline in fintech fundraising, outlined in the newly released Swiss Venture Capital Report 2021, can be partially explained by the lack of large funding rounds in 2020. Most deals closed last year went towards seed and early stage fintech startups, such as AlgoTrader (CHF 5.5 million raised in two rounds), Flovtec (CHF 4.5 million), and i2 invest (CHF 1.3 million), Liquity (CHF 2.2 million), neon (CHF 5 million), vlot (CHF 1 million) and Yokoy (Expense Robot) (CHF 1.7 million), data compiled by Startupticker.ch show.

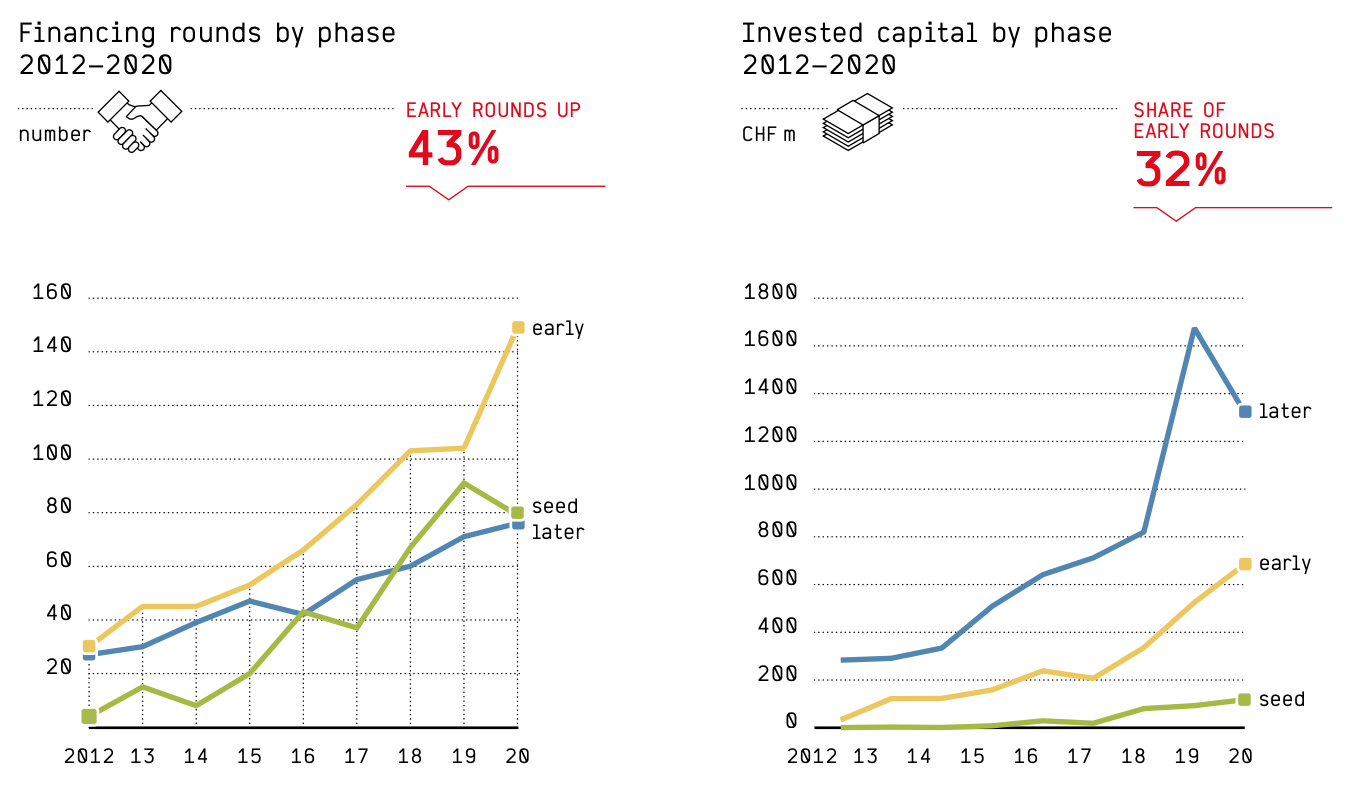

The trend was consistent across all sectors. In 2020, early phase financing achieved strong growth and attracted a significantly larger share of the investment amount than in previous years.

Financing rounds and invested capital by phase, Swiss Venture Capital Report 2021, Startupticker.ch

Out of the 38 fintech deals closed in 2020, only 7 were worth more than CHF 10 million. Bitcoin Suisse raised the biggest fintech funding round of 2020 and the 11th largest one across all sectors combined (CHF 45 million).

In fintech, the biggest funding rounds of 2020 went towards crypto/blockchain startups, which besides Bitcoin Suisse, include SEBA Bank (CHF 20 million), Metaco (CHF 16 million) and Crypto Finance (CHF 14 million). Other notable fintech deals in 2020 include NetGuardians (CHF 17 million), Immozins (CHF 12.5 million) and Alpian (CHF 12.2 million).

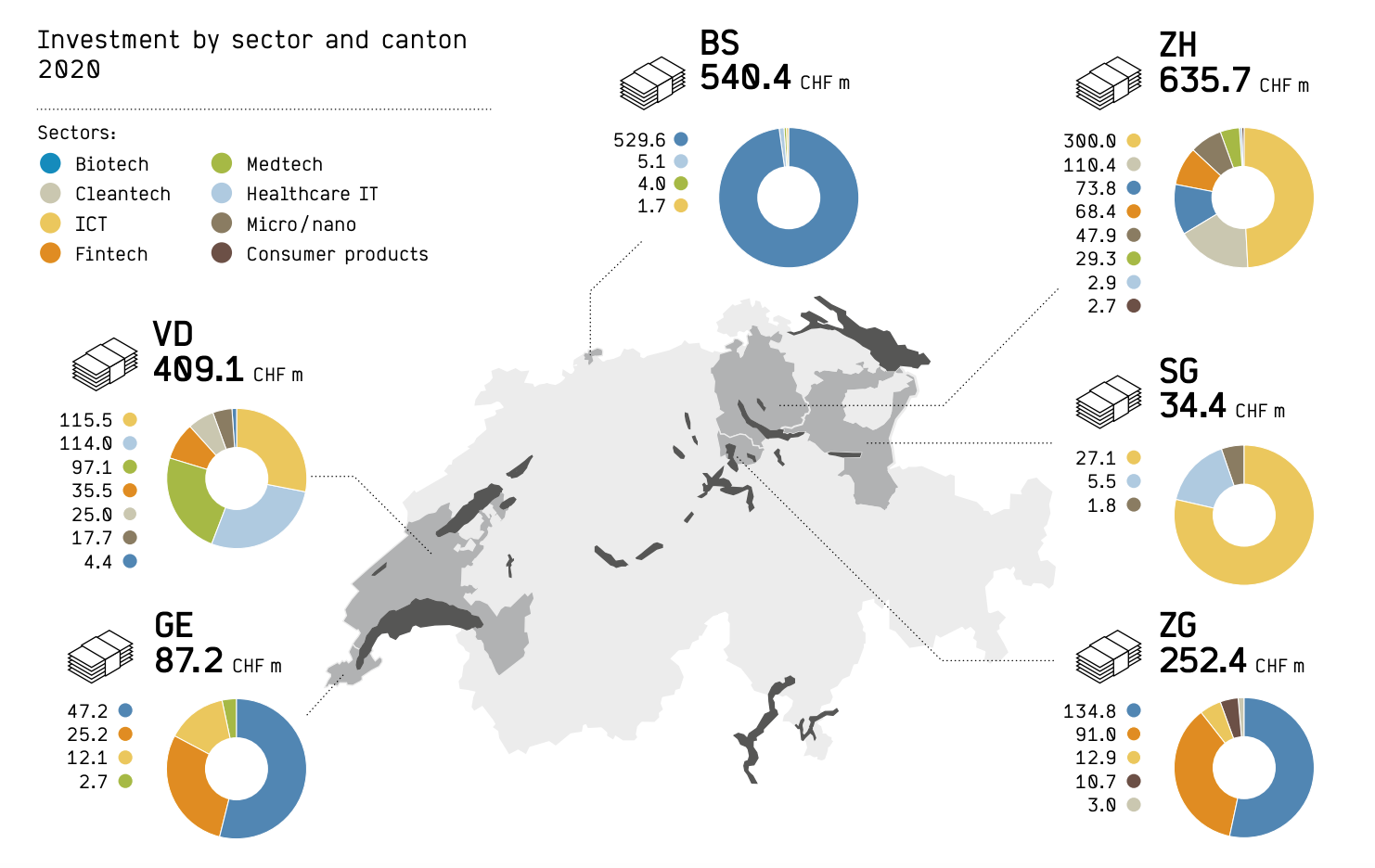

In 2020, Zug was the leader in fintech investment with CHF 91 million raised, representing 41.3% of all fintech funding for that year in Switzerland. Zug is followed by Zurich with CHF 68.4 million (31%), Vaud with CHF 35.5 million (16.1%), and Geneva with CHF 25.2 million (11.4%).

Investment by sector and canton 2020, Swiss Venture Capital Report 2021, Startupticker.ch

2020 fintech acquisition deals

Data compiled by Startupticker.ch show that eight Swiss fintech companies were acquired in 2020. Noteworthy acquisitions included leading banking software developer Avaloq, which was acquired by Japan’s NEC Corporation for a whopping CHF 2.05 billion, the purchase of wealthtech developer Evolute by banking service and software provider Etops, and the takeover of debt financing platform operator Advanon by rival CreditGate24.

Other trade sales in 2020 include AAAccell, an award-winning startup that delivers artificial intelligence (AI)-based solutions for asset and risk management, which was purchased by Germany’s LPA Captech Group; and AI and data science company Incube, which was acquired by London-based fintech company Finantix.

Swiss venture capital trends in 2020

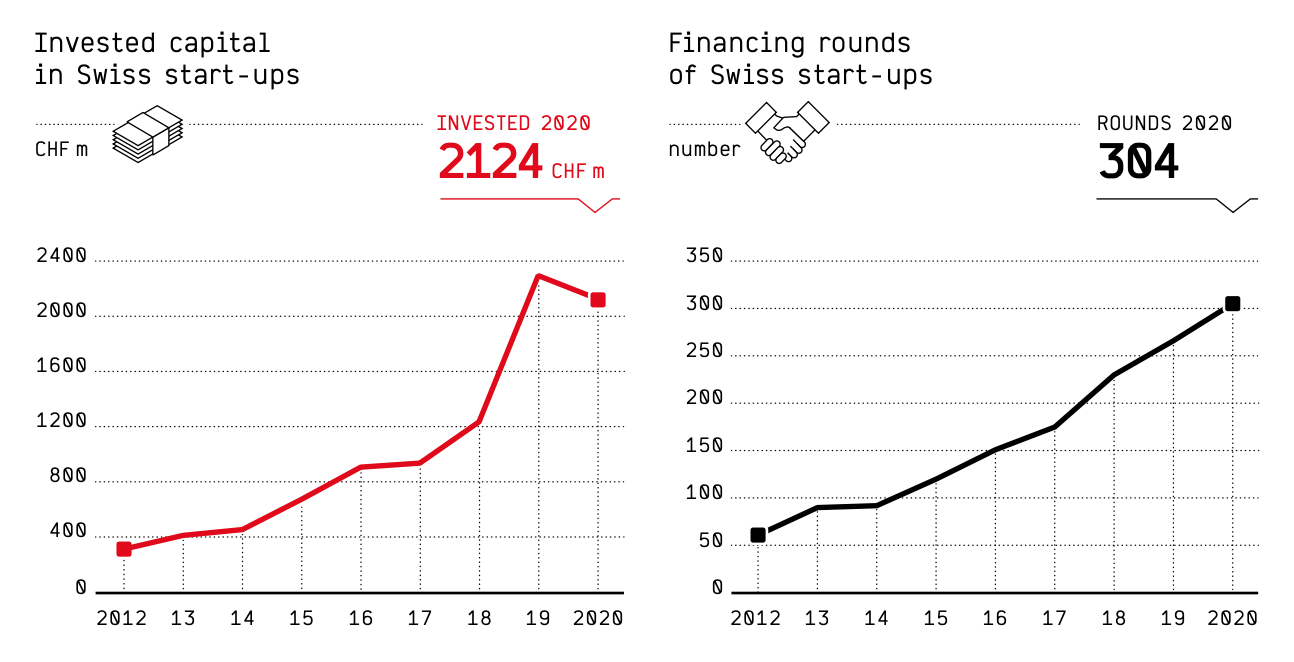

Despite a slight 7.4% decrease compared to the previous year, investment in Swiss startups remained robust in 2020 with more than CHF 2.1 billion in venture capital being raised through 304 rounds, a new record.

Invested capital in Swiss startups and financing rounds, Swiss Venture Capital Report 2021, Startupticker.ch

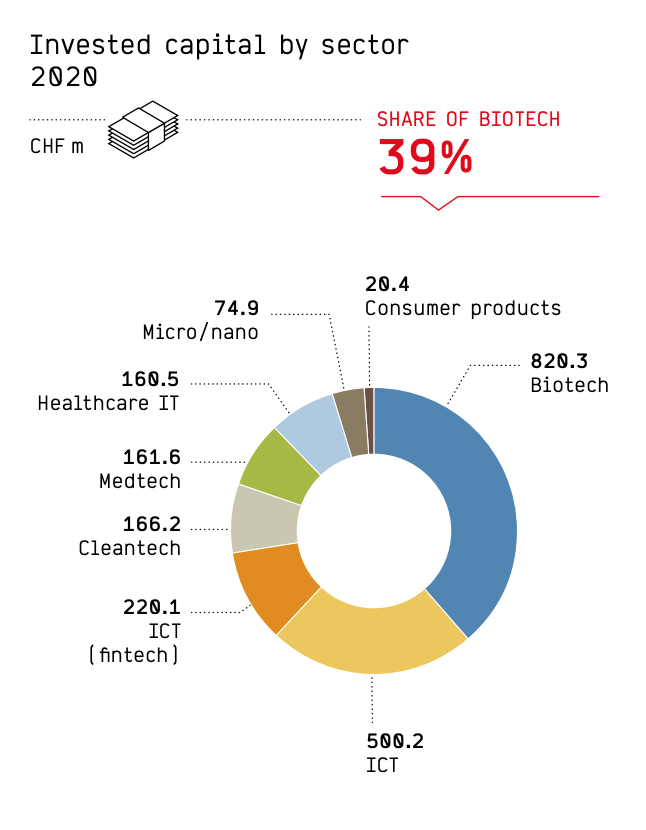

The biotech sector took the lion’s share, raising more than CHF 820 million in 2020, or 39% of all capital invested that year.

11 of the 20 biggest financing rounds of 2020 went toward 9 biotech companies with some of the largest ones being raised by very young startups. Two biotech companies that made it into the top 20 of the largest financing rounds were founded in 2020, and two were established in 2019.

None of the 9 biotech companies that made the list were founded prior to 2015.

After biotech, the ICT sector raised the second largest amount (CHF 500 million), followed by fintech, cleantech (CHF 166.2 million) and medtech (CHF 161.6 million).

Invested capital by industry in 2020, Swiss Venture Capital Report 2021, Startupticker.ch

The post Swiss Fintech Funding Drops 38% in 2020 appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments